Choosing Private Cloud Providers: A Data-Driven Comparison

Choosing a private cloud provider isn’t a niche decision anymore. It’s a strategic response to the public cloud’s promise of infinite scale meeting the reality of unpredictable costs and complex data regulations. The goal isn’t to run from the cloud; it’s to build a more predictable, controlled version of it.

Why Private Cloud Adoption Is Accelerating

The narrative that all workloads are destined for a public hyperscaler is being challenged by operational and financial realities. A significant number of companies are either repatriating workloads from the public cloud or deliberately designing hybrid models from the start.

Two primary factors are driving this shift: cost predictability and data sovereignty. Public cloud egress fees—the cost to move your own data out of their network—can undermine budgets. A workload that appears cost-effective at a small scale can become a significant financial liability as data transfer volumes increase, making accurate forecasting difficult.

The Regulatory Imperative

Simultaneously, regulators are enforcing stricter rules on data residency. Mandates like GDPR in Europe or federal standards like FedRAMP in the U.S. have significant penalties, imposing strict policies on how and where sensitive information is stored and processed. For a global business, navigating this patchwork of compliance rules makes a controlled private cloud a pragmatic necessity.

Market data supports this trend. The hybrid private cloud sector is projected to capture a 78.2% global market share by 2025. This indicates the default enterprise strategy is a mix of on-premise control and public cloud agility. The full market analysis is available from Coherent Market Insights.

This approach allows organizations to secure their most sensitive workloads in a tightly controlled environment while using public cloud services for variable, non-critical, or development workloads. It’s a calculated strategy to mitigate financial and regulatory risk.

Key Decision Drivers For Private Cloud Adoption

The move to a private cloud is typically driven by a combination of technical requirements and business objectives that make it a more defensible choice than an all-in public cloud strategy for specific applications.

The table below outlines the core drivers observed in enterprise deployments, connecting technical architecture to specific business outcomes.

| Driver | Technical Implication | Business Rationale |

|---|---|---|

| Cost Predictability | Fixed infrastructure costs (CapEx/OpEx) eliminate variable data transfer and API call fees. | Enables accurate financial forecasting and prevents budget overruns common with consumption-based public cloud billing models. |

| Data Sovereignty | Physical control over server location ensures compliance with regulations like GDPR, HIPAA, and FedRAMP. | Mitigates legal and financial risks associated with non-compliance in regulated industries. |

| Performance Guarantees | Single-tenant architecture eliminates the “noisy neighbor” problem, providing consistent, low-latency performance. | Supports mission-critical applications where performance degradation directly impacts revenue or operations. |

| Enhanced Security | Dedicated hardware and network isolation provide a smaller attack surface and greater control over security policies. | Protects sensitive intellectual property and customer data, reducing the risk of costly data breaches. |

These drivers all point to a single theme: control. When performance, security, cost, or compliance are non-negotiable requirements, direct control over the infrastructure is often the only way to guarantee the desired outcome.

Evaluating Integrated Private Cloud Providers

Selecting a major private cloud provider requires looking beyond marketing claims to analyze the underlying architecture and commercial models. The decision often comes down to how well a provider’s stack aligns with existing infrastructure, operational skills, and long-term TCO. The focus should be less on feature count and more on which platform creates the least operational friction.

A key part of this evaluation is determining where a private cloud fits into the broader IT strategy, particularly when making a hybrid cloud vs. multi-cloud decision. The right provider acts as a core component of a unified plan, not an isolated silo.

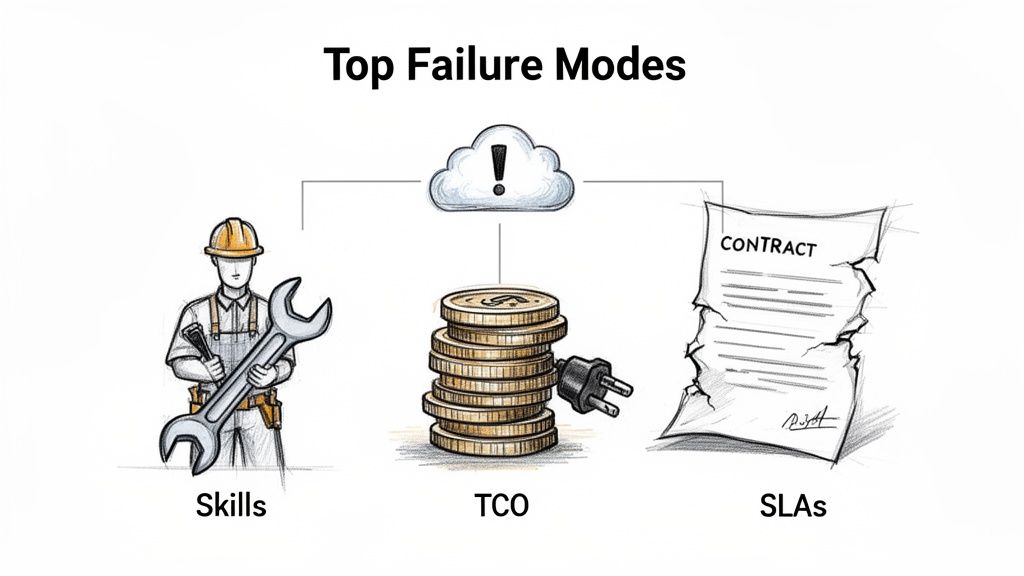

This infographic highlights the primary business drivers—cost, control, and compliance—that lead organizations to these platforms.

These three pillars represent the core trade-offs to balance when committing to a private cloud architecture.

Dell APEX: The Integrated Hardware Play

Dell APEX offers a tightly integrated, full-stack solution from a single vendor. It bundles Dell hardware (e.g., VxRail hyper-converged infrastructure) with VMware’s software ecosystem, delivered as a managed service with consumption-based pricing. This model is designed for organizations that prioritize operational simplicity and predictable SLAs.

The primary value proposition is risk reduction. By controlling the entire stack, Dell can offer guarantees that are difficult to achieve in multi-vendor environments. For instance, the APEX Cloud Platform for 5G telecom cores is marketed with a 99.999% availability SLA. This level of assurance is compelling when considering that a high percentage of cloud projects face challenges due to integration issues.

When NOT to buy: If your organization has standardized on a non-VMware hypervisor like KVM or seeks to avoid lock-in to a single hardware vendor, APEX is likely not the right fit. Its key strength—tight integration—is also its primary limitation.

HPE GreenLake: The Public Cloud Economic Model

HPE GreenLake brings the public cloud’s economic model on-premises. Instead of a large upfront capital expenditure, customers pay for what they use, while HPE owns and manages the hardware in the customer’s data center or a colocation facility. This model appeals to finance departments seeking to shift from CapEx to OpEx.

Technically, GreenLake offers a broad portfolio of services—from bare metal and containers to machine learning platforms—managed through the HPE Central portal. The model includes a buffer of on-site capacity for instant scaling without procurement delays.

The core concept is to provide the financial flexibility of the public cloud with the control and performance of dedicated hardware. However, this flexibility comes with contractual commitments, including minimum usage levels. Exiting the ecosystem is a significant undertaking.

When NOT to buy: For organizations with stable, predictable workloads, GreenLake’s consumption model may be more expensive over a 3-5 year term than an outright hardware purchase. If your team possesses strong infrastructure management skills and prefers direct asset ownership, the managed service premium may not provide sufficient value. A detailed vendor due diligence checklist is necessary to accurately model these long-term costs.

IBM Cloud Private: The Legacy Integration Specialist

IBM Cloud Private (now part of IBM Cloud Paks) is designed for a specific customer profile: large enterprises with substantial investments in IBM middleware and mainframe systems. Its architecture focuses on modernizing these core legacy applications with containers and Kubernetes while maintaining tight integration with systems like Db2 and WebSphere.

The platform is a Kubernetes-native environment that can run on-premises or on any cloud. Its differentiation comes from pre-integrated software bundles (Cloud Paks) for data, automation, and security, engineered to accelerate the modernization of applications within the IBM ecosystem.

When NOT to buy: If your organization has minimal or no exposure to the IBM software stack, this platform offers little advantage. Its value is directly proportional to existing investments in IBM technologies. For a “greenfield” cloud-native project, vendor-agnostic private cloud providers are a more logical and cost-effective choice.

Analyzing Software-Defined and HCI Leaders

Beyond integrated hardware stacks, the engine of a modern private cloud is its software layer, specifically the hyper-converged infrastructure (HCI) platform that pools compute, storage, and networking into a single software-defined system. This is where operational leverage is gained. Two names dominate this space: VMware and Nutanix.

A surface-level comparison is insufficient. While both offer virtualization and software-defined storage, the critical differences lie in their core architectures, licensing models, and the day-to-day operational reality they create for engineering teams.

The choice between them requires an honest assessment of your team’s skills, hardware preferences, and tolerance for vendor lock-in.

VMware vSphere and vSAN: The Enterprise Standard

VMware is the incumbent due to its vSphere hypervisor being a cornerstone of enterprise IT for over two decades. This has fostered a large ecosystem and a deep talent pool of engineers familiar with the platform. For many companies, VMware has historically been the path of least resistance.

The platform’s strength is its deep feature set and integrations with a broad portfolio of enterprise tools for networking (NSX), automation (vRealize), and container management (Tanzu). It can be used to build a sophisticated private cloud, but this comes with significant complexity and cost.

Key Takeaway for CTOs: VMware’s value has been its ubiquity and mature ecosystem. However, the risk profile has changed. Recent licensing changes following the Broadcom acquisition have introduced significant cost uncertainty and amplified concerns over vendor lock-in, prompting even long-standing customers to evaluate alternatives.

This shift has made exploring alternatives a priority. One common migration path being considered is moving off the VMware stack to a more hardware-agnostic platform. For those exploring this route, understanding the technical and operational hurdles is critical. Our guide on planning a migration from VMware to Nutanix provides more detail.

Nutanix: The Challenger Focused on Simplicity

Nutanix entered the market by directly addressing VMware’s complexity. Its architecture is built on simplicity and hardware independence. The core product, Nutanix Acropolis Hypervisor (AHV), is a KVM-based hypervisor included at no additional licensing cost—a direct challenge to vSphere’s licensing model.

The platform’s primary appeal is its “one-click” operational model, which simplifies management tasks like firmware upgrades, cluster scaling, and troubleshooting. By abstracting the underlying hardware, Nutanix allows IT teams to manage infrastructure like a cloud service without requiring deep specialists in storage or networking.

However, this simplicity involves trade-offs. While Nutanix has a growing ecosystem, it does not yet match the breadth of third-party tools that integrate with VMware. Its market share, though increasing, remains smaller than VMware’s, which can be a consideration for organizations that prioritize long-term vendor stability.

A Head-to-Head Technical Comparison

The choice between VMware and Nutanix often depends on a few key technical and operational differences. This table breaks down the critical factors.

VMware vs. Nutanix: A Technical Comparison

A comparative analysis focusing on key technical and operational differentiators between the two leading HCI and private cloud software providers.

| Evaluation Criterion | VMware (vSphere/vSAN) | Nutanix AHV | Key Takeaway for CTOs |

|---|---|---|---|

| Core Architecture | Component-based stack (vSphere, vSAN, NSX). Each is a powerful but distinct product, often managed separately. | Fully integrated HCI stack. Compute, storage, and virtualization are managed as a single, unified entity from day one. | Nutanix offers greater out-of-the-box simplicity. VMware provides more specialized control but requires more integration effort and expertise. |

| Hardware Flexibility | Extensive Hardware Compatibility List (HCL), but the ecosystem is tightly controlled and often optimized for specific vendors. | Hardware-agnostic. Runs on a wide range of servers from Dell, HPE, Lenovo, and others, providing purchasing leverage. | Nutanix offers more freedom from hardware vendor lock-in. VMware’s HCL is more restrictive. |

| Management Overhead | Higher. Requires deep expertise across multiple product lines and their respective licensing models. Often necessitates a larger administrative team. | Lower. Designed for IT generalists with a “one-click” philosophy for most operations, simplifying day-to-day management. | For lean teams, Nutanix reduces operational burden. For teams with deep VMware talent, the cost of retraining may be a factor. |

| Licensing Model | Complex, recently overhauled, and subscription-based. Often bundled in ways that can increase TCO and create lock-in. | Simpler subscription model. The core hypervisor (AHV) is included, which significantly reduces initial software costs. | VMware’s current licensing model is a major source of cost uncertainty. Nutanix typically offers a more predictable and often lower TCO. |

Ultimately, the software layer is what transforms servers into a private cloud service. The global private cloud market is projected to grow from $124.68 billion in 2024 to $241.99 billion by 2032. Success in this market will depend on automation and clear SLAs, not just brand recognition.

Understanding The Hidden Costs of Private Cloud

A primary motivation for adopting a private cloud is to escape the unpredictable costs of public cloud. However, many projects trade one set of opaque costs for another. A successful private cloud requires a fundamental shift in operational discipline.

Project failures are typically not a single event but a slow process driven by unbudgeted costs and unforeseen complexity. While initial hardware and software costs are scrutinized, it’s the ongoing operational drag that often undermines the business case.

Underestimating Operational Complexity and Skills Gaps

The most common reason these projects fail is underestimating the engineering talent required to run a private cloud as a service. Deploying a VMware or Nutanix cluster is relatively straightforward; turning it into an automated, self-service platform that developers will use is not. This requires a team with skills that are both expensive and difficult to find.

This is not a task for a traditional systems administrator. A successful team needs proficiency in a specific set of modern tools:

- Automation and Orchestration: Expertise in tools like Ansible, Terraform, or similar for provisioning and configuration is non-negotiable. Without them, you’re just managing VMs manually, which defeats the purpose of building a cloud.

- Container Management: A modern private cloud is typically based on Kubernetes. This requires specialized skills in cluster deployment, networking (CNI), storage (CSI), and security—a different discipline from traditional VM management.

A common mistake is attempting to staff a private cloud project with existing infrastructure administrators, assuming they can learn on the job. This approach often results in a clunky, manual platform that lacks the speed and self-service capabilities that justified the project.

Inaccurate Total Cost of Ownership Calculations

The second cause of project failure is a flawed Total Cost of Ownership (TCO) model. Most TCO analyses capture the direct costs—hardware and software licenses—but fail to account for the persistent, recurring operational costs over the platform’s lifecycle.

A realistic TCO must include these often-overlooked items:

- Environmental Costs: Power and cooling are significant. A standard 42U rack can draw 5-15 kW of power, translating to thousands of dollars per month in electricity costs.

- Hardware Refresh Cycles: Servers and storage have a useful life of 3-5 years. The capital for this refresh cycle must be included in the TCO from the outset.

- Personnel and Training: This includes not just salaries but also the budget for continuous training to maintain the team’s skills in a rapidly evolving tech stack. For more on this, see our guide on effective cloud cost optimization strategies.

Poorly Defined Service Level Agreements

The final element that can undermine a private cloud is the failure to define and meet Service Level Agreements (SLAs) that are meaningful to the business. A technically sound private cloud can be a commercial failure if it cannot deliver the performance, uptime, or provisioning speed the business requires.

Market data shows that private hybrid platforms offering Kubernetes-native PaaS are growing at an 11.64% CAGR through 2031. To be successful, a private cloud must deliver a service comparable to public cloud alternatives. An SLA must be more than an uptime percentage; it needs specific, measurable targets for metrics like “time to provision a new developer environment” or “guaranteed storage IOPS for Tier-1 databases.” Without these, the private cloud becomes a bottleneck that encourages shadow IT and fails to deliver its intended business value.

When a Private Cloud Is The Wrong Choice

Adopting a private cloud should be a deliberate, strategic decision, not a reactive response to public cloud costs. For certain business models and operational contexts, a private cloud is a poor investment that can impede momentum. Understanding when the control of a private cloud is outweighed by the agility of a hyperscaler is critical.

This decision involves navigating the trade-offs in the private cloud vs public cloud debate. A private cloud entails significant capital expenditure and operational overhead that can become a liability for the wrong type of organization.

Early-Stage Startups and Capital Constraints

For an early-stage startup, capital is a finite resource. Allocating hundreds of thousands of dollars to servers and software licenses is often a misallocation of funds that could be used for product development or sales. The public cloud’s pay-as-you-go model is designed for this scenario.

Startups can begin with a small monthly infrastructure spend and scale only as user demand grows. This links infrastructure costs directly to revenue, a financial discipline that private cloud cannot offer at a small scale.

Highly Unpredictable or Bursty Workloads

The primary advantage of the public cloud is its elasticity. For businesses with massive, unpredictable traffic spikes—such as an e-commerce site on Black Friday or a media outlet covering a major event—a private cloud is the wrong tool.

Building a private cloud to handle peak traffic means that 99% of the time, a significant portion of expensive hardware will be underutilized. Public cloud providers allow scaling up to handle a surge for a few hours and then scaling back down, with charges only for the resources consumed. This “burstability” provides an economic advantage that a fixed-capacity private cloud cannot match.

While large enterprises, which hold a 61.53% market share, often choose private cloud for stable, predictable workloads, the model is ill-suited for volatility. Even as SMEs adopt private cloud at a 12.89% CAGR, they must ensure their workloads are predictable enough to justify the upfront investment.

Organizations Lacking Deep In-House Expertise

Running a private cloud effectively requires a dedicated platform engineering team with specialized skills in automation, networking, security, and orchestration tools like Kubernetes.

If an organization does not have this talent in-house—and is not prepared to fund the $150k-$220k salaries required to hire it—a private cloud project is at high risk of failure. It can quickly devolve into a manually managed, slow, and unreliable system that becomes a bottleneck. In such cases, leveraging the managed services of a public cloud provider is a less risky and more pragmatic approach.

Private Cloud FAQs

As you evaluate private cloud providers, the focus shifts from marketing claims to operational realities and financial justification. Here are the most common questions from CTOs and engineering leaders.

How Do I Calculate The True TCO of a Private Cloud?

A credible Total Cost of Ownership (TCO) model must extend beyond the initial hardware quote and encompass all direct and indirect costs over a 3-5 year lifecycle.

A common error is to simply compare hardware CapEx to a public cloud bill. A comprehensive TCO includes:

- Capital Expenditures (CapEx): The full cost for servers, storage, and networking equipment, amortized over its useful lifespan (typically 3-5 years).

- Software Licensing: All recurring fees for the hypervisor, orchestration software, and mandatory support contracts.

- Operational Expenditures (OpEx): This includes data center space (cost per rack), power consumption (cost per kWh), cooling, and physical security.

- Personnel Costs: The fully-loaded cost of the skilled engineers required to manage, automate, and secure the platform. This represents premium talent.

A critical mistake is failing to model realistic public cloud egress fees, which can add 10-15% or more to a hyperscaler bill. The final TCO should be compared against a 3-year public cloud Reserved Instance plan that includes this data transfer overhead.

What Is The Biggest Risk In a Private Cloud Migration?

The primary risk is operational, not technical. Many organizations successfully deploy the hardware and software but fail to establish the discipline required to run it as a true “cloud service.”

The result is an expensive, virtualized infrastructure that lacks the self-service portals, API-driven automation, and rapid provisioning that define a cloud experience.

This risk can be mitigated by investing in an infrastructure-as-code platform (like Ansible or Terraform) and a dedicated platform engineering team from the project’s inception. Without this commitment, IT becomes a manual bottleneck, and the promised business agility is never realized. The project may succeed technically but fail commercially due to a lack of ROI.

Can a Small Business Realistically Use a Private Cloud?

For most small businesses, a large-scale, on-premises private cloud is not feasible due to high capital costs and specialized staffing requirements. However, the market has evolved to offer viable models for this segment.

Smaller companies can access the benefits of a private cloud in two main ways:

- Hosted Private Cloud: Providers like Rackspace offer dedicated, single-tenant hardware that they host and manage in their data centers. This provides resource isolation without the burden of managing physical infrastructure.

- Hyper-Converged Infrastructure (HCI): Vendors like Nutanix offer smaller, “right-sized” HCI appliances that simplify deployment and management. These are designed for teams without deep storage or networking expertise.

Both options represent a larger investment than a pay-as-you-go public cloud account. However, for small or mid-sized businesses with strict data residency or compliance mandates that preclude multi-tenant public clouds, these are valid alternatives. The decision depends on whether those regulatory or performance requirements justify the higher baseline cost.

Making a defensible vendor decision is the hardest part of any modernization project. At Modernization Intel, we provide unbiased, data-driven intelligence on 200+ implementation partners, so you can see real costs, failure rates, and specializations before you sign a contract. Get your vendor shortlist at https://softwaremodernizationservices.com.