A Skeptic's Guide to RFP Software Development

A request for proposal (RFP) for software development is intended as a risk mitigation tool. In practice, it’s often a procurement formality. For complex technical projects, the process is notoriously ineffective, leading to budget overruns and partnerships that fail from the outset.

The primary issue is a fundamental disconnect between rigid procurement templates and the iterative nature of software engineering.

Why Most Software Development RFPs Fail

The traditional RFP process is poorly suited for selecting a software development partner. It requires organizations to create detailed, upfront specifications for problems that are not yet fully understood.

This structure incentivizes vendors to bid on ambiguous requirements, which often results in the lowest-cost proposal winning, rather than the most competent one. The consequences are predictable: scope creep becomes a near certainty, deadlines are missed, and the final product frequently fails to solve the core business need. Many organizations treat the RFP as a compliance exercise instead of a tool for collaborative problem-solving.

The Misalignment of Goals and Process

A frequent point of failure is the gap between business outcomes and technical specifications. A business leader’s goal might be to increase customer retention by 15%, but the RFP requests a checklist of programming languages and database technologies. This forces vendors to propose solutions based on a scoring matrix, not on a deep understanding of strategic objectives.

The most common error is writing a ‘solution-based’ RFP that dictates how a vendor must build the software. This stifles innovation and prevents you from leveraging their expertise. A better approach is a ‘problem-based’ RFP that clearly defines the business problem, constraints, and success metrics.

This flawed methodology creates a scenario where vendors optimize proposals to win the bid, not to ensure project success. They are incentivized to propose the tech stack they know best, even if it’s a poor fit for your long-term operational goals.

The Financial and Operational Fallout

The stakes are significant. For vendors, RFPs now drive an average of 39% of total company revenue, according to Qorus Software research, making proposal management a critical function. Yet, the process is inefficient. The same research indicates that approximately 20% of RFPs go unfinished as vendors exhaust their resources, representing substantial wasted effort.

For the company issuing the RFP, the consequences are more severe:

- Budget Overruns: A partner chosen based on a low bid for a poorly defined scope will almost certainly issue change orders. The final cost often exceeds the initial, misleading estimate.

- Technical Debt: To protect thin margins, the selected vendor may compromise on architecture or code quality. This results in an unmaintainable product that incurs high future maintenance costs.

- Failed Partnerships: The adversarial nature of a poorly executed RFP can damage the relationship from the start, eroding trust before development begins.

To avoid these outcomes, technical leaders must reclaim the process from procurement-driven templates and implement a defensible, data-driven approach. For more on this, you can explore our guide on software procurement best practices.

The shift required is a move from conventional thinking to a more effective, data-driven alternative.

Common RFP Failure Points and Effective Alternatives

This table outlines common pitfalls in software RFPs and the strategic adjustments needed to address them.

| Common Failure Point | Conventional (Flawed) Approach | Data-Driven (Effective) Approach |

|---|---|---|

| Ambiguous Scope | Demanding fixed-price bids on vague, high-level feature lists. | Funding a paid discovery/prototype phase to define scope collaboratively. |

| Vendor Selection | Choosing the lowest-cost bidder based on a feature checklist. | Shortlisting 2-3 vendors for a paid “bake-off” to evaluate real-world capability. |

| Requirements | Writing a 100-page document dictating the “how” (tech stack, architecture). | Defining the “what” and “why” (business problems, user stories, success metrics). |

| Communication | Restricting vendor communication to a formal Q&A portal to ensure “fairness.” | Holding interactive workshops and deep-dive sessions with shortlisted vendors. |

| Partnership Model | An adversarial, client-vendor relationship focused on contract enforcement. | A collaborative partnership focused on shared business outcomes and mutual success. |

Transitioning from the left column to the right changes the RFP from a rigid procurement exercise into a dynamic tool for finding a partner who can solve your business problem.

Defining Success Before Writing Your RFP

A significant percentage of software development RFPs fail before a vendor ever sees them. Teams often jump straight into listing features without first defining measurable success criteria.

This omission is a primary cause of failed software projects. It leads to ambiguous requirements, scope creep, and subsequent disputes. Goals such as “an improved user experience” or “faster performance” are not contractually verifiable. They allow for broad interpretation, which introduces risk when significant budget is allocated. Success must be defined with specific metrics that can be written directly into the Statement of Work (SOW).

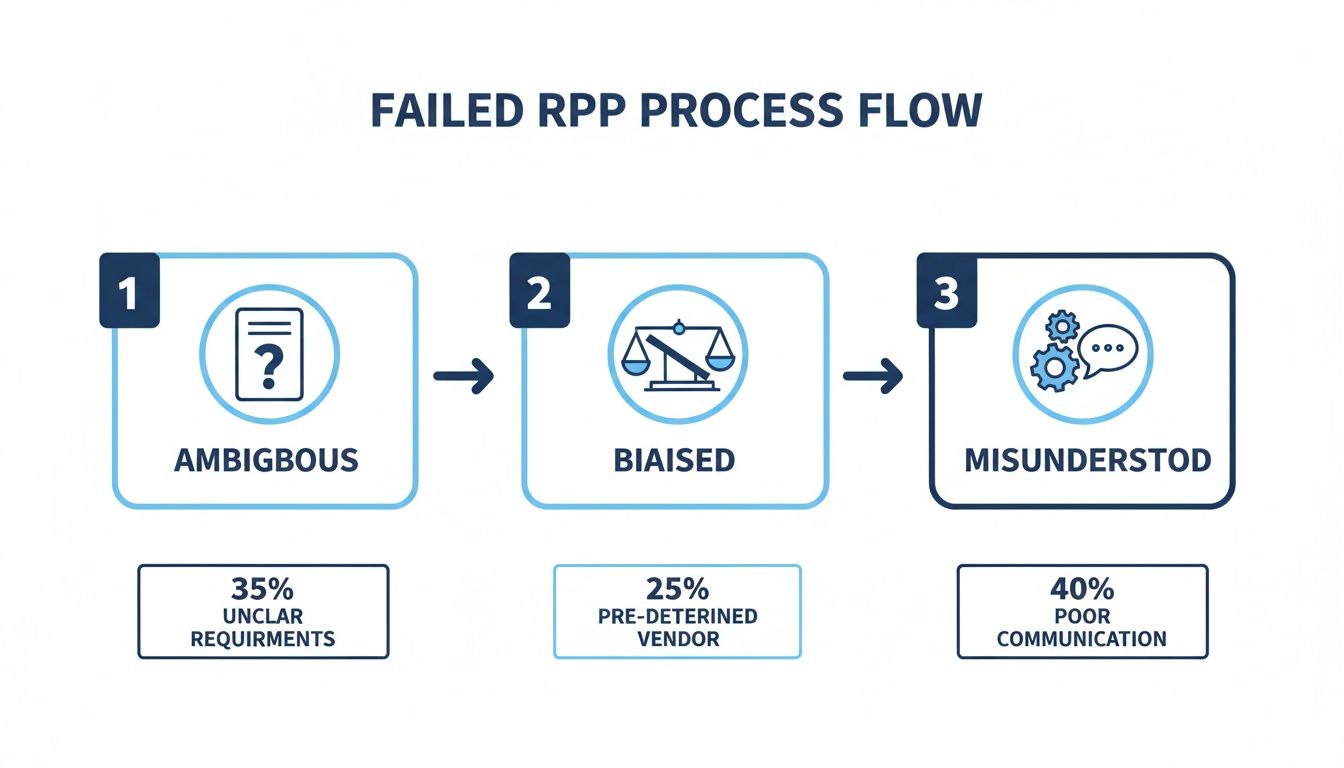

This flowchart illustrates a typical failure pattern, which originates with ambiguity.

Vague requirements create a domino effect, making objective scoring difficult and leading to biased vendor selection and misunderstood deliverables. The cycle can only be broken by defining success with precision from the start.

Translating Business Goals into Technical KPIs

The initial step requires a conversation between business and technical stakeholders to translate high-level business objectives into concrete technical Key Performance Indicators (KPIs). This is an alignment exercise to agree on what is most important.

Consider a business goal like “increase customer engagement.” This must be broken down into specific, measurable technical targets:

- User Action: A user must be able to complete the checkout process in under 60 seconds.

- System Performance: Product detail pages must load in under 1.5 seconds on a standard 4G connection.

- API Response: Key mobile app APIs must maintain a P95 latency of <250ms under a load of 1,000 concurrent users.

This level of detail eliminates ambiguity. It provides vendors a clear target for their solution architecture and gives you an objective standard for accountability post-launch.

Distinguishing Must-Haves from Deal-Breakers

Not all requirements have equal weight. A common mistake is failing to distinguish between core functional needs (must-haves) and non-negotiable constraints (deal-breakers).

A “must-have” is a feature the business requires, like “the ability to process credit card payments.” A “deal-breaker” is a technical constraint that will immediately disqualify a vendor, such as “the proposed solution must not use a NoSQL database because our operations team lacks the required expertise.”

Combining these in an RFP creates noise and dilutes the scoring model. Deal-breakers should be presented upfront as binary questions. If a vendor cannot meet them, they are disqualified.

Examples of Deal-Breakers:

- Compliance: The platform must be GDPR compliant, with all data hosted exclusively within the EU.

- Architectural Constraints: The solution must be deployable within our existing Kubernetes environment and integrate with our Jenkins CI/CD pipeline.

- Security: The vendor must provide a current SOC 2 Type II report and agree to a third-party penetration test before launch.

Embedding Criteria into the RFP and SOW

These measurable criteria should be central to your RFP, directly informing the questions you ask and the scoring model you use.

This is not just about the RFP; it’s about structuring the contract for success. Every defined KPI should be transferable into the SOW as part of the acceptance criteria.

When a vendor signs the SOW, they are not just agreeing to build features; they are contractually committing to deliver a system that meets these precise performance, security, and scalability targets. This upfront work is a critical risk mitigation strategy, shifting the dynamic from procuring a vague “service” to procuring a verifiable outcome.

Crafting Requirements That Attract Expert Vendors

Vague requirements attract opportunistic vendors; precise requirements attract expert partners.

If your RFP for software development is a generic feature list, you will receive bids from generalist firms. To filter out unqualified bidders and find a true technical partner, your requirements must go beyond high-level user stories to specify real-world constraints: architectural guardrails, data migration challenges, and critical integration points. This level of detail serves as a qualification test; only vendors with genuine technical depth will be able to respond adequately.

Moving from User Stories to Technical Realities

A user story like, “As a user, I want to see my order history,” is a starting point, not a complete requirement. An expert vendor needs more technical detail to provide a meaningful proposal.

What does that story imply technically?

- Data Source: Is the order history sourced from a legacy AS/400 system, a PostgreSQL database, or a third-party platform like Shopify?

- Performance: Does the history for a power user with over 1,000 past orders need to load in under 500ms?

- Data Latency: Is a 24-hour data lag acceptable, or is real-time consistency required?

Asking these questions internally before writing the RFP forces your team to confront the project’s complexity. Providing the answers in the RFP allows vendors to design a realistic solution and provide a more accurate cost estimate.

Define Your “When NOT to Buy” Scenarios

An “anti-requirement”—a deal-breaker—is a powerful tool in an RFP. It states, in clear terms, the technical or operational constraints that will immediately disqualify a proposal. This respects everyone’s time by eliminating mismatched partners early.

A “When NOT to buy” clause is a non-negotiable constraint. It informs a vendor, “If your standard solution does X, we are not a fit.” This saves significant time by pre-qualifying potential partners.

A fintech company handling sensitive data might state:

- Data Residency: “The proposed solution must not store any customer PII outside of our designated Azure East US region. No exceptions.”

- Decimal Precision: “Describe your approach to handling fixed-point decimal arithmetic. Solutions relying solely on standard floating-point primitives for monetary calculations will be disqualified.”

The second point is a technical probe for expertise. It tests a vendor’s knowledge in a domain where rounding errors can have significant financial consequences. A vendor unable to discuss the use of BigDecimal in Java versus a standard double may not be qualified to build a payment system.

Ask Questions That Reveal True Expertise

RFP questions should be designed to distinguish real-world experience from marketing claims. Generic questions yield generic answers. Reviewing common request for proposal questions can provide a baseline, but they must be adapted to your specific context.

Instead of asking, “Do you have experience with legacy modernization?” consider a more specific question:

“Provide a specific example of a COBOL-to-Java migration you completed. Describe how you handled the translation of COMP-3 packed decimal fields to maintain data integrity and prevent rounding errors. Include code snippets or pseudocode if possible.”

A question like this is difficult to answer without direct experience. It compels the vendor to demonstrate expertise rather than just claim it and signals that you are a sophisticated buyer.

This approach has become more critical with the rise of AI-driven proposal generation. While research from Writer.com shows that 61% of AI users report ROI within a year, it also means vendors can easily generate plausible but superficial responses. A deeply technical question necessitates human expert involvement.

By crafting requirements with this level of precision, you change the dynamic of the rfp software development process from a passive procurement exercise to an active partnership definition.

Implementing a Defensible Vendor Scoring Model

Once proposals are received, the objective is to move beyond subjective impressions to an auditable decision. A well-structured scoring model is the best defense against defaulting to the lowest-cost bid or being influenced by internal politics.

Without a weighted scoring matrix, there is no logical framework to justify the final decision. It forces the team to agree on priorities before reviewing proposals, ensuring alignment. This makes the final choice defensible to stakeholders, including finance leadership.

Building a Weighted Scoring Matrix

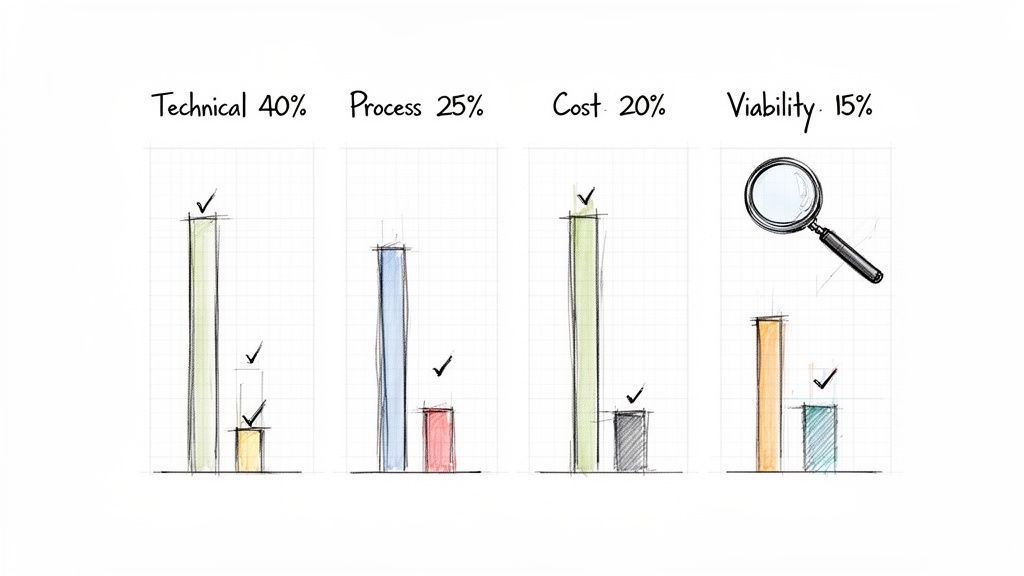

Weighting is critical. For a complex modernization project, a vendor’s technical competence is more important than a minor price difference. The scoring model must reflect this.

A potential weighting for a software modernization project might be:

- Technical Competence (40%): Does the proposed solution address the core problem? Does the team have experience with our specific type of technical debt?

- Process & Methodology (25%): How are projects managed? What is their approach to QA, communication, and scope changes?

- Cost & Value (20%): This includes total cost of ownership, pricing transparency, and the overall value proposition, not just the lowest price.

- Vendor Viability (15%): How stable is their business? What do references indicate? Do they have a track record with projects of a similar scale?

This model intentionally de-prioritizes cost. A vendor who scores perfectly on cost (20/20) but poorly on technical competence (20/40) will lose to a more expensive but more capable partner. This provides a mathematical justification against selecting an unsuitable vendor based on price alone.

A simple matrix should be used by all evaluation committee members to standardize scoring.

Sample Vendor Scoring Matrix for a Modernization Project

| Evaluation Category | Weighting (%) | Key Criteria Examples | Scoring (1-5) |

|---|---|---|---|

| Technical Competence | 40% | Proposed architecture, legacy system experience, data migration strategy, security plan | |

| Process & Methodology | 25% | Project management (Agile/Scrum), QA/testing approach, communication plan, change management | |

| Cost & Value | 20% | Total project cost, pricing model clarity, value for money, team rate card | |

| Vendor Viability | 15% | Case studies, client references, financial stability, team composition and experience |

This structure transforms subjective proposals into comparable data points, making the shortlisting process more objective and defensible.

Beyond the Proposal: Technical Deep-Dives

A proposal is a sales document and not a reliable indicator of a team’s technical skill. After initial scoring narrows the field to 2-3 finalists, a technical deep-dive is necessary.

This is not a sales demonstration. It is a working session where your engineering team can question the vendor’s proposed technical lead and architect. The goal is to identify weaknesses in the proposal, challenge assumptions, and evaluate their problem-solving abilities.

Ask specific questions that test real-world experience:

- “Walk us through the data mapping challenges you anticipate when migrating our EBCDIC mainframe files to a relational database.”

- “You proposed a microservices architecture. How would you define the service boundaries between our order management and inventory systems to avoid tight coupling?”

- “Describe your strategy for performance testing the system to meet our <200ms API response time requirement under peak load.”

The quality of their answers is a stronger signal of competence than the proposal itself.

Structuring a Meaningful Proof of Concept

For mission-critical projects, a paid Proof of Concept (POC) is an effective de-risking tool. This is a small, time-boxed engagement where you ask your top 2 vendors to solve a narrow slice of the actual problem.

For a legacy system modernization, a good POC challenge would be:

“Here is an obfuscated sample of a complex COBOL program. Your task is to refactor this into maintainable Java, connect it to a sample database, and demonstrate that the business logic produces identical outputs.”

This tests technical skill, development process, and team collaboration. Paying for this effort signals serious intent and provides tangible work products for comparison.

Performing Reference Checks That Matter

Do not rely solely on the curated list of references provided by the vendor. Ask for contacts from a project that encountered challenges. How a team manages adversity is more revealing than positive testimonials.

Use your professional network. Ask the vendor for the names of the project manager and technical lead from a specific case study. Use LinkedIn to find other engineers who worked at that client company during the same period and reach out for an informal perspective. Verifying claims is a critical step; our guide on third-party verification methods offers a structured approach.

Combining a weighted scoring matrix with these validation steps creates a transparent, data-driven process. It ensures your rfp software development effort results in a partnership, not just a transaction.

Uncovering Hidden Costs and Demanding Transparency

The price in a vendor proposal is often an optimistic, best-case scenario designed to win the business. The true cost of a software project is frequently found in vague contract clauses, unmentioned fees, and operational expenses that arise post-contract.

Demanding transparency is about de-risking a significant investment. The initial proposal is only a down payment. Without a complete financial picture, you are not comparing prices effectively.

Beyond the Initial Build Cost

To understand the full financial scope, a grasp of Software Development Cost Estimation is necessary. A low initial bid can conceal an architecture with high long-term costs. The conversation must be shifted from the project fee to the Total Cost of Ownership (TCO).

TCO forces vendors to justify technical choices financially. A solution built on proprietary, licensed software might be faster to implement, but recurring fees can become a long-term financial burden.

Your RFP must ask direct questions to uncover these costs:

- Hosting & Infrastructure: “Provide a detailed TCO projection for this architecture over three years, including all hosting, data transfer, and managed service fees.”

- Licensing & Subscriptions: “List every third-party software, API, or service required. Include current annual costs and any known price increases.”

- Maintenance & Support: “Detail the costs for your post-launch support packages, including SLAs and response times for each tier.”

This shifts the discussion from a one-time project cost to the ongoing operational reality.

Exposing Common Hidden Expenses

Vendor business models often include revenue streams that are not highlighted in proposals. Your task is to identify them.

Common hidden costs include:

- Vague Change Request Fees: If the process for handling out-of-scope work is poorly defined, minor feature adjustments can lead to significant budget increases.

- Data Migration Charges: Migrating data from legacy systems is often complex. Some vendors quote this as a separate line item that may be underestimated.

- Knowledge Transfer & Offboarding: The costs for documentation, training your internal team, and decommissioning old environments are rarely included upfront.

A COBOL migration is a classic case. A vendor might quote a per-line-of-code price, such as $1.50 to $4.00. This figure often excludes complex and expensive tasks like data remediation, parallel testing environments, and validation. These “hidden” costs can double the project’s final price.

To counter this, your RFP must demand a fully-loaded rate card with the blended and individual hourly rates for every role that may be involved in the project.

A transparent partner will address these questions directly. A vendor relying on hidden fees may become defensive. Their reaction can be informative. This financial diligence is a non-negotiable part of any serious vendor evaluation process.

When to Avoid an RFP for Software Development

A formal Request for Proposal is not universally applicable. For certain software projects, a rigid RFP process can be counterproductive and wasteful. Knowing when an RFP is the wrong tool is a critical strategic decision.

The administrative overhead of drafting, issuing, and evaluating a full RFP can outweigh the benefits, especially for smaller projects or initiatives with unclear requirements. The RFP process is designed for procuring well-understood commodities, which is often a poor fit for the exploratory nature of custom software development.

For Exploratory and Ill-Defined Projects

If you cannot clearly articulate the problem, business outcomes, and success metrics, you are not ready for an RFP.

Issuing a detailed request for an ambiguous project forces vendors to make assumptions. Their proposals, cost estimates, and timelines will be based on speculation. This makes a meaningful comparison of proposals impossible, as each vendor will interpret the requirements differently.

Consider these alternatives instead of a full RFP:

- Paid Discovery Engagement: Hire one or two firms for a short, paid project (typically 2-4 weeks) to help define the scope, explore technical options, and build a high-level backlog. This produces a clear roadmap that may inform a subsequent RFP.

- Request for Information (RFI): Use an RFI to gather market intelligence on possible solutions and key vendors. It is a low-commitment method for educating your team before making a significant commitment.

Forcing a fixed-bid RFP on an undefined problem almost guarantees scope creep, change orders, and budget overruns. You are asking vendors to bid on an unknown quantity, and the resulting contract will offer little protection.

When You Have a Proven Incumbent Partner

If you have an existing vendor relationship that has consistently delivered high-quality work and understands your business and technology stack, a competitive RFP process may not be necessary.

Forcing a trusted partner into a formal bidding process can be counterproductive. Their institutional knowledge provides a significant advantage that a new vendor would need months to acquire. This ramp-up time can negate any potential cost savings from a competitive bid and may damage a valuable relationship.

Instead of a full RFP, hold the incumbent partner accountable by requesting a detailed Statement of Work (SOW) for the new project. Scrutinize their estimates, challenge their assumptions, and benchmark their rates against the market.

If their proposal is sound and the pricing is fair, the risk of onboarding a new partner—with its associated learning curve and potential for error—often outweighs the benefits of a formal bidding process. The primary exception is for large, multi-year initiatives where procurement policies mandate a competitive process.

Common Questions We Get Asked

Even with a structured approach, practical questions often arise during the RFP process. Here are direct answers to common inquiries.

How Long Does This Whole RFP Thing Actually Take?

For projects in the $250K to $2M+ range, budget 8-12 weeks from the start of RFP drafting to contract signing.

Attempting to complete this process in a month often leads to poor partner selection due to insufficient diligence.

A realistic timeline:

- Weeks 1-3: Internal scope definition, stakeholder alignment, and RFP document creation.

- Weeks 4-6: Vendor response period. Qualified firms need adequate time to prepare a thoughtful proposal.

- Weeks 7-10: Proposal evaluation, technical deep-dives, and finalist demonstrations.

- Weeks 11-12: Final selection, contract negotiation, and legal review.

Any timeline suggesting a complex project can be initiated in under eight weeks is a red flag. It implies that critical steps like technical validation or reference checks are being skipped.

How Many Vendors Should We Send the RFP To?

The optimal number is 3-5 pre-qualified vendors.

This range creates sufficient competitive tension while keeping the evaluation workload manageable. Inviting only one or two firms reduces your leverage. Inviting more than seven signals to top-tier firms that you are “price shopping,” reducing their incentive to submit a high-quality proposal.

Pro Tip: For a long list of potential partners, start with a lightweight, one-page Request for Information (RFI). Use market intelligence to identify a dozen firms, send the RFI to gauge interest and basic fit, and then invite only the top 3-5 to the full RFP.

What’s the Single Biggest Mistake People Make in a Technical RFP?

The most common error is writing a “solution-based” RFP that dictates how to build the software—specifying the architecture, tech stack, and implementation details.

This constrains the experts you are trying to hire and prevents them from proposing innovative solutions based on their experience.

The correct approach is a “problem-based” RFP:

- Clearly define the business problem.

- Outline operational constraints (e.g., must integrate with Salesforce, must run on Azure).

- Provide measurable success criteria (e.g., “reduce user onboarding time by 50%”).

Then, allow the vendors to propose the how. This approach encourages better solutions and reveals which partners can effectively connect business goals to a technical strategy.

At Modernization Intel, we provide market intelligence to de-risk vendor selection. Our platform contains unbiased data on partner costs, common project failure points, and true specializations. This enables a defensible decision without requiring dozens of sales meetings. Get Your Vendor Shortlist

Need help with your modernization project?

Get matched with vetted specialists who can help you modernize your APIs, migrate to Kubernetes, or transform legacy systems.

Browse Services