12 Best IT Staff Augmentation Companies: A 2025 Data-Driven Analysis

IT staff augmentation is frequently positioned as a simple fix for skill gaps. However, many engagements introduce more operational friction than they resolve. Gartner research suggests the core issue isn’t a lack of talent but a mismatch in engagement models, vetting processes, and cost structures. The market is saturated with platforms and agencies making functionally identical claims, making it difficult to discern which model aligns with specific technical and budgetary constraints.

This guide provides a data-driven analysis of 12 IT staff augmentation companies. We dissect the operational realities of each, from talent-matching algorithms and vetting rigor to the hidden costs embedded in their pricing models. You will find a clear breakdown of which vendors excel at providing niche specialists versus those optimized for scaling agile teams with full-stack engineers.

We provide the vendor intelligence needed to make an informed decision, including:

- Vendor specialization mapped to specific tech stacks and roles.

- Typical engagement costs and timeframes to help budget accurately.

- Common implementation pitfalls and failure points for each model.

- A practical vendor selection framework for internal evaluation.

Each profile includes direct links and platform screenshots to provide a clear view of the user experience. The goal is to equip you with objective data to select a partner that integrates effectively, rather than one that becomes another management burden.

1. Toptal

Toptal positions itself as a network for the top 3% of freelance talent, making it a viable option for organizations prioritizing skill over cost. The model is built on an intensive vetting process that includes language screening, timed algorithm tests, technical interviews, and test projects. This rigor makes Toptal a frequent consideration for CTOs needing to onboard senior engineers, project managers, or designers without the typical risks of an open freelance marketplace.

Core Engagement Model & User Experience

Engagements begin with a client providing detailed project requirements. Toptal’s matching team then identifies candidates, often presenting options within 48 hours. The platform’s key differentiator is its two-week, no-risk trial period. If the talent is not a fit within the first two weeks, the client pays nothing and can be rematched. This de-risks the hiring process for high-stakes projects. However, reports suggest access requires a monthly client platform subscription, an added cost to factor into the total budget.

| Feature Analysis | Assessment |

|---|---|

| Talent Vetting & Quality | Strong. The “top 3%” claim is marketing, but the vetting is undeniably deep and filters for senior talent. |

| Matching Speed | Fast. Typically 24-72 hours from scoping to candidate introduction. |

| Role Diversity | Broad. Extends beyond engineering to include project/product management, design, and finance experts. |

| Pricing & Transparency | Limited. Rates are premium but competitive for the talent caliber. Transparency is limited until after scoping. |

| Risk Mitigation | Strong. The two-week trial and talent replacement guarantee are significant client protections. |

When NOT to buy

Toptal is not a cost-effective solution for junior to mid-level roles or for companies on a tight budget. If the primary driver is finding the lowest possible hourly rate, other IT staff augmentation companies will offer more competitive pricing. The premium rates and potential platform fees make it better suited for roles where expertise and speed are the primary decision-making factors.

Website: https://www.toptal.com

2. Upwork

Upwork is the largest global freelancer marketplace, providing access to a vast talent pool. It functions as a high-volume sourcing platform where companies can find contractors for nearly any role, from short-term bug fixes to long-term project support. For organizations needing programmatic hiring, Upwork’s Enterprise and Business tiers offer centralized billing, compliance services, and dedicated account management, making it a scalable option among IT staff augmentation companies.

Core Engagement Model & User Experience

Clients post a job, and freelancers submit proposals. The platform facilitates the entire workflow from interviewing and hiring to time tracking and payment processing. A key feature is Upwork Any Hire, which acts as an Employer of Record (EOR) service, allowing companies to compliantly engage talent as contractors or employees without establishing a local legal entity. While base platform access is free, clients pay a contract initiation fee and a 3-5% payment processing fee. You can find a deeper analysis of contractor costs by reviewing data on hourly IT consulting rates.

| Feature Analysis | Assessment |

|---|---|

| Talent Vetting & Quality | Variable. Quality ranges from entry-level to expert; significant client-side diligence is required to vet candidates. |

| Matching Speed | Fast. Proposals often arrive within hours of posting a job, enabling rapid hiring cycles. |

| Role Diversity | Excellent. The platform’s scale means nearly every conceivable IT skill set is represented. |

| Pricing & Transparency | Excellent. Freelancer rates and platform fees are clear. Pricing is highly competitive due to the marketplace model. |

| Risk Mitigation | Fair. Payment protection holds funds in escrow, but quality assurance is primarily the client’s responsibility. |

When NOT to buy

Upwork is less suitable for mission-critical roles where deep, pre-vetted expertise is a non-negotiable requirement. The volume of talent means engineering managers must invest considerable time in screening and interviewing to separate high-quality professionals from less experienced freelancers. If your team lacks the capacity for a thorough vetting process, a more curated talent network is a more efficient choice.

Website: https://www.upwork.com

3. Andela

Andela targets companies scaling engineering teams with vetted global talent, emphasizing speed and fit via an AI-powered matching platform. Originating with a focus on African tech talent, Andela has expanded into a global network. Their model is designed for organizations that need a pipeline of remote engineers without the overhead of sourcing and vetting them from scratch. This makes them a contender among IT staff augmentation companies for rapid team expansion.

Core Engagement Model & User Experience

Andela’s process uses an AI to match client requirements against its pool of over 150,000 assessed technologists. Engagements can be structured on a monthly or hourly basis. A key operational detail is that all developer rates are negotiated and set in USD, which simplifies budgeting and avoids currency fluctuation risks for clients. This structured rate-setting provides a degree of financial predictability often missing in open marketplaces.

| Feature Analysis | Assessment |

|---|---|

| Talent Vetting & Quality | Good. Vetting is consistent through skill assessments, though not as intensive as some exclusive networks. |

| Matching Speed | Fast. The AI-assisted matching engine is designed to present qualified candidates within days. |

| Role Diversity | Good. Primarily focused on software engineering roles across various tech stacks, including data and DevOps. |

| Pricing & Transparency | Limited. While rates are negotiated per engagement, setting them in USD offers clarity once established. |

| Risk Mitigation | Standard. Offers talent replacement, but lacks a prominent no-risk trial period like some competitors. |

When NOT to buy

Andela’s model is less suited for companies that require talent to work onsite or within highly restrictive time zones, as its strength is its globally distributed network. Organizations seeking niche, non-engineering roles may find its talent pool too engineering-centric. If your procurement process requires absolute price transparency before engaging in discussions, Andela’s negotiated pricing model may be a point of friction.

Website: https://www.andela.com

4. Turing

Turing uses an AI-powered platform for sourcing and managing remote software engineers, specifically targeting companies seeking long-term, full-time talent. Its “Intelligent Talent Cloud” uses AI for initial matching and for ongoing quality control. This data-driven approach appeals to organizations that need to scale remote teams with a focus on engineers who can work within U.S. time zones, making Turing a notable player among IT staff augmentation companies.

Core Engagement Model & User Experience

A key part of Turing’s model is that developers keep 100% of their agreed rate. The platform makes its revenue on the client side. The process begins with a client submitting job requirements, after which the AI system matches them with vetted candidates. Turing then provides a custom quote, as pricing is not public. The platform also handles onboarding, compliance, and payroll, simplifying the administrative burden of a distributed team.

| Feature Analysis | Assessment |

|---|---|

| Talent Vetting & Quality | Good. Vetting is automated and extensive, covering both technical skills and communication abilities. |

| Matching Speed | Fast. AI-driven matching allows for rapid candidate presentation, often within a few days. |

| Role Diversity | Focused. Primarily concentrated on software engineering roles across various popular and niche tech stacks. |

| Pricing & Transparency | Poor. Lack of public pricing is a significant drawback. Custom quotes are only provided after scoping. |

| Risk Mitigation | Fair. Provides a two-week risk-free trial, allowing clients to ensure a good fit before committing. |

When NOT to buy

Turing may not be the ideal choice for companies needing short-term project staff. The focus on long-term, full-time remote engagements means it’s less suited for fractional staff augmentation. Furthermore, the lack of pricing transparency requires a time investment in the scoping process before you can assess budget fit, which can be a barrier for teams needing to make rapid hiring decisions.

Website: https://www.turing.com

5. Gun.io

Gun.io operates as a curated marketplace connecting companies with vetted freelance engineers, emphasizing transparency. Its model appeals to hiring managers who want upfront pricing without hidden fees. Candidates on the platform are pre-vetted, and their profiles display an all-in hourly rate, which simplifies budgeting. This transparent approach is a significant differentiator from platforms where rates are negotiated or bundled with opaque fees.

Core Engagement Model & User Experience

Clients can browse vetted talent and see hourly rates directly on profiles. The platform facilitates direct connections and contracts, with U.S.-based support handling compliance and billing. A key feature is the option to convert a contractor to a full-time employee for a one-time fee of 20% of the first-year salary. This provides a flexible “try-before-you-buy” path for building permanent teams.

| Feature Analysis | Assessment |

|---|---|

| Talent Vetting & Quality | Good. Vetting is in place, though less intensive than premium platforms, offering a balance of quality and access. |

| Matching Speed | Moderate. Dependent on direct client browsing and outreach. |

| Role Diversity | Focused. Primarily centered on software engineering and development roles across various tech stacks. |

| Pricing & Transparency | Excellent. Rates are set by talent and displayed publicly, with no hidden client-side platform fees. |

| Risk Mitigation | Fair. U.S.-based compliance and billing support offer protection, with talent swaps available if needed. |

When NOT to buy

If your project requires a highly structured, agency-led engagement with account managers hand-selecting candidates, Gun.io’s marketplace model might feel too self-service. Because rates are set by individual developers, budget forecasting can be less predictable than with platforms that offer standardized rate cards. It is less suitable for enterprise clients needing to source dozens of engineers simultaneously under a single master service agreement.

Website: https://gun.io

6. Braintrust (UseBraintrust)

Braintrust operates on a decentralized, user-owned marketplace model. By allowing talent to keep 100% of their earnings, it attracts experienced professionals who are often deterred by high commission fees on other platforms. For companies, this translates into a more direct relationship with talent and a transparent fee structure.

Core Engagement Model & User Experience

The model is straightforward: clients pay talent’s full rate plus a flat 15% platform fee. This fee covers sourcing, matching, and invoicing. Braintrust also offers a “Bring Your Own Talent” (BYO-Talent) option, allowing companies to onboard their existing contractors onto the platform for invoicing and compliance at a reduced 10% fee. Payments are typically handled via ACH; credit card payments incur an additional 3.9% processing surcharge.

| Feature Analysis | Assessment |

|---|---|

| Talent Vetting & Quality | Good. Vetting is community-driven and screeners review profiles, but may not be as centrally rigorous as Toptal’s. |

| Matching Speed | Moderate. Dependent on talent availability and application; can take several days to a week. |

| Role Diversity | Strong in Tech. Primarily focused on engineering, design, and product roles, with some marketing and strategy. |

| Pricing & Transparency | Excellent. The flat 15% client fee is transparent. Talent keeping 100% of their rate is a key differentiator. |

| Risk Mitigation | Fair. Standard contractual protections are in place, but lacks a formal, no-cost trial period like competitors. |

When NOT to buy

If your procurement process requires a single, all-inclusive invoice and cannot handle a separate platform fee, Braintrust’s billing model may add administrative friction. Organizations that rely on paying contractors via credit card will find the 3.9% surcharge a notable extra cost. It is also less ideal for companies seeking a high-touch, fully managed engagement where an account manager handles the talent relationship.

Website: https://www.usebraintrust.com

7. TEKsystems

TEKsystems is one of the largest IT staffing and services firms in the U.S., positioning itself as an enterprise-grade solution for high-volume hiring. Unlike marketplace platforms, TEKsystems operates as a traditional staffing agency, leveraging over 2,000 recruiters. This model is built for organizations that require structured, compliant, and scalable staff augmentation, especially those in the public sector or large corporations with established MSP/VMS programs. They manage the entire lifecycle, from sourcing to W-2 payroll and benefits.

Core Engagement Model & User Experience

Engaging with TEKsystems involves working with an account manager who coordinates with internal recruitment teams. Their strength lies in handling complex requirements like security clearances, industry certifications, and large-scale team deployments. They offer multiple engagement models, including contract, contract-to-hire, and full statement-of-work (SOW) teams. The experience is more high-touch than a self-service platform, which suits large programs but can be slower for single hires.

| Feature Analysis | Assessment |

|---|---|

| Talent Vetting & Quality | Good. Vetting is consistent and standardized for enterprise needs, but may not be as deep as niche platforms. |

| Matching Speed | Moderate. Can be fast for common roles, but slower for highly specialized needs. |

| Role Diversity | Excellent. Covers the full IT spectrum from infrastructure and security to cloud, data, and application dev. |

| Pricing & Transparency | Poor. Rates are negotiated per engagement and vary by market; less transparent than platform-based pricing. |

| Risk Mitigation | Good. As the employer of record (for W-2 contractors), TEKsystems handles compliance and HR-related risks. |

When NOT to buy

TEKsystems is not built for startups or small teams seeking a single hire with transparent, fixed pricing. The model’s overhead and account management structure often result in higher blended rates compared to direct-sourcing platforms. If your goal is to find a top-tier freelancer for a short-term project without extensive compliance needs, a marketplace will be a more efficient and cost-effective choice.

Website: https://www.teksystems.com

8. Robert Half Technology (Robert Half)

Robert Half Technology is an established IT staffing firm, operating as a large-scale traditional agency. The firm excels at sourcing talent for contract, contract-to-hire, and permanent roles, leveraging a massive candidate database and over 300 physical locations. This makes it a primary choice for companies that require on-site staff, need to manage U.S. payroll (W-2) compliance, or value a local recruiting team.

Core Engagement Model & User Experience

Engaging with Robert Half involves speaking with a local account manager. The company uses an AI-assisted matching system to filter its network, often presenting candidates within 48 hours. Its key differentiator is the ability to fulfill on-site and W-2 employment needs, a critical requirement for organizations with specific HR or security protocols. Pricing is structured around traditional agency markups on the talent’s bill rate, which is often a point of negotiation.

| Feature Analysis | Assessment |

|---|---|

| Talent Vetting & Quality | Good. Vetting is standard for a large agency but may not be as technically deep as specialist platforms. |

| Matching Speed | Fast. AI-assisted matching and a large candidate pool enable rapid turnaround, often in 48 hours. |

| Role Diversity | Broad. Strong focus on core IT roles like infrastructure, help desk, software dev, data, and security. |

| Pricing & Transparency | Limited. Bill rates are negotiated and include agency fees. Less transparent than fixed-rate marketplaces. |

| Risk Mitigation | Standard. Offers candidate replacement guarantees typical of traditional staffing agencies. |

When NOT to buy

Robert Half is less ideal for organizations seeking cost-effective global talent or those comfortable with a fully remote, contractor-based model. The agency markup can make their rates less competitive than direct-to-talent platforms. If your project does not require on-site presence or W-2 employment and your main goal is to access a global talent pool at lower price points, other IT staff augmentation companies will be a better fit.

Website: https://www.roberthalf.com/us/en/tech-it

9. BairesDev

BairesDev is a nearshore staff augmentation firm that connects organizations with senior, English-proficient engineering talent from Latin America. Its primary value proposition is offering time-zone-aligned, real-time collaboration for U.S.-based teams without the high costs of onshore developers. The company focuses on assembling and scaling dedicated squads, positioning itself as a solution for companies needing to build out entire development pods.

Core Engagement Model & User Experience

The engagement process with BairesDev typically starts with a discovery call to define required skills and team size. The company then leverages its pool of over 4,000 pre-vetted engineers to match candidates, aiming for an onboarding timeline of two to four weeks. A key differentiator is its ability to rapidly scale multi-developer squads. While BairesDev handles the talent sourcing and HR overhead, clients manage the augmented staff directly as integrated members of their teams.

| Feature Analysis | Assessment |

|---|---|

| Talent Vetting & Quality | Strong. Focus is on senior (5+ years) talent with mandatory English proficiency and a multi-step vetting process. |

| Matching Speed | Moderate. Onboarding typically takes 2–4 weeks, which is slower than some platforms but faster than direct hiring. |

| Role Diversity | Focused. Primarily software engineering, QA, and data science roles. Less emphasis on non-technical talent. |

| Pricing & Transparency | Poor. Pricing is not public; custom quotes are provided after scoping. This makes initial budget planning difficult. |

| Risk Mitigation | Standard. Offers talent replacement guarantees, but lacks a “no-risk” trial period like some competitors. |

When NOT to buy

BairesDev is not ideal for companies that need just one or two junior-to-mid-level developers or those requiring 24-hour talent placement. The model is built for scaling dedicated teams, making it less cost-effective for minor, short-term augmentations. Organizations requiring full pricing transparency before discovery calls may find the custom-quote model a significant hurdle.

Website: https://www.bairesdev.com/staff-augmentation

10. Randstad Technologies (Randstad USA)

As one of the largest global staffing agencies, Randstad Technologies brings a traditional recruitment model to IT staff augmentation. It excels where a local U.S. presence is non-negotiable, particularly for on-site or hybrid roles requiring large-scale deployments, such as infrastructure rollouts. Randstad leverages its network of over 60 U.S. offices and a massive talent pool to staff roles across the technology spectrum. This makes it a choice for established enterprises needing to scale large, geographically dispersed teams.

Core Engagement Model & User Experience

Engagements with Randstad begin with a consultation with a local account manager. Their primary differentiator is the ability to handle complex logistics, including visa sponsorship, background checks, and payroll management, which is critical for heavily regulated industries. Unlike platform-based competitors, Randstad’s model is relationship-driven, relying on experienced recruiters to source and vet candidates. The process can be slower than automated platforms but offers a higher degree of customization for enterprise programs.

| Feature Analysis | Assessment |

|---|---|

| Talent Vetting & Quality | Good. Vetting is a standard agency process (interviews, reference checks) rather than deep technical testing. |

| Matching Speed | Moderate. Varies by role complexity and location; can range from days to weeks. |

| Role Diversity | Excellent. Covers a vast range of IT roles, from niche infrastructure skills to common development stacks. |

| Pricing & Transparency | Poor. Bill rates are negotiated per engagement and are not disclosed upfront. Standard agency markups apply. |

| Risk Mitigation | Good. Offers candidate replacement guarantees and handles all employer-of-record compliance responsibilities. |

When NOT to buy

Randstad is not an ideal choice for startups or small teams seeking fast, cost-effective access to remote-only senior developers. The agency model includes higher overhead costs compared to freelance platforms, and the process is not optimized for speed. If your project requires only one or two senior software engineers and doesn’t have strict on-site or U.S.-only requirements, more streamlined and transparently priced IT staff augmentation companies are a better fit.

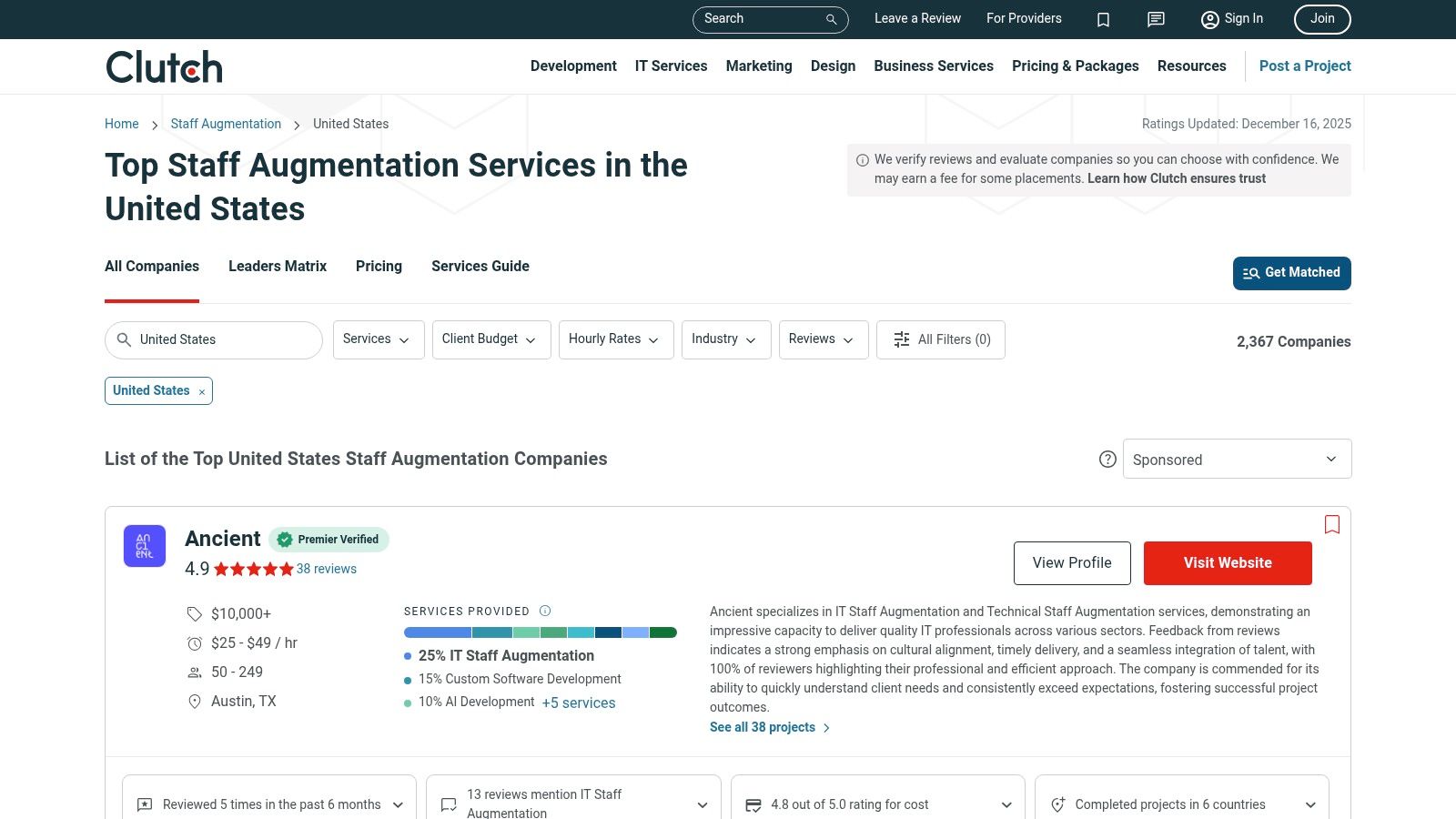

11. Clutch

Clutch is not a direct provider but a B2B research and reviews platform that functions as a directory for comparing staff augmentation providers. It offers a starting point for market research, allowing leaders to scan the landscape, benchmark costs, and identify partners based on verified client feedback. The platform aggregates data like hourly rates, minimum project sizes, and industry focus, making it a tool for initial vendor shortlisting. For companies needing to perform due diligence, Clutch provides a structured way to gather baseline information.

Core Engagement Model & User Experience

Clutch is a free-to-use directory. Users can filter thousands of IT staff augmentation companies by location, budget, team size, and industry focus. Each vendor profile includes a portfolio, service line percentages (e.g., 60% Staff Augmentation), and, most importantly, verified client reviews. While Clutch provides vendor-submitted rate ranges, this data is most effective for initial budget validation. A practical approach is to use it to create a vendor shortlist, then proceed with your own due diligence.

| Feature Analysis | Assessment |

|---|---|

| Talent Vetting & Quality | Variable. Quality is vendor-dependent; Clutch vets the reviews, not the vendors’ internal talent pools. |

| Matching Speed | N/A. Clutch is a directory, not a matching service. |

| Role Diversity | Excellent. The directory covers virtually every role and technology stack imaginable through its vendors. |

| Pricing & Transparency | Good. Provides rate ranges and project minimums, but this information is self-reported by vendors. |

| Risk Mitigation | Fair. Verified reviews reduce risk, but there are no direct platform guarantees like a trial period. |

When NOT to buy

Clutch is a starting point, not an end-to-end solution. It should not be the sole basis for a hiring decision, as rankings can be influenced by sponsored placements. If you need a fully managed service that vets and matches talent for you within a guaranteed timeframe, direct engagement platforms like Toptal or Andela are more appropriate. Clutch is a research tool; the onus of vetting, interviewing, and contracting remains entirely on you.

Website: https://clutch.co/us/it-services/staff-augmentation

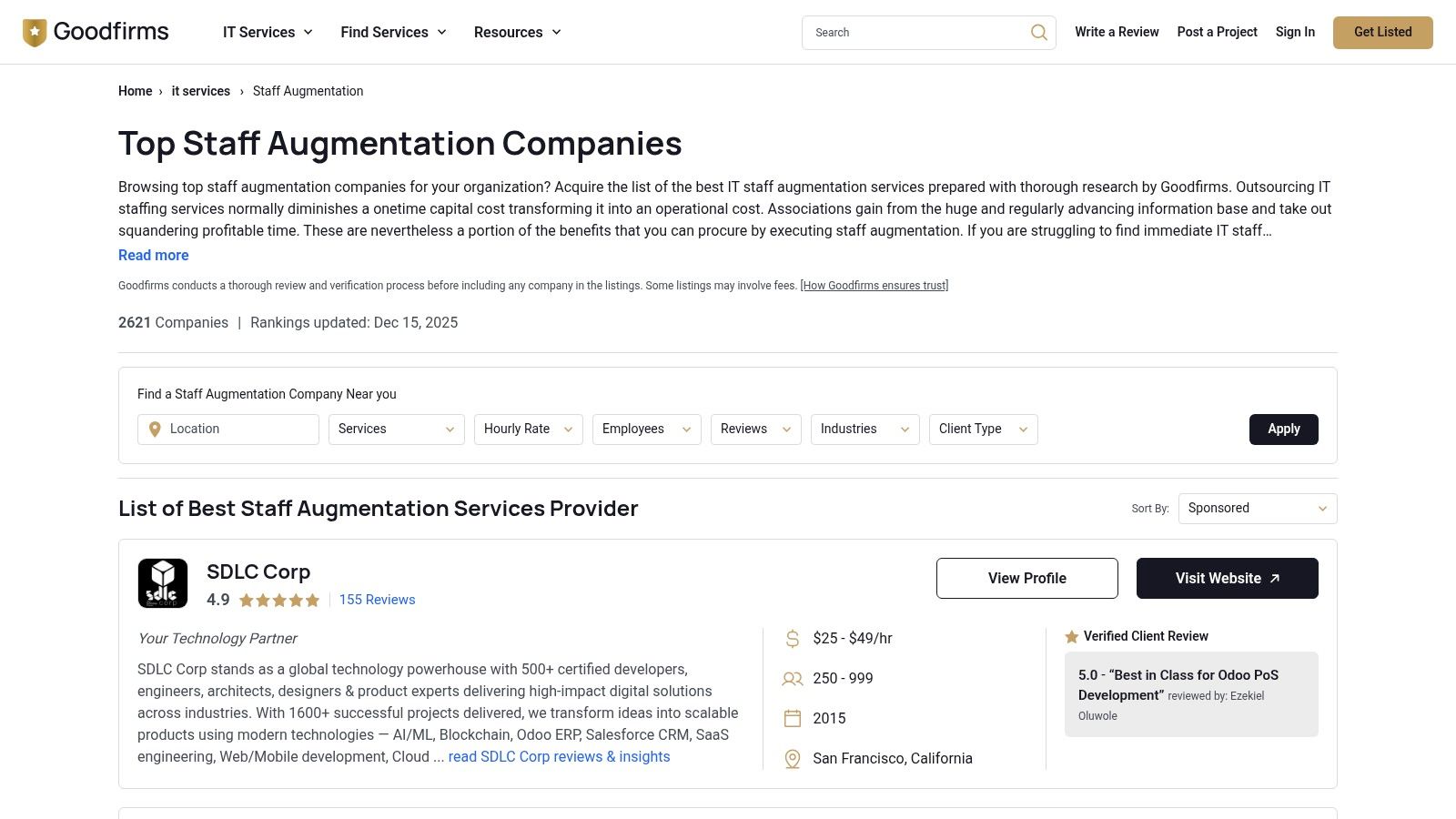

12. GoodFirms

GoodFirms operates not as a direct talent provider but as a B2B research and review platform. For companies in the discovery phase, it serves as a resource for shortlisting a broad pool of IT staff augmentation companies. Its strength is its extensive filterable database, allowing users to compare vendors based on hourly rates, company size, location, and verified client reviews. This makes it useful for initial market research and price discovery.

Core Engagement Model & User Experience

The platform is free to browse, with vendors creating profiles that list their services and often, hourly rate bands (e.g., $25 - $49/hour). The user experience is straightforward: apply filters to narrow down thousands of listings to a shortlist. GoodFirms does not facilitate matching or contracting. Instead, it provides the company’s contact information, pushing the responsibility for vetting, negotiation, and engagement directly onto the client. The primary value is in a consolidated vendor comparison based on self-reported data and reviews.

| Feature Analysis | Assessment |

|---|---|

| Talent Vetting & Quality | Variable. Quality is entirely dependent on the listed vendor; GoodFirms verifies reviews but not talent skill. |

| Matching Speed | N/A. The platform is for discovery only; engagement speed depends on your outreach process. |

| Role Diversity | Very Broad. Lists agencies covering nearly every conceivable IT role and technology stack. |

| Pricing & Transparency | Good. Many vendors publish their hourly rate ranges, which is useful for initial budget planning. |

| Risk Mitigation | Low. Risk is entirely on the client. Due diligence on shortlisted vendors is non-negotiable. |

When NOT to buy

GoodFirms is not an end-to-end solution. If you need a managed process with pre-vetted talent, rapid matching, and contractual safeguards like a trial period, this platform is unsuitable. It is a research tool, and the quality of listings varies significantly. Teams without the internal capacity to perform deep due diligence on multiple potential vendors will find the uncurated nature of the listings to be a significant time sink.

Website: https://www.goodfirms.co/it-services/staff-augmentation

Top 12 IT Staff Augmentation Companies Comparison

| Vendor | Business Model & Target Audience | Core Features / Unique Selling Points | Pricing Transparency & Price Signals | Key Risks / When NOT to buy |

|---|---|---|---|---|

| Toptal | Curated freelance network — enterprises needing senior vetted talent | Two-week no‑risk trial, fast matching, senior PM/design/engineering coverage | Premium model; reported client platform fee; rates quoted after scoping | Higher cost vs. nearshore, subscription to manage, limited upfront rate visibility |

| Upwork | Large open marketplace + enterprise programs — fast sourcing at scale | Massive talent pool, payment protection, EOR/Any Hire, enterprise tier | Wide rate range, client fees (typ. 3–5%), marketplace pricing variance | Inconsistent quality; requires client-side diligence to vet candidates |

| Andela | Vetted global developers — scaling distributed engineering teams | 150k+ talent, AI‑assisted matching, skill assessments, USD rate setting | Negotiated per engagement, structured rate‑setting reduces surprises | No public pricing; contract terms and commitments can vary |

| Turing | AI‑matched remote engineers focused on U.S. overlap — long‑term hires | AI matching, onboarding, payout management, devs keep 100% | Opaque pricing; client quotes after scoping, premium for U.S. time‑overlap | Pricing not public, can be premium for U.S.‑aligned schedules |

| Gun.io | Curated vetted engineers — contract or direct‑hire with US support | All‑in hourly rates visible on profiles, convert-to-hire option (20% FY salary) | Transparent per‑candidate hourly rates shown publicly | Rates vary widely by seniority; budget depends on candidate selection |

| Braintrust (UseBraintrust) | User‑owned marketplace — cost‑sensitive buyers seeking senior contractors | Talent keeps 100%, flat client fee (15% standard, 10% BYO) | Clear flat fees, ACH/CC billing (CC +3.9%) | CC surcharges add back‑office steps, payment handling can be complex |

| TEKsystems | Large staffing firm — enterprise & public‑sector programs | Enterprise IT augmentation, W‑2 payroll, compliance, MSP/VMS integration | Negotiated rates, published state rate cards for public sector | Less rate transparency, higher cost and less flexible for single hires |

| Robert Half Technology | National tech staffing — on‑site/W‑2, rapid local sourcing | Fast turnaround (often ~48h), AI matching, 300+ locations, W‑2 support | Bill rates negotiated; agency markups common | Pricing opacity and markups; may not suit tight budget projects |

| BairesDev | Nearshore LATAM teams — U.S. time‑zone alignment, squad scaling | Senior, English‑proficient LATAM engineers, dedicated teams, 2–4 week onboarding | Custom quotes only; typical bands cited but no public rates | Pricing opaque, engagement bands vary by scope |

| Randstad Technologies | Nationwide staffing & talent solutions — large rollouts, compliance needs | Local offices, large STEM bench, visa/compliance support, on‑site/hybrid options | Negotiated pricing, agency model | Agency pricing opacity; not ideal for transparent per‑hour benchmarking |

| Clutch | Vendor directory & research — procurement and shortlisting | Verified client reviews, hourly rate ranges, min project sizes, filters | Vendor‑submitted rate ranges, free market scan | Sponsored placements, data may be vendor‑provided and require verification |

| GoodFirms | Global listings & discovery — broad vendor shortlists & price discovery | Hourly rate bands, reviews, location/team filters, sorting tools | Vendor‑submitted rate bands; free to browse | Listing quality varies; due diligence required for accuracy |

Making a Defensible Augmentation Decision

Navigating the landscape of IT staff augmentation companies is a high-stakes decision. The difference between a successful engagement and a failed one that consumes engineering management cycles is often decided during vendor selection. The market is a fragmented ecosystem of freelancer marketplaces, talent platforms, nearshore providers, and traditional staffing agencies, each with a distinct risk profile and operational model.

The decision is more complex than finding a developer with the right skills. Your choice commits you to a specific engagement model, cost structure, and level of administrative overhead. Platforms like Toptal offer access to a pre-vetted global talent pool, but success hinges on your internal team’s ability to manage remote contributors. In contrast, traditional firms like TEKsystems absorb much of the HR and compliance burden but introduce significant, often opaque, cost markups and slower ramp-up times.

Synthesizing Your Selection Framework

To move from this list to a defensible shortlist, anchor your decision in your organization’s operational realities. A startup with a lean management structure might find the transparency and lower costs of a marketplace like Braintrust compelling. Conversely, a large, compliance-heavy enterprise will likely find the programmatic support and risk mitigation offered by an agency like Randstad to be non-negotiable, even at a higher price point.

Your selection criteria must be a weighted matrix. Consider these pivotal factors:

- Total Cost of Engagement vs. Rate Card Price: A lower hourly rate from a marketplace can be misleading. Factor in the internal cost of your team’s time for vetting, onboarding, and project management. An all-in rate from an agency, while higher, may represent a lower total cost when these “soft” costs are accounted for.

- Speed-to-Productivity: How quickly do you need a new team member contributing code? Platforms leveraging AI matching promise rapid placements. Traditional agencies typically have a multi-week process. This timeframe can be a critical deciding factor.

- Risk and Liability: What is your organization’s tolerance for co-employment risk? Engaging independent contractors through platforms like Upwork places a greater compliance burden on your team. Full-service agencies who employ consultants directly (W-2 model) insulate you from these legal and financial risks.

Final Considerations Before You Engage

Ultimately, the best IT staff augmentation companies are those that align with your project’s needs and your company’s operational maturity. The most common failure mode is a mismatch between these two elements: a large enterprise trying to use a freelancer platform built for startups, or a small company overpaying for an enterprise-grade agency it doesn’t need.

Before signing any contract, conduct rigorous technical interviews, perform reference checks on both the individual and the firm, and define success metrics and exit clauses in the statement of work. Treat this decision with the same diligence you would a full-time executive hire. The right partner becomes an extension of your team, while the wrong one becomes a source of friction, delay, and technical debt. Choose deliberately.

Making an objective choice requires more than vendor-supplied marketing materials. Modernization Intel provides unbiased, data-driven intelligence on IT staff augmentation companies, including validated cost benchmarks, typical failure rates, and contract term analysis. Use our platform to benchmark proposals and build a vendor shortlist based on real-world performance data. Get Your Vendor Shortlist.

Need help with your modernization project?

Get matched with vetted specialists who can help you modernize your APIs, migrate to Kubernetes, or transform legacy systems.

Browse Services