12 Vetted Directories for Finding ERP Consulting Companies in 2026

Gartner reports that 55-75% of ERP projects fail to meet their objectives, a statistic often rooted in flawed partner selection. Standard vendor discovery relies heavily on self-reported capabilities, sponsored placements, and vendor-curated case studies. This creates significant selection risk, as most shortlists are built on biased, incomplete data before the first discovery call even happens. This guide provides a vetted, critical analysis of 12 directories and marketplaces where technical leaders can find qualified erp consulting companies.

We cut through the marketing noise to examine the data models, potential biases, and specific use cases for each platform. You will learn the distinct advantages and limitations of official partner portals like SAP’s Partner Finder versus broader directories like Clutch. We also analyze gig marketplaces like Upwork for sourcing niche skills and cloud-native service listings within AWS Marketplace. This approach helps you move beyond generic lists and create a defensible shortlist based on verifiable data. To overcome inherent biases and ensure a comprehensive view when creating these vendor lists, understanding how to effectively build your ultimate prospect database can be invaluable.

This resource is designed for CTOs and VPs of Engineering tasked with making high-stakes implementation decisions. Each profile includes a balanced assessment of its strengths, documented failure modes, and clear ‘When NOT to buy’ guidance. We provide screenshots and direct links to each directory, enabling you to start building a more objective, data-driven vendor evaluation process immediately.

1. Clutch.co – ERP Consulting Companies directory

Clutch.co is a B2B ratings and reviews platform that acts as a comprehensive directory for shortlisting and performing initial due diligence on ERP consulting companies. Its primary value for technical leaders lies in the depth of its verified client reviews, which go far beyond simple star ratings to include project scope, budget details, and candid feedback on the engagement process. This allows for a qualitative assessment of a firm’s capabilities and client management style before initiating a formal RFP process.

The platform’s filtering system is particularly useful, allowing you to narrow down potential partners by ERP system (e.g., SAP, Oracle, NetSuite), industry focus, project budget, and hourly rate. This granular search capability helps filter out a significant amount of noise common in broader searches. While Clutch provides a strong starting point for identifying potential vendors, it’s crucial to understand its business model.

Key Evaluation Criteria

- Verified Reviews: Clutch analysts conduct phone interviews with a vendor’s clients to gather detailed, objective feedback on project outcomes. This is the platform’s core strength.

- Service Focus Filters: You can specifically search for firms specializing in ERP implementation, customization, or ongoing support.

- Leaders Matrix: This visual tool plots companies based on their ability to deliver and their market presence, offering a quick way to identify established players.

When NOT to buy

Clutch’s sponsorship model means that firms with larger marketing budgets often gain more visibility, which can bias search results. The listed project costs are self-reported ranges and should be treated as preliminary estimates, not binding quotes. It’s a useful tool for building a long list of candidates but should be supplemented with direct outreach and deeper vetting. For a broader perspective, you might find it useful to explore directories covering a wider array of IT consulting companies to compare how ERP specialists stack up against generalists.

Website: https://clutch.co/it-services/erp

2. G2 – Microsoft/Dynamics ERP Consulting Services

G2 serves as a peer-to-peer review platform where its dedicated category for Microsoft Dynamics 365 partners is particularly valuable. For technical leaders committed to the Microsoft ecosystem, G2 offers a robust alternative to Clutch for validating potential ERP consulting companies. Its strength lies in the sheer volume of user-generated reviews, which provides a broad dataset for gauging partner reputation and comparing service delivery across different firms. This makes it a strong resource for validating a shortlist or cross-referencing vendors found in Microsoft’s own partner directory.

The platform’s grid-based comparison tools allow you to visually map out partners based on user satisfaction and market presence, offering a quick way to identify leaders in specific Dynamics 365 competencies. Filters for company size, region, and specific service lines like implementation or managed services help refine the search. While its focus is narrow, the depth within the Microsoft niche is significant, providing a focused lens on partners specializing in this specific technology stack.

Key Evaluation Criteria

- Grid Comparison: G2’s proprietary Grid visualizes partners in a four-quadrant matrix (Leaders, High Performers, Contenders, Niche), allowing for rapid comparison based on aggregated review data.

- Review Volume: The platform often has a larger quantity of reviews for a given partner compared to other directories, enabling better apples-to-apples comparisons.

- Focused Filters: You can drill down into specific Microsoft competencies, which is useful for finding partners with verified expertise in areas like Finance, Supply Chain, or Commerce.

When NOT to buy

G2’s primary limitation is its Microsoft-centric focus; it offers minimal utility for buyers evaluating SAP, Oracle, or other major ERP systems. The reviews, while numerous, can lack the detailed project scope and budget specifics found in Clutch’s interview-based format. It’s best used as a high-level validation tool for gauging market sentiment rather than a primary source for deep implementation details. Evaluating a potential IT service provider from this platform requires supplementing the review data with direct vendor conversations.

Website: https://www.g2.com/categories/microsoft-consulting-services/f/dynamics-365-enterprise

3. Upwork – Freelance and boutique ERP consultants

Upwork serves as an on-demand marketplace for sourcing individual ERP consultants and small, specialized teams. Rather than engaging large-scale ERP consulting companies, this platform is ideal for staff augmentation, niche project work, or securing advisory expertise. Technical leaders use it to find functional and technical consultants across systems like NetSuite, SAP, Dynamics, and Odoo for discrete tasks like data migration, report development, or system testing.

The platform provides a direct way to engage talent, often with proposal turnarounds within 24–48 hours for urgent needs. Key value comes from the transparency of freelancer profiles, which include work histories, client reviews, and certifications. This allows you to vet individuals based on demonstrated experience rather than a firm’s marketing materials. However, the model places the burden of project scoping, management, and quality assurance squarely on the buyer.

Key Evaluation Criteria

- Niche Skill Access: The platform excels at finding specialists for specific modules, integrations, or legacy system data extraction that larger firms may not staff efficiently.

- Transparent Rates and History: Every freelancer has a public profile with their hourly rate, total hours billed on the platform, and detailed client feedback, simplifying initial budget estimates.

- Integrated Contracting: Upwork manages contracts, escrow, and dispute resolution, which provides a layer of security for both parties without extensive legal overhead.

When NOT to buy

Upwork is not suitable for complex, multi-year ERP transformation programs that require deep strategic oversight, cohesive team management, and long-term accountability. The model breaks down when significant cross-functional coordination and program management are needed. While transparent, the listed rates vary widely; it’s useful to understand the market by reviewing typical hourly IT consulting rates to set realistic expectations. Success on Upwork depends heavily on your ability to precisely define requirements and manage freelance resources directly.

Website: https://www.upwork.com/hire/enterprise-resource-planners/us/

4. AWS Marketplace – Professional Services

For organizations whose ERP strategy is tightly coupled with their cloud infrastructure, AWS Marketplace offers a direct procurement channel for professional services. This platform allows technical leaders to find and contract with AWS partners for services like ERP migration, implementation, and cloud modernization. Its primary advantage is streamlining procurement and billing by consolidating service costs onto a single AWS invoice, which can simplify vendor onboarding and financial governance.

The marketplace is especially useful when the scope of work involves significant cloud architecture or analytics components alongside the core ERP work. You can use a request-for-offer workflow or negotiate private offers with standardized terms, reducing the legal friction common in traditional SOW-based engagements. This makes it a compelling option for sourcing erp consulting companies that are already deep within the AWS ecosystem.

Key Evaluation Criteria

- Consolidated AWS Billing: Simplifies procurement by allowing professional services to be paid directly through your existing AWS account and invoice.

- Private Offers: Enables direct negotiation with a chosen partner on custom terms and pricing, all managed within the AWS ecosystem.

- Procurement Guardrails: Leverages existing AWS account controls and standardized contract terms to speed up the legal and purchasing cycles.

When NOT to buy

The platform’s primary drawback is its AWS-centric nature; it naturally favors engagements with a heavy cloud or infrastructure component. Many traditional, on-premise focused ERP systems integrators do not list their services here, so the marketplace depth varies and may not represent the full landscape of potential partners. It’s best used when the ERP project is inextricably linked to AWS services, not for sourcing consultants for a purely on-premise or multi-cloud deployment.

Website: https://aws.amazon.com/marketplace/features/professional-services

5. Microsoft AppSource / Find a Dynamics Partner

For organizations committed to the Microsoft ecosystem, the official Dynamics 365 partner directory and AppSource marketplace serve as the authoritative starting point. This platform is specifically tailored to locating Microsoft-vetted ERP consulting companies specializing in Dynamics 365. Its primary value is the direct validation from Microsoft and the availability of prepackaged, fixed-scope consulting offers like assessments, workshops, and proof-of-concept implementations.

This approach allows technical leaders to de-risk the initial discovery and planning phases with predictable costs and deliverables before committing to a full-scale implementation. The directory’s filters let you search for partners based on their certified competencies (e.g., Small and Midsize Business Management) and specific product expertise within the Dynamics 365 suite, ensuring you connect with a firm that has proven experience with your specific technology stack.

Key Evaluation Criteria

- Prepackaged Offers: Many partners list fixed-price, time-bound engagements like a “2-Week Business Central Assessment” or a “4-Week F&O Implementation Workshop,” which are ideal for controlled initial scoping.

- Official Microsoft Competencies: Partners are categorized by Microsoft-validated specializations, providing a reliable indicator of their expertise and successful project history.

- Direct Ecosystem Integration: The platform connects you with firms that are deeply integrated into Microsoft’s support and product development channels, including access to programs like FastTrack.

When NOT to buy

This directory is exclusively for the Microsoft Dynamics 365 ecosystem. It offers no value if you are evaluating or operating on other platforms like NetSuite, SAP, or Oracle. While the initial packaged offers provide cost clarity for discovery, they are merely entry points; the total cost of ownership for a full implementation will require custom scoping and will be significantly higher than the listed prices for these introductory services.

Website: https://www.microsoft.com/en-gb/dynamics-365/partners/find-a-partner

6. SAP Partner Finder

For organizations committed to the SAP ecosystem, the SAP Partner Finder is the canonical source for identifying and vetting certified implementation partners. Unlike third-party directories, this platform provides direct access to SAP’s official list of qualified firms, ensuring that any partner you find has met the vendor’s criteria for specific solutions like S/4HANA, Business One, or SAP ERP Cloud. Its primary value is serving as an authoritative first step to building a shortlist of credible, SAP-approved ERP consulting companies.

The platform allows technical leaders to filter potential partners by solution, industry specialization, geographic location, and partner type (e.g., sell, build, consult). This granularity is crucial for matching a firm’s certified expertise with your specific technical and business requirements. For instance, you can isolate partners with proven S/4HANA implementation qualifications within the manufacturing sector in your region, streamlining the initial discovery phase.

Key Evaluation Criteria

- Official Certification: The directory only lists partners who have met SAP’s official certification and qualification standards for specific products and services.

- Solution-Specific Search: Users can filter specifically for partners qualified in S/4HANA, SAP ERP Cloud, Business ByDesign, and other niche SAP workloads.

- Partner-Packaged Solutions: The directory highlights pre-packaged, fixed-scope solutions offered by partners, which can provide a clearer path for specific, well-defined projects.

When NOT to buy

The SAP Partner Finder is a tool for validation but poor for initial market research or cost analysis. The platform provides no pricing information, project budget ranges, or client reviews, making it impossible to gauge engagement costs or client satisfaction without direct contact. The user experience can also be cumbersome, often requiring multiple clicks and filter adjustments to narrow down the list. Use this directory to verify the credentials of potential SAP partners, not as a primary tool for comparing them against non-SAP specialists or evaluating their project delivery track record.

Website: https://www.sap.com/partners/find.html

7. Oracle Cloud Marketplace – Consulting/Service Listings

For organizations committed to the Oracle ecosystem, the Oracle Cloud Marketplace serves as a direct, curated source for finding implementation and consulting partners. It functions as a specialized directory where vendors list their services, such as consulting, integration, and training, specifically for Oracle Fusion Cloud ERP and Oracle Cloud Infrastructure (OCI). The primary advantage for technical leaders is the tight alignment between the listed services and the Oracle product stack, which eliminates ambiguity about a partner’s core competencies.

Unlike generalist B2B directories, the marketplace provides a filtered view of firms that have a proven relationship with Oracle. Listings often include customer success stories and clearly define which Oracle products are supported. Buyers can filter by region and specific cloud products, streamlining the initial search for qualified erp consulting companies. Engagements are typically initiated by submitting a contact request rather than a direct purchase, leading to a traditional sales and quoting process.

Key Evaluation Criteria

- Direct Ecosystem Integration: The platform exclusively features partners with demonstrable expertise in Oracle products, reducing the risk of hiring a generalist for a specialist’s job.

- Service Categorization: You can filter specifically for implementation, managed services, or specialized consulting, allowing for a focused partner search.

- Product-Specific Listings: Consultants clearly state which Oracle Cloud products they support, helping you match expertise directly to your technology stack.

When NOT to buy

The marketplace is inherently biased towards Oracle-centric solutions and partners. If you are conducting a multi-platform evaluation (e.g., comparing Oracle NetSuite to SAP S/4HANA), this platform offers no value for assessing non-Oracle consultants. The depth of listings can also be inconsistent across different service categories and regions. It is a resource for finding Oracle-vetted partners but is not suitable for platform-agnostic vendor discovery or broad market comparisons.

Website: https://docs.oracle.com/en-us/iaas/Content/Marketplace/Tasks/creating-service-listing.htm

8. NetSuite Partner Directory

For organizations committed to the NetSuite ecosystem, Oracle’s official NetSuite Partner Directory is the canonical starting point for finding verified implementation and support partners. This directory exclusively lists firms that have met NetSuite’s partnership criteria, providing a baseline level of vetting. It helps technical leaders identify certified specialists for implementations, customizations, and ongoing managed services, directly from the source.

The platform allows you to filter potential ERP consulting companies by region and partner type, such as “Solution Providers” who resell licenses and “Alliance Partners” who provide specialized services. It also highlights award-winning partners and their specializations, offering a quick way to identify firms recognized for excellence in specific verticals or service areas. While it’s an authoritative list, it’s designed to initiate contact, not to provide deep comparative data.

Key Evaluation Criteria

- Official Verification: Every company listed is an officially recognized NetSuite partner, which guarantees a certain level of platform expertise and training.

- Partner Type Filters: The ability to distinguish between Solution Providers and Alliance Partners helps you find the right engagement model for your needs, whether you require licensing or just service delivery.

- Specialization Spotlights: The directory highlights partners with specific industry or micro-vertical expertise, which is crucial for complex or regulated sectors.

When NOT to buy

The directory is a lead-generation tool for NetSuite partners, not an objective review platform. It provides no information on project costs, engagement models, or client satisfaction, requiring you to conduct all due diligence externally. The quality and scale of partners vary significantly; a “Partner of the Year” award may not guarantee a good fit for a smaller-scale project. Use this directory to build a list of potential NetSuite-specific firms, then vet them on platforms like Clutch.co or through direct reference checks.

Website: https://www.netsuite.com/portal/partners/find-a-partner.shtml

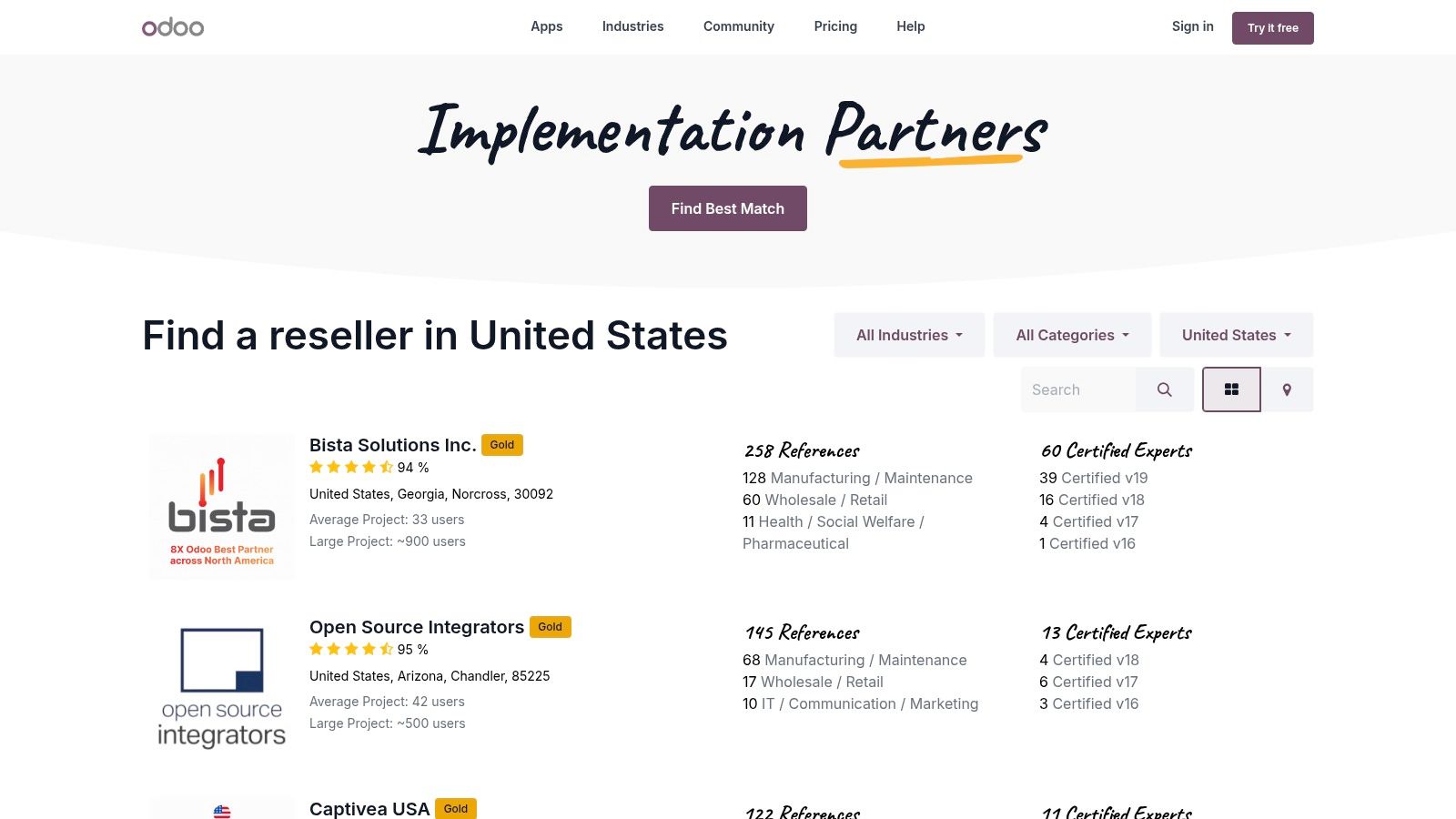

9. Odoo Official Partner Directory (U.S.)

For technical leaders evaluating open-source ERP solutions, the Odoo Official Partner Directory is a critical starting point. It provides a vetted list of implementation partners, categorized by partnership level (Gold, Silver, Ready), which signals their experience and resource commitment to the Odoo ecosystem. The directory is most useful for scoping small to mid-market projects, particularly for manufacturing and distribution companies where Odoo has significant traction.

Unlike generic directories, the platform provides rich metadata directly from the source, including the number of Odoo-certified experts on staff and client reference counts. This data allows for a more informed initial assessment of a partner’s scale and capability to handle specific project complexities. Filters for industry and country enable you to quickly narrow the field to relevant U.S.-based firms, making it an efficient tool for building a shortlist of potential Odoo-specialized ERP consulting companies.

Key Evaluation Criteria

- Partner Tiers: Gold and Silver statuses are earned based on experience, sales volume, and certified resources, providing a quick proxy for a firm’s investment and success.

- Certified Expert Count: This metric indicates the depth of a partner’s technical team and their ability to support complex customizations or larger deployments.

- Industry and Country Filters: Allows for precise targeting of partners with relevant domain expertise and local presence within the United States.

When NOT to buy

The directory effectively highlights partner status but offers no insight into a firm’s specific project management methodologies or delivery rigor, which can vary widely. All pricing and project scope details require direct engagement, as the platform does not provide cost estimators. Treat the directory as a discovery tool for identifying certified partners, but plan for an extensive vetting process to validate their implementation and support quality.

Website: https://www.odoo.com/partners

10. Acumatica Partner Directory

For organizations committed to the Acumatica Cloud ERP ecosystem, the official Acumatica Partner Directory is the designated starting point for finding implementation and support vendors. Because Acumatica operates on a channel-first model, you can only procure and implement the software through a certified partner. This directory serves as the primary, vetted source for connecting with these essential third-party ERP consulting companies.

The platform allows you to search a list of over 200 certified U.S. partners and filter them by state or specialization, such as manufacturing, distribution, or retail. This direct alignment between a partner’s certified expertise and Acumatica’s industry-specific editions is the directory’s core value. It ensures you are engaging with firms that have demonstrated proficiency in the exact modules your business requires, streamlining the initial vetting process.

Key Evaluation Criteria

- Channel-First Model: This isn’t just a list; it’s the required procurement channel. Partners are trained and certified directly by Acumatica, ensuring a baseline level of product knowledge.

- Specialization Filters: The ability to filter by industry edition (e.g., Manufacturing, Construction) is critical for matching partner skills to your specific operational needs.

- Direct Engagement: The directory provides direct contact information, allowing you to bypass a central sales gatekeeper and initiate scoping conversations with qualified implementation teams.

When NOT to buy

The directory is effective for finding Acumatica specialists but offers no qualitative data. There are no client reviews, project cost estimates, or performance metrics. It’s a discovery tool, not a due diligence platform. Furthermore, pricing is entirely absent and requires direct partner engagement for scoping calls. The directory’s domain (acumaticapartners.com) being separate from the main Acumatica site can also create initial brand confusion.

Website: https://www.acumaticapartners.com/

11. Epicor Partner Directory

The Epicor Partner Directory is the official vendor-managed resource for locating specialists certified in Epicor’s product suite. For technical leaders in discrete manufacturing or distribution, this directory offers a direct path to vetted partners for systems like Epicor Kinetic and Prophet 21. Its primary advantage is its focus: every listed firm has a demonstrable background in Epicor’s specific ecosystem, eliminating the noise of generalist ERP consulting companies.

This platform is a crucial first stop if your organization is committed to the Epicor stack. It allows you to filter potential partners by their specific product expertise and industry specialization, which is particularly valuable given Epicor’s deep penetration in sectors like automotive, fabricated metals, and industrial machinery. While the directory provides a reliable list of certified implementation partners, you must engage them directly for any pricing, project scope, or capability discussions.

Key Evaluation Criteria

- Official Certification: All listed partners are officially recognized by Epicor, ensuring they are trained on current methodologies and product versions.

- Industry and Product Filters: The ability to search by specific ERP products (e.g., Kinetic, Prophet 21) and niche industries helps quickly identify relevant specialists.

- Direct Access: The directory connects you with both Epicor’s internal Professional Services group and third-party systems integrators, offering a choice between vendor-led and partner-led engagements.

When NOT to buy

The directory is exclusively for the Epicor ecosystem; it provides no value if you are evaluating competing ERPs. Navigation can feel disjointed, sometimes routing you between the partner directory and separate services pages on the main Epicor site. All commercial details, including project costs and scope, are only available via direct outreach and custom proposals, making it unsuitable for initial high-level budget estimations.

Website: https://www.epicor.com/en-us/partners/partner-directory/

12. IFS Partner Finder

For technical leaders in asset-intensive or service-centric industries, the IFS Partner Finder is a specialized directory for sourcing certified expertise. Unlike generalist platforms, it exclusively lists partners within the IFS ecosystem, covering ERP, Enterprise Asset Management (EAM), and Field Service Management. Its primary value is in identifying firms with proven capabilities in complex operational environments like manufacturing, aerospace, defense, and energy, where generic ERP implementations often fail.

The platform allows filtering by region and partner type, clearly distinguishing between tiers like Global and Platinum partners, which signals a higher level of investment and certification in the IFS platform. This helps narrow the search to the most qualified and committed ERP consulting companies for IFS Cloud. While the directory provides a solid starting point, it lacks pricing data and detailed project reviews, requiring direct outreach for due diligence.

Key Evaluation Criteria

- Focused Ecosystem: The directory is purpose-built for IFS, making it highly efficient for finding specialists without the noise of unrelated ERP systems.

- Partner Program Tiers: You can assess a partner’s commitment and expertise level based on their official status (e.g., Platinum), which is gated by training and certification requirements.

- Regional Search: Allows you to locate local or regional partners, which can be critical for on-site implementation and support needs in specific geographies.

When NOT to buy

The platform’s specialization is also its main limitation. The partner pool is significantly smaller than for mainstream ERPs like SAP or Oracle, potentially limiting choices, especially in certain U.S. regions. All engagement details, including cost, scope, and client references, must be obtained directly from the partners, making it a tool for initial discovery rather than deep comparative analysis.

Website: https://www.ifs.com/partners/find-an-ifs-partner

Top 12 ERP Consulting Resources Comparison

| Source | Core features & coverage | Quality signals / UX | Best for / Target audience | Key risks / Limitations | Procurement & pricing notes |

|---|---|---|---|---|---|

| Clutch.co – ERP Consulting Companies directory | Curated marketplace; filters by location, ERP platform, industry, budget; Leaders Matrix | Verified client reviews, detailed case studies; strong U.S. mid‑market coverage | Shortlisting SIs; qualitative due diligence before RFPs | Pay‑to‑list visibility bias; self‑reported pricing | Contact forms for RFPs; pricing ranges self‑reported, not binding |

| G2 – Microsoft/Dynamics ERP Consulting Services | Buyer‑review listings for Dynamics partners; region & competency filters | Large review base; category comparisons for apples‑to‑apples checks | Validating Dynamics partner reputation and shortlists | Primarily Microsoft‑focused; some listings light on implementation detail | Contact via listings; pricing usually not detailed |

| Upwork – Freelance and boutique ERP consultants | On‑demand freelancers & small teams; hourly rates, certifications, escrow | Transparent hourly rates and freelancer histories; fast proposals | Niche tasks, staff augmentation, short‑term/data migration work | Requires strong buyer scoping & vendor management; not for multi‑year programs | Hourly pricing visible; platform contracts and escrow |

| AWS Marketplace – Professional Services | Catalog of AWS partner services; request‑for‑offer; private offers; consolidated billing | Procurement guardrails; alignment with AWS architecture and controls | ERP on AWS, cloud/analytics modernization, AWS‑aligned projects | Skews cloud/infrastructure; marketplace depth varies by category | Consolidated AWS billing; private offers support negotiated terms |

| Microsoft AppSource / Find a Dynamics Partner | Prepackaged fixed‑scope offers, partner directory, FastTrack guidance | Microsoft partner validation; predictable scoping for discovery/POCs | Predictable entry points and POCs for Dynamics 365 projects | Dynamics‑only focus; larger programs need custom scoping beyond offers | Fixed‑price workshops available; partner contact for larger quotes |

| SAP Partner Finder | Official SAP directory by solution, industry, geography; partner awards | Certified partner listings; canonical source for SAP implementers | Finding S/4HANA and SAP‑qualified implementers | Click‑heavy UX; no pricing shown on directory | Requires partner outreach for scoping and pricing |

| Oracle Cloud Marketplace – Consulting/Service Listings | Service listings for Oracle Fusion Cloud & OCI; region/product targeting | Vendor success stories; supported Oracle services listed on listings | Oracle Fusion Cloud ERP and OCI‑aligned consulting | Contact/quote model; listing depth varies by category | Contact to obtain quotes; not click‑to‑buy |

| NetSuite Partner Directory | Official NetSuite partner directory by region and partner type | Verified partners; partner awards and specializations highlighted | NetSuite implementations, optimizations, managed services | No pricing shown; quality varies across partners | Partner outreach required for proposals and pricing |

| Odoo Official Partner Directory (U.S.) | Partner grades, certified expert counts, reference counts; industry filters | Rich partner metadata for fit and scale estimation | SMB/mid‑market open‑source ERP projects (manufacturing, distribution) | Delivery rigor varies across ecosystem; validate methodologies | Contact partners for scoping and project pricing |

| Acumatica Partner Directory | U.S. certified partners with specialization filters; direct contact flow | 200+ certified partners; clear mapping to industry editions | Buying and implementing Acumatica via certified partners | Separate directory/site can confuse users; no listed pricing | Partner outreach required for quotes and scoping |

| Epicor Partner Directory | Partners for Epicor Kinetic, Prophet 21; filters by product and industry | Certified partners trained on Epicor methodologies | Discrete manufacturers and distributors | Navigation split across Epicor sites; custom proposals only | Contact for proposals and pricing |

| IFS Partner Finder | Global directory for IFS ERP/EAM/Field Service; highlights platinum partners | Training and certification gating; focused, deep ecosystem | Asset‑intensive and service‑centric enterprises | Smaller partner pool in some U.S. regions; limited choices | Partner contact required for engagement details and pricing |

Beyond Directories: A Framework for Final Vendor Selection

The directories analyzed here serve a critical initial purpose: they transform a nebulous need into a tangible longlist. They are excellent for identifying the possible partners. However, relying solely on these listings for a final decision introduces unacceptable risk for multi-million dollar ERP initiatives. A polished profile on G2 or a certification in the AWS Marketplace does not guarantee a consultant’s ability to manage your specific data migration nuances or navigate the internal politics of a cross-departmental rollout.

These platforms are best used for discovery, not final validation. The real work begins once you have a shortlist of three to five promising erp consulting companies. The focus must shift from marketing copy to verified execution capability. The difference between a successful go-live and a project that stalls for 18 months, exceeding its budget by 40%, is determined in this next phase of diligence.

From Longlist to Defensible Decision

Making a defensible choice requires moving beyond the vendor-provided information that populates directory profiles. Your internal evaluation framework should prioritize objective, verifiable evidence of a partner’s technical and operational competence. This is a crucial step in de-risking your investment.

Here are the actionable steps to take your shortlist to a final, data-backed selection:

-

Demand Technical Deep Dives: Move past the sales pitch. Your engineering team must lead technical discovery calls focused on methodology. How do they handle data cleansing and validation? What is their specific approach to integration with your legacy systems? Ask for their runbook for managing cutover weekends. A competent partner will have documented processes; a weak one will offer vague assurances.

-

Scrutinize Scoping Rigor: Request anonymized Statements of Work (SOWs) from past projects of similar scope. Pay close attention to how they define deliverables, outline change control processes, and specify acceptance criteria. Vague SOWs are a primary cause of scope creep and budget overruns. Look for precision and a clear understanding of potential failure points.

-

Conduct Off-List Reference Checks: Vendor-supplied references are, by definition, success stories. Use your professional network to find former clients who are not on the official reference list. These conversations often reveal how a partner handles pressure, communicates bad news, and resolves conflicts when things go wrong.

-

Validate Specialization Claims: Many firms claim to be “manufacturing ERP specialists.” Test this. Present them with a highly specific, technically challenging scenario relevant to your industry. For example, ask a potential manufacturing partner how they would handle lot traceability for a regulated product with a complex bill of materials. Their answer will quickly separate true experts from generalists.

While these directories are a primary starting point, some technical leaders also cast a wider net. For those exploring less conventional discovery methods, leveraging sophisticated B2B lead generation tools can uncover boutique firms or specialized independent consultants who may not be listed in the major ecosystem marketplaces. This approach can supplement your core search, but requires a robust internal vetting process to qualify these less-visible candidates. Ultimately, the goal is to build a comprehensive view of the market, ensuring no high-potential partner is overlooked. Selecting from the top-tier of erp consulting companies requires this level of exhaustive diligence to ensure a successful implementation that delivers on its promised business value.

A directory provides a map, but it doesn’t tell you which path is safe. At Modernization Intel, we provide the unbiased, data-driven intelligence needed to navigate that path. We have quantified the performance, failure modes, and typical engagement costs of hundreds of ERP implementation partners to help you make a defensible, data-backed decision. Get your curated vendor shortlist and de-risk your ERP investment by visiting Modernization Intel.

Need help with your modernization project?

Get matched with vetted specialists who can help you modernize your APIs, migrate to Kubernetes, or transform legacy systems.

Browse Services