A CTO's Guide to DevOps Consulting Companies: Vetting Partners

Hiring one of the top DevOps consulting companies is an investment in speed and expertise. The engagement isn’t just about tactical work like building a CI/CD pipeline; it’s about altering the operational DNA of your engineering team to ship better software, faster. You’re bringing in a specialized team to achieve outcomes that would take an internal team months or years to develop independently.

Understanding The DevOps Consulting Landscape

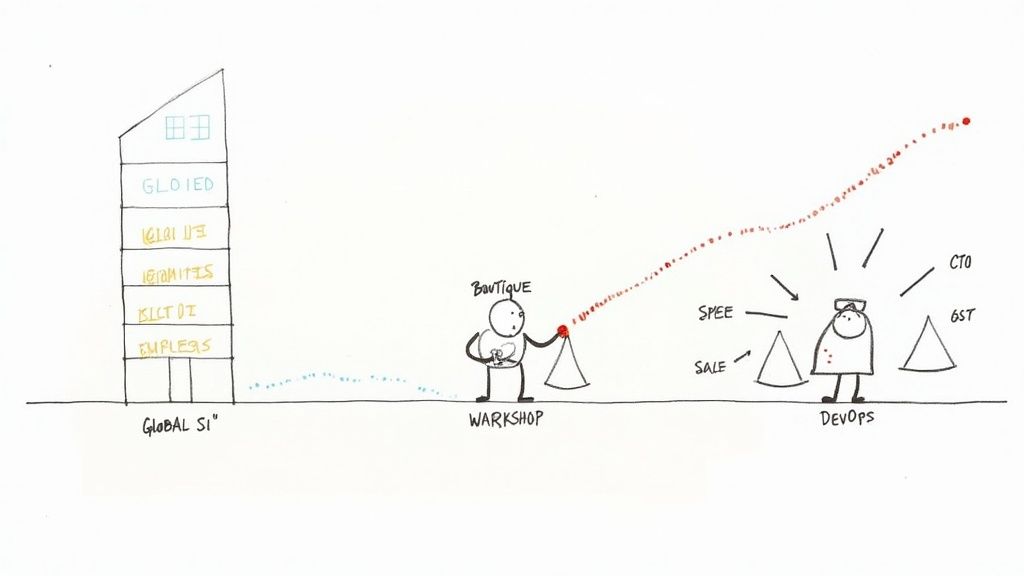

Before vetting firms, it’s critical to understand the two ends of the market: massive Global Systems Integrators (SIs) and hyper-focused boutique shops. They serve fundamentally different needs. Selecting the wrong partner type is a common and costly error.

The market is projected to reach approximately USD 25 billion by 2025. This growth is driven by significant adoption; research indicates that around 80% of Global 2000 companies either have dedicated DevOps teams or utilize consultants for these initiatives. Additional data on this trend is available from sources like Scalacode.com.

Global Systems Integrators vs. Boutique Specialists

Global SIs like Accenture or Deloitte are structured for large-scale, enterprise-wide transformation. Their core competency lies in navigating the complex politics of a Fortune 500, managing sprawling programs, and linking technology projects to high-level business objectives. Their focus is strategic overhaul, not hands-on, deep-in-the-weeds engineering.

Boutique firms are the operational inverse. They offer mastery of a specific craft. This could be an AWS Premier Partner focused exclusively on Kubernetes, a firm specializing in FinTech compliance automation, or a team dedicated to platform engineering. They provide senior, battle-tested engineers directly to a problem without the layers of project management overhead.

A common failure pattern is engaging a Global SI to solve a tactical engineering problem. This often results in paying a significant premium for a layer of program managers who buffer you from the actual engineers, slowing execution and inflating the cost for a task a specialized team could complete in a fraction of the time.

The choice depends on the problem’s nature. Is it primarily organizational and political, or is it technical and executional? The table below outlines the trade-offs.

| Criterion | Global Systems Integrator (SI) | Specialized Boutique Firm |

|---|---|---|

| Best For | Enterprise-wide process re-engineering and strategic transformation. | Specific technical problem-solving and rapid implementation. |

| Typical Team | Program managers, business analysts, junior-to-mid level engineers. | Senior and principal engineers, hands-on architects. |

| Pricing Model | Large, fixed-bid projects; multi-year retainers. | Time & materials; smaller, project-based fees ($75k-$250k). |

| Primary Risk | Slow execution, high overhead, and insufficient deep technical expertise. | Limited capacity for large-scale organizational change management. |

Why Many DevOps Engagements Fail

A DevOps consulting project often begins with promises of faster releases and improved stability. However, CTOs frequently end up with the same problems and a depleted budget. The issue is rarely the consultant’s raw technical skill. It’s often a mismatch between their standardized playbook and the client’s operational reality.

These failures follow predictable patterns. Identifying them early can prevent an engagement that consumes capital while delivering only presentations. The root cause is frequently a misdiagnosis of the core problem.

The “Best Practices” Playbook That Doesn’t Fit

Most DevOps consulting firms arrive with a rigid, pre-packaged solution. They have a preferred stack—perhaps Terraform for IaC, Jenkins for CI/CD, and Prometheus for monitoring—which they have deployed for numerous clients. While efficient for the consultant, this approach can be detrimental when it conflicts with an organization’s existing workflows.

For instance, a consultant might advocate for a full migration to Kubernetes, emphasizing its scalability and portability. But if the in-house team has zero container experience and the monolithic application isn’t designed for microservices, the project becomes an exercise in forcing a technical solution where it doesn’t fit. The outcome is often an overly complex system the team cannot maintain or debug effectively.

A frequent failure scenario: The consultant recommends a toolchain aligned with their partner incentives, not client needs. Mandating a specific cloud provider’s proprietary DevOps tools can create vendor lock-in, undermining the goal of building a portable, resilient architecture.

Obsessing Over Tools, Ignoring People

Another predictable failure mode is treating DevOps as a tooling problem. A firm might be hired to build a new CI/CD pipeline and execute it flawlessly. However, if deep-seated cultural issues—such as blame-oriented post-mortems or a rigid wall between Dev and Ops—are not addressed, the new pipeline merely accelerates dysfunctional habits.

Effective DevOps transformation requires restructuring how teams collaborate and define ownership. Without addressing the human element, advanced automation tools are unlikely to yield the promised results.

- Symptom: The new CI/CD pipeline is live, but developers still hand off code “over the wall” for the Ops team to deploy and manage.

- Root Cause: The engagement was purely technical. No effort was made to restructure team responsibilities or create shared ownership of the application in production.

- Result: Inter-team friction persists, deployment remains a bottleneck, and the anticipated velocity improvements do not materialize.

Misaligned Business and Technical Goals

Finally, an engagement is set up to fail when its objectives are not tied to specific business outcomes. “Implement Infrastructure as Code” is a technical task, not a business objective. A meaningful goal sounds like this: “Reduce new environment provisioning time from 3 weeks to 1 hour to enable faster sales demos and increase deal closure rates.”

This disconnect often occurs when a project is scoped by one department (e.g., IT Operations) without input from the teams it is intended to serve (e.g., Product or Sales). The consultant delivers exactly what was requested, but the solution addresses a problem that was not a business priority. It’s a technically successful project that delivers zero business value.

A Comparative Matrix Of DevOps Consultant Types

Not all DevOps consulting firms are interchangeable. The market is divided between Global Systems Integrators (SIs) and focused, practitioner-led Specialized DevOps Firms.

Selecting the wrong type is a primary cause of failed engagements, budget overruns, and a lack of meaningful impact on engineering velocity or system stability. As a CTO, it’s necessary to look past marketing claims and understand the underlying business models of these firms.

The right choice depends on your specific problem. Are you orchestrating a multi-year, enterprise-wide transformation affecting dozens of business units? Or are you trying to fix a crippling 45-minute build time that is impacting developer productivity? The answer determines the appropriate partner profile.

This infographic breaks down common failure points in DevOps projects. The failure is typically not the tool, but a fundamental mismatch between the hired partner and the actual problem.

As shown, failure often traces back to a misalignment between the partner’s model, the existing tech stack, and the intended business outcome.

When comparing DevOps consulting partners, the difference between a global SI and a specialized firm is stark. One sells large-scale program management; the other sells direct access to senior engineering talent. The following table outlines the operational realities.

DevOps Consultant Specialization Matrix

| Criterion | Global Systems Integrators (e.g., Accenture, IBM) | Specialized DevOps Firms (e.g., Slalom, Contino) |

|---|---|---|

| Primary Use Case | Enterprise-wide process overhaul tied to major business initiatives. Multi-year transformations. | Solving a defined technical problem. Accelerating a specific, high-stakes project. |

| Team Composition | Heavy on project managers and business analysts. Execution by junior-to-mid level engineers. | Primarily senior, hands-on engineers and architects who operate in the code and CLIs. |

| Engagement Model | Multi-year, multi-million dollar fixed-bid contracts and retainers. High overhead. | Project-based fees ($75k-$500k) or time-and-materials for access to senior talent. |

| Technical Depth | Generalist knowledge across many platforms and tools. Broad but not deep. | Deep, specialized expertise in a specific cloud ecosystem (AWS, Azure, GCP) and its toolchain. |

| Common Failure | Paying a 30-40% premium for management overhead on a technical project, resulting in slow, mediocre execution. | Lacking the scale or process maturity to drive change across a large, siloed, political organization. |

This matrix is a tool for avoiding common hiring mistakes. Choose the model that aligns with your immediate problem, not the one with the most recognizable brand or most polished presentation.

Global Systems Integrators (Accenture, Deloitte, IBM)

Global SIs are proficient at managing complexity at enterprise scale. Their core strength is not deep, hands-on engineering but large-scale program management, organizational change, and navigating the political landscape of a Fortune 500 company. They excel at aligning tech initiatives with C-suite strategy and are structured to handle corporate procurement and legal processes.

This strength comes with a trade-off: technical depth. The teams are often heavy on project managers and light on senior engineers. The true experts are typically spread thin across multiple accounts, functioning more as advisors than practitioners.

An SI is a suitable choice when a DevOps initiative is part of a broader, multi-million-dollar business transformation. They are an unsuitable choice for solving a specific technical challenge, like implementing a secure container orchestration platform for a high-compliance workload. You will likely pay a 30-40% premium for program management that adds little value to pure technical execution.

Specialized DevOps Firms (Slalom, Contino, Boutique Shops)

Specialized DevOps firms are the tactical inverse of Global SIs. Their value proposition is providing direct access to senior, hands-on engineers who have solved your specific problem multiple times.

These firms focus on specific ecosystems—whether it’s AWS, Azure, or GCP—and often hold the highest-tier partner certifications. They are execution-focused. They are brought in to implement solutions quickly.

They are a strong fit for an organization with a well-defined technical problem, such as modernizing a legacy CI/CD pipeline or implementing Infrastructure as Code (IaC) for a critical application. For more on these types of projects, you can review strategies for DevOps integration modernization. Their flatter structure means clients work directly with the practitioner solving the problem.

The trade-off is their limited capacity to handle widespread organizational change. They are engineers, not management consultants, and typically lack the resources to navigate cross-departmental politics in a large enterprise.

Key Differentiators For CTOs

When evaluating these two models, focus on three critical areas: platform expertise, industry vertical, and technical hurdles.

An SI might claim “expertise” across all three major cloud providers, but this knowledge is often superficial. A specialized firm, in contrast, may only work with AWS but will possess institutional knowledge of its services that isn’t found in official documentation, including undocumented limits and battle-tested configurations.

-

Platform Expertise: A global SI offers broad but shallow knowledge; their engineers are generalists. A specialized firm provides deep expertise in one or two platforms, often with direct communication lines to the cloud provider’s product teams.

-

Industry Vertical: SIs have extensive experience in regulated industries like finance, primarily from a compliance and process standpoint. A specialized FinTech DevOps firm will have hands-on experience implementing immutable infrastructure that meets PCI DSS controls, not just writing a report about it.

Selecting the right partner requires an honest assessment of your organization’s needs and capabilities. A common mistake is hiring a firm based on its marketing claims rather than its operational model.

Deconstructing The True Costs Of DevOps Consulting

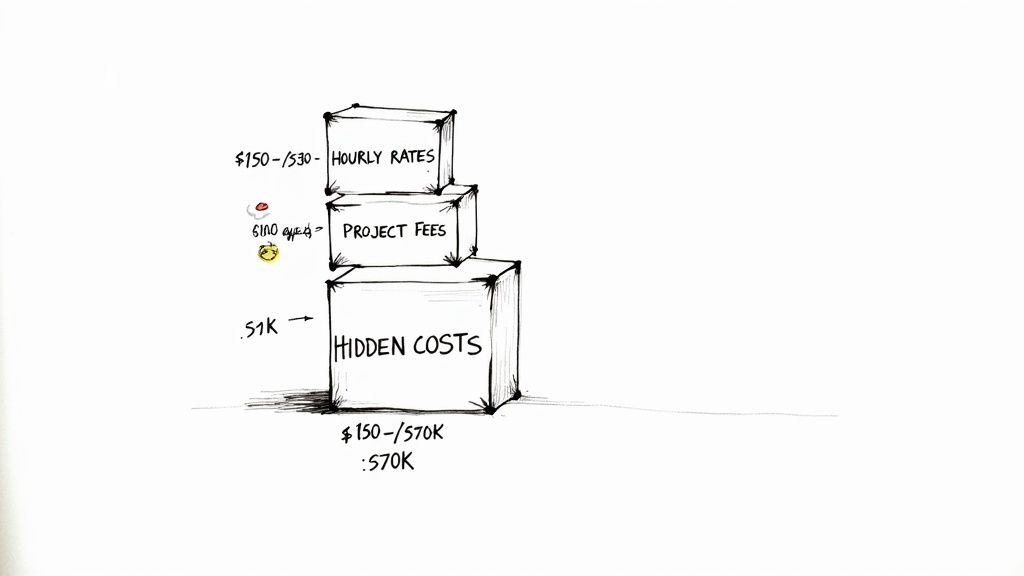

Vague sales pitches like “competitive rates” are not useful for budgeting. The actual cost of hiring a top-tier DevOps consulting firm includes their invoice, your team’s time commitment, and other expenses that are rarely included in the initial proposal.

Understanding these numbers is necessary to calculate a credible ROI and avoid budget surprises. Many firms are intentionally ambiguous about pricing. To make an informed decision, you need real-world data to anchor expectations and identify proposals that are either overpriced or dangerously under-scoped.

Standard Pricing Models and Rate Cards

Most DevOps consulting work is sold using one of three models. The preferred model often indicates the firm’s focus—whether they are providing tactical staff augmentation or selling strategic, outcome-based projects.

-

Hourly (Time & Materials): This model is common for accessing deep, specialized expertise. Rates reflect an engineer’s experience and skill scarcity. Expect to pay $150-$350 per hour for a senior DevOps or platform engineer with deep expertise in a specific cloud ecosystem. A detailed breakdown of these figures is available in this guide to hourly IT consulting rates.

-

Project-Based Fee: For work with a defined scope, firms will quote a fixed price. A project to build a production-ready CI/CD pipeline for a single application typically costs between $75,000 and $250,000. This model provides cost predictability but requires a detailed Statement of Work (SOW) to prevent scope creep.

-

Monthly Retainer: This is used for ongoing services like managed services, observability, or Site Reliability Engineering (SRE) support. Retainers can start around $15,000 per month and exceed $50,000, depending on the SLA, system complexity, and on-call coverage requirements.

Quantifying The Hidden Costs

The consultant’s invoice is only the starting point. Hidden costs can add 20-30% to the total project spend if unplanned. These costs are not malicious; they are simply assumed to be the client’s responsibility.

The largest hidden cost is your own team’s time. If your engineers are not shadowing the consultants, pair programming, and co-writing documentation, you are renting a dependency, not acquiring expertise. This internal support can consume 10-15 hours per week from your most skilled personnel.

A realistic budget must account for this internal burn rate to reflect the true total cost of ownership.

Uncovering The Overlooked Expenses

Beyond your team’s time, other hard costs will appear on invoices from other vendors.

Tool Licensing and Subscriptions

Modern DevOps involves commercial tools for security, artifact management, and observability.

- SonarQube or Snyk: Budget $150 - $400 per developer per year for code quality and security scanning.

- JFrog ArtFactory: An enterprise license can start at $20,000 per year.

- Datadog or New Relic: These are consumption-based, but a mid-sized environment can cost $5,000 - $10,000 per month.

Cloud Consumption Overhead

Building new infrastructure in the cloud costs money. During a migration or platform build, you will run old and new environments in parallel. This duplication can increase your cloud bill by 15-25% for the project’s duration. A competent consultant should help forecast this temporary increase.

By breaking down these costs, you can move from a vague estimate to a detailed financial model, which is necessary for securing leadership buy-in and measuring investment returns.

When NOT to Hire DevOps Consulting Companies

Hiring one of the top DevOps consulting companies is not a universal solution. In some cases, engaging an external firm is counterproductive, consuming budget and political capital with no tangible results.

The most common failures occur when a company attempts to purchase a technical solution for a human problem. Engaging a consultant before your organization is ready is a predictable and expensive mistake. An honest self-assessment is required: are the foundational pieces in place for an engagement to succeed?

Your Problem Is Cultural, Not Technical

This is the most critical point. Do not try to outsource cultural change. At its core, DevOps is about dismantling silos between development and operations, fostering shared ownership, and creating tight feedback loops. A consultant can provide tools and process diagrams, but they cannot compel collaboration between antagonistic teams.

If your engineering organization is characterized by finger-pointing in post-mortems and hostility between teams, a consultant will likely exacerbate these issues. The new CI/CD pipeline they build will become another point of conflict rather than a shared asset.

A consultant cannot fix a trust problem. If your developers view Ops as a roadblock and Ops views developers as reckless, no amount of automation will resolve the underlying dysfunction. The engagement will fail because the human systems are broken.

You Don’t Have a Clearly Defined Problem

Hiring a firm without a specific, measurable goal is a recipe for failure. Vague requests like “we need to do DevOps” lead to endless discovery phases and escalating costs. These projects typically result in extensive slide decks but no actual change in software delivery.

A successful partnership begins with a precise problem statement.

- Vague request: “Improve our deployment process.”

- Specific goal: “Reduce the average deployment lead time for the core API from 7 days to under 24 hours.”

- Vague request: “Modernize our infrastructure.”

- Specific goal: “Migrate the auth service to EKS and automate its provisioning with Terraform by the end of Q3.”

Without this level of specificity, there is no way to measure success, and the consulting firm has no clear endpoint. The result is often a project that exceeds its budget by 30-50% while delivering ambiguous value.

Before signing a contract, you must be able to state the exact metric you intend to change, and by how much. If you cannot, you are not ready.

Building Your Shortlist and the Technical Gauntlet

Selecting a DevOps partner requires a rigorous, evidence-based technical evaluation, not just a review of marketing materials. A real-world technical interview reveals a consultant’s actual knowledge. Your task is to bypass the sales pitch and assess their hands-on expertise.

The first step is building a shortlist. The DevOps consulting market includes global IT firms like Accenture, IBM, Deloitte, TCS, Capgemini, and Wipro, as well as a growing number of specialized boutique firms.

Once you have a list of potential partners, you need a weighted scorecard to compare them objectively.

Create a Weighted Vendor Scorecard

A scorecard transforms subjective impressions into objective data, providing a defensible basis for your final decision. For a complete template, you can use our vendor due diligence checklist.

Key categories include:

- Technical Proficiency (40% Weight): Do they have demonstrated expertise in your stack? Request documented experience with your specific challenges, such as high-compliance container orchestration on AWS versus Azure.

- Methodology & Process (30% Weight): How do they handle knowledge transfer? What is their post-mortem process? A refusal to commit to specific, measurable KPIs is a significant red flag.

- Cultural Alignment (20% Weight): How do they handle disagreements? Do they follow a rigid playbook or adapt to your team’s context? This determines if they will be a partner or just a vendor.

- Cost & Value (10% Weight): Analyze the total cost of engagement, including tool licenses and the time required from your internal team. The lowest price is rarely the best value.

The Technical Interview Checklist That Exposes the Truth

The scorecard will help narrow the field to two or three contenders. The technical interview is the final step. These questions are designed to move candidates beyond rehearsed answers to share real-world experience. You are looking for honesty and a logical thought process.

The best consultants are willing to discuss their failures. A candidate who claims to have never led a failed project is likely either inexperienced or not being transparent.

Pose these questions to the senior engineers who will be assigned to your project, not the sales engineer.

Scenario-Based Technical Questions:

- On Failure and Recovery: “Describe a CI/CD pipeline you built that failed in production. Walk me through the post-mortem. What was the root cause, and what specific changes did you implement to prevent recurrence?”

- On Governance and Autonomy: “In a microservices environment, how do you balance developer autonomy with centralized governance? Describe a specific toolchain or policy you implemented to manage this, such as using OPA for policy-as-code or creating standardized Terraform modules.”

- On Security Integration: “Describe a time you integrated security scanning (SAST/DAST/SCA) into a CI/CD pipeline without impeding developer velocity. What trade-offs did you make between security rigor and deployment frequency?”

- On Legacy Systems: “Outline your 90-day plan for introducing DevOps principles to a team maintaining a legacy monolith with no test coverage. Where would you start, and what would be the first tangible win you would aim for?”

These questions force a conversation about the practical realities of trade-offs, failures, and complex problems. The quality of the answers will indicate who can deliver results versus who can deliver a good pitch.

Your Questions, Answered

Here are direct answers to common questions from engineering leaders vetting DevOps consulting firms.

What is a realistic ROI?

A successful engagement should deliver a 20-50% reduction in deployment lead times and a 15-30% drop in change failure rates within the first six months.

A reputable firm will write Key Performance Indicators (KPIs) directly into the statement of work, contractually linking their technical activities to business metrics like infrastructure spend or feature delivery velocity.

Is a tool-agnostic or specialist firm better?

This depends on whether you are optimizing an existing system or implementing a new one.

If you need to execute a project within your current stack (e.g., optimizing AWS pipelines), a specialist is typically faster and more efficient.

If you are undertaking a strategic transformation or suspect your current toolchain is a constraint, a tool-agnostic firm can provide a more objective, long-term perspective. They are not incentivized to sell you more of what you already have.

How can we avoid vendor lock-in and ensure knowledge transfer?

Make it a contractual requirement. Do not accept vague promises of “collaboration.”

Effective knowledge transfer includes:

- Paired programming sessions

- Joint architectural design reviews

- Comprehensive, human-readable documentation

- A formal, multi-week off-boarding plan

A top-tier consultant’s goal should be to make themselves obsolete. Mandate co-creation and training sessions in the SOW. If they cannot articulate how they will upskill your team, you are renting labor, not acquiring expertise.

The global DevOps market was valued at USD 3.71 billion in 2018 and is projected to reach nearly USD 15 billion by 2026, with a 19.1% CAGR. North America accounted for approximately 49.3% of the market share in 2018. This data is available from market analyses by firms like Fortune Business Insights.

Modernization Intel provides data-driven intelligence on implementation partners. We deliver real cost data, documented failure rates, and specialization analysis to support defensible vendor decisions. Get your vendor shortlist at https://softwaremodernizationservices.com.

Need help with your modernization project?

Get matched with vetted specialists who can help you modernize your APIs, migrate to Kubernetes, or transform legacy systems.

Browse Services