A CTO's Guide to Understanding Call Center Cost

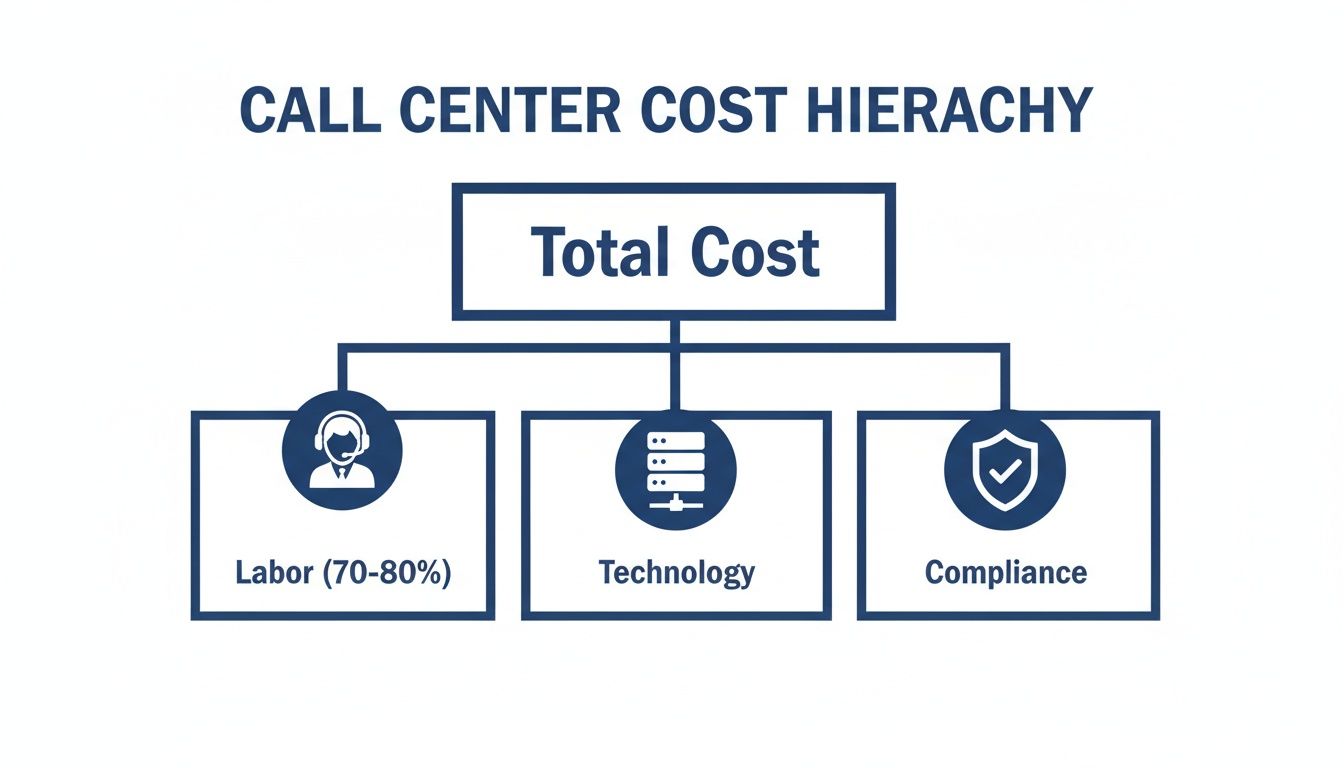

Analyzing your true call center cost requires looking past per-agent pricing. A fully-loaded cost analysis reveals that while labor constitutes 70-80% of the budget, the primary financial risks are often buried in mismanaged technology, complex integrations, and overlooked compliance mandates.

Deconstructing the True Cost of a Call Center

Many leaders focus exclusively on agent salaries—the most visible expense—while missing the underlying technology and operational overhead that can derail the entire budget. This narrow view often leads to significant, unplanned cost overruns.

As a CTO, your responsibility is to dissect the entire cost structure to make a defensible decision between building an in-house center or outsourcing to a partner.

The core components of a call center budget are consistent, but the payment models differ significantly.

- In-House: You accept higher upfront capital expenditures (CapEx) and direct management overhead in exchange for complete control.

- Outsourcing: You convert CapEx into a predictable monthly operational expense (OpEx) but introduce vendor management risks and relinquish some direct oversight.

This diagram breaks down the primary cost drivers that must be accounted for.

While labor represents the largest portion, technology and compliance are significant and often unpredictable cost centers that require a thorough technical deep-dive.

In-House vs. Outsourced Call Center Cost Comparison

To make this tangible, let’s compare the cost structures side-by-side. The following table provides a high-level view of where capital is allocated in each model, highlighting where financial risk and management burdens lie.

| Cost Category | In-House Model (Example Cost) | Outsourced Model (Example Cost) | Key Considerations for CTOs |

|---|---|---|---|

| Agent Labor | $45,000/agent/year (fully loaded) | $25-$35/agent/hour (all-inclusive) | In-house includes recruiting, training, and attrition costs. Outsourcing bundles this, but you lose direct control over hiring quality. |

| Supervision & Management | $70,000/supervisor/year | Included in per-hour rate | Does your organization have the internal leadership bandwidth and expertise to manage a call center team effectively? |

| Technology (CCaaS/CRM) | $150/agent/month (licenses) | Included in per-hour rate | In-house requires managing vendor contracts and integrations. Outsourced partners manage this, but you are limited to their tech stack. |

| Telecom & Infrastructure | $2,000/agent/year (plus hardware) | Included in per-hour rate | The in-house model requires owning carrier relationships and infrastructure reliability. Outsourcing offloads this operational risk. |

| Compliance & Security | $20,000+ per audit/year | Amortized across clients | PCI, HIPAA, and other certifications are expensive and complex to maintain. A BPO partner’s security posture requires careful validation. |

This is not an exhaustive list, but it illustrates the fundamental trade-off: The in-house model places the burden of capital investment, operational execution, and risk management on your organization. The outsourced model converts this into a simpler operating expense but introduces vendor dependency and potential quality control challenges.

Core Cost Categories to Evaluate

To build a financial model that withstands scrutiny, you must break down costs into these distinct categories. Each one contains variables and risks that can inflate your total cost of ownership (TCO). For a more detailed breakdown of these expenses, CallZent has published a resource on Mastering Call Center Costs: A Practical Guide.

Here are the foundational elements to assess:

- Labor Costs: This includes hourly wages, recruiting, training, benefits, payroll taxes, and supervisor salaries. Agent attrition, which can exceed 30-45% annually, is a significant and often hidden cost.

- Technology and Infrastructure: This category includes recurring software licenses for CCaaS platforms, CRM, and quality monitoring tools. For in-house builds, it also includes hardware, servers, and telephony infrastructure.

- Compliance and Security: The cost of maintaining compliance with standards like PCI-DSS for payments or HIPAA for healthcare data is substantial. It requires specialized software, regular audits, and secure infrastructure, all of which add significant overhead.

A frequent mistake is underestimating the “soft costs” of managing these systems. The time your internal IT and engineering teams spend on maintenance, integration, and troubleshooting is a real expense that must be included in any TCO calculation. Factoring this in is a core part of effective budgeting for IT.

Ultimately, understanding the true cost isn’t about finding the lowest-priced option. It’s about identifying the model that provides the optimal balance of performance, risk, and financial predictability for your business requirements.

The Global Labor Arbitrage Driving Your Budget

Labor isn’t just a line item in a call center budget; it often accounts for 70-80% of total costs. Any analysis that doesn’t start here is incomplete. Understanding global labor economics is about decoding the financial engine that powers every vendor proposal you will receive.

When a BPO vendor submits a proposal, they are primarily selling access to a specific labor market. Their business model is built on the significant variance in the “fully loaded hourly cost” for an agent in different countries. This cost includes not just wages but also benefits, payroll taxes, recruiting, and management.

The financial disparity directly impacts your bottom line. A fully loaded call center agent in the United States costs approximately $20.50 USD per hour. In comparison, the cost is around $3.00 in the Philippines, $2.00 in South Africa, and $1.50 in India. This is why over 70% of Fortune 500 companies outsource, pursuing labor savings that can reach 80-90%. You can explore more data on these global labor cost differences to understand the market dynamics.

Onshore vs. Offshore: A Pure Cost Comparison

The numbers present a compelling, though simplistic, case for offshoring. For the cost of a single U.S.-based agent at $20.50/hour, you could hire approximately seven agents in the Philippines or thirteen agents in India. This cost delta is the reason the BPO (Business Process Outsourcing) industry exists.

However, this raw cost comparison is only the starting point. A proper technical and operational evaluation goes much deeper.

Pure labor arbitrage can be a trap. A lower hourly rate is meaningless if you experience poor first-call resolution, high agent attrition, or security compliance failures. The objective is to find the optimal balance of cost, skill, and risk—not just the lowest number on a spreadsheet.

For many companies, the decision is not a simple binary choice.

The Rise of Nearshoring: A Strategic Compromise

Nearshoring offers a strategic middle ground, balancing the high costs of domestic operations with the logistical complexities of traditional offshoring. Countries like Mexico and Colombia have become primary locations for this model.

Here’s why nearshoring is gaining traction:

- Time Zone Alignment: Operating in a similar time zone to the U.S. facilitates real-time collaboration, which is critical for support escalations, joint training sessions, and management oversight.

- Cultural Proximity: Shared cultural context and language skills, particularly for serving Spanish-speaking customers in the U.S., can improve customer rapport and satisfaction scores.

- Reduced Travel Costs: The time and cost for site visits for training, quality audits, or relationship-building are a fraction of a trip to Asia.

While nearshore rates are higher than in India or the Philippines, they still offer significant savings over U.S. operations. A fully loaded agent in these regions typically costs between $5.00 and $9.00 per hour. This presents a compelling financial case for businesses that require tighter integration and cultural alignment than what traditional offshoring can offer. The right choice depends on your specific operational needs, customer demographics, and tolerance for logistical overhead.

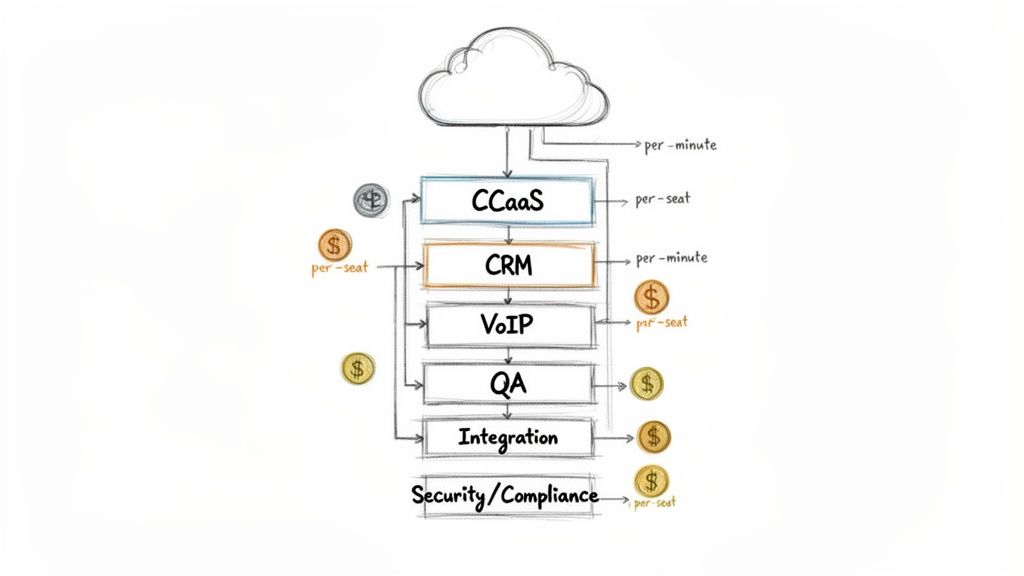

Analyzing the Technology and Infrastructure Stack

After labor, the technology stack is the next largest component of a call center budget. Mismanagement here leads not only to overspending but also to operational friction that impacts agent productivity and customer satisfaction. The real expense is not the software license sticker price but a web of interconnected costs that require careful scrutiny.

For any CTO or engineering lead, a detailed Total Cost of Ownership (TCO) analysis is non-negotiable. The primary decision is whether to invest capital in an on-premise build or shift to a subscription-based cloud model. On-premise requires significant upfront CapEx for servers, hardware, and data centers. A cloud-based Contact Center as a Service (CCaaS) converts this to a recurring OpEx.

The shift from CapEx to OpEx appears attractive, but cloud providers are incentivized to have you over-commit on resources. Without rigorous governance, monthly bills can escalate. The first step is to understand their pricing models.

Breaking Down Software and Telephony Costs

Modern contact center software is typically priced in one of three ways. Each model links costs to a different business lever, and selecting the wrong one can lead to unnecessary expense.

- Per-Seat Pricing: The most straightforward model. You pay a fixed monthly fee for each agent or supervisor using the platform (e.g., CCaaS, CRM). Costs typically range from $100 to $250 per agent per month. This model is predictable but can be inefficient if you have a high number of seasonal or part-time agents occupying paid-for but unused seats.

- Per-Minute Pricing: Classic telephony billing. You pay for each minute an agent is on a call. Outbound calls might cost $0.02 to $0.10 per minute, while inbound toll-free lines can cost more. This model directly links costs to call volume.

- Usage-Based Pricing: A catch-all category that can include charges per call, per SMS, per chatbot session, or per gigabyte of call recording storage. It is the most flexible model but also the most difficult to forecast.

At the core is Voice over IP (VoIP) telephony. Pricing can range from $25 to over $300 per user per month, depending on features, call volume, and included hardware. This variance requires you to get granular on what is bundled into a CCaaS package versus what is billed as a separate line item.

Cost Trap Alert: Do not assume a CCaaS platform’s “per-seat” license includes all telephony charges. Often, connectivity to the PSTN and per-minute charges are billed separately. We have seen clients receive invoices 20-30% higher than budgeted due to this misunderstanding.

To provide a clearer picture, let’s break down how these technology costs compare between on-premise and CCaaS models.

Call Center Technology Cost Breakdown

The table below provides a detailed look at typical technology and software expenses, comparing the traditional on-premise model against the modern cloud-based CCaaS approach. This covers the entire ecosystem, from the dialer to the database.

| Technology Component | On-Premise Model Cost Range | CCaaS Model Cost Range | Primary Vendor Examples |

|---|---|---|---|

| Core Platform (ACD, IVR) | $500K - $2M+ (Upfront CapEx) | $120 - $250 /seat/mo | Five9, Talkdesk, Genesys |

| Telephony/VoIP | $50K - $300K (Hardware) + Usage | $0.01 - $0.08 /minute (Usage) | Twilio, Bandwidth, Vonage |

| CRM Integration | $25K - $100K (Prof. Services) | $10 - $50 /seat/mo (Add-on) | Salesforce, Zendesk, HubSpot |

| Workforce Management | $50 - $100 /seat/mo (Separate) | Often bundled in Pro/Ent. tiers | NICE, Verint, Calabrio |

| Data Storage (Recordings) | $5K - $20K /year (SAN/NAS) | $0.02 - $0.05 /GB/mo (Cloud) | AWS S3, Azure Blob Storage |

| Annual Maintenance | 18-25% of initial software cost | Included in subscription | N/A |

The on-premise model is defined by significant upfront capital expenditure and ongoing maintenance fees, while the CCaaS model shifts everything to a predictable (if managed correctly) operational expense.

The Hidden Costs of Integration and Compliance

Financial models that prove accurate are those that account for costs not listed on the vendor’s pricing page. These are the areas where budgets most often fail, and they require direct engineering oversight.

Systems Integration Costs Your call center must integrate with your CRM, billing platform, and other internal systems. Professional services to build these integrations are almost never included in the standard license fee. You should budget an additional 15-50% on top of the first-year platform cost for this work. Overlooking this is a primary reason modernization projects fail to meet their ROI targets. Reviewing detailed guides on cloud cost optimization strategies can help you manage these variables.

Security and Compliance Overhead If you handle payments or health data, meeting regulations like PCI-DSS or HIPAA is non-negotiable and expensive. This is an ongoing financial commitment, not a one-time setup.

- Specialized Software: You will need tools for call recording encryption, data masking for sensitive information, and secure payment gateways.

- Regular Audits: Third-party certification audits can cost $20,000 or more annually, per certification.

- Secure Infrastructure: Architecting your environment to meet these strict security controls adds significant upfront and operational costs.

These technology costs form a complex puzzle. A vendor’s low per-seat price can obscure much larger expenses related to integration, compliance, and telephony usage. A thorough TCO analysis is the only way to see the complete financial picture.

How AI Is Reshaping Call Center Economics

AI is changing the call center cost equation by automating repetitive tasks and augmenting human agents. This is not about replacing teams but about practical applications that directly reduce the operational budget.

The primary impact of AI is intelligent automation. A well-trained chatbot can handle a significant volume of simple, repetitive inquiries like “what’s my balance?” or “where’s my order?”. This allows experienced human agents to focus on complex, high-value problems. The result is that fewer agents are needed to handle the same call volume.

The financial impact is substantial. Projections indicate AI is on track to reduce global customer service costs by $80 billion by 2026, largely by automating one out of every ten agent interactions. AI-powered centers already resolve 14% more issues per hour and reduce average handle time by 9%. The market, valued at $3.98 billion in 2025, is expected to grow as more organizations see these results.

Tangible Impacts on Core Cost Metrics

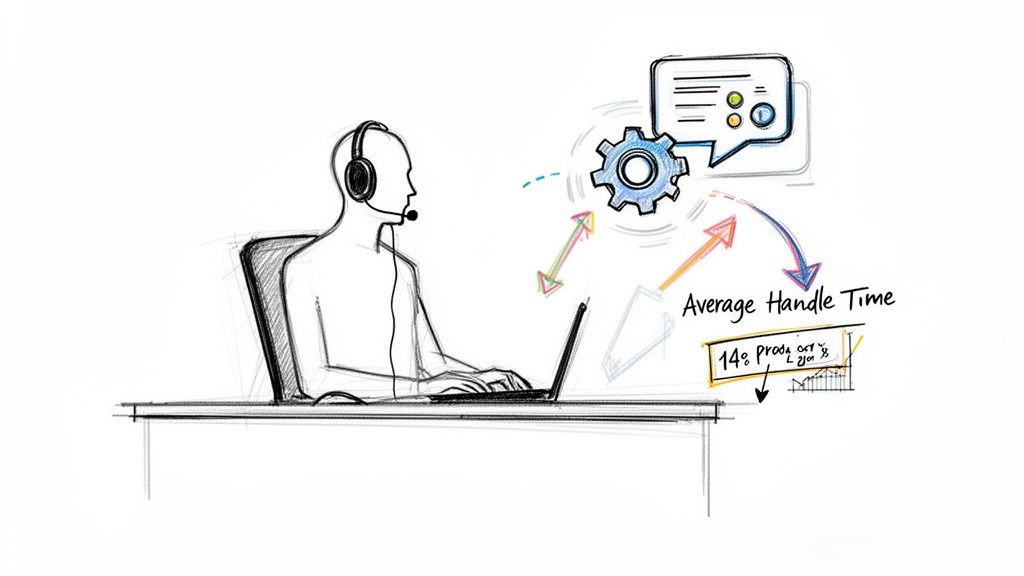

AI improves operational efficiency by directly impacting the two metrics with the largest influence on labor costs: Average Handle Time (AHT) and First Call Resolution (FCR).

Here’s how it works in practice:

- Reducing AHT: Instead of making customers wait while agents search a CRM or knowledge base, AI surfaces relevant information instantly. This reduces dead air and accelerates time-to-resolution.

- Boosting FCR: AI can guide agents through complex troubleshooting steps, ensuring they have the right information at the right time. This reduces errors that lead to callbacks. A higher FCR means fewer total calls and lower labor spend.

A common mistake is viewing AI as a replacement for agents. A more effective strategy is augmentation. An AI co-pilot can improve a good agent’s productivity by 14% or more, enhancing quality and efficiency without the brand risk associated with fully-automated service.

The Implementation Cost and The ‘Science Project’ Risk

Implementing AI is a significant systems integration project with a corresponding price tag. You should budget between $1,000 to $2,000 per agent for the initial setup, training, and integration work. This is not a plug-and-play solution.

The process is similar to other large-scale technical migrations. Just as a COBOL modernization can become a financial drain without meticulous planning, an AI implementation can easily turn into an expensive “science project” with no clear business payoff. Without a solid business case and an experienced partner, the investment is a gamble.

Success depends on treating this as an infrastructure upgrade, not a software purchase. Researching the strategic use of AI for call centers can provide insights into achieving real cost reductions through proper planning. The key is to select a partner with a track record of delivering measurable business outcomes, not just impressive demos. Without this diligence, you risk investing significant capital into a system that fails to reduce your bottom-line call center cost.

Outsourcing Your Call Center? Let’s Talk About the Real Costs.

Deciding to outsource your call center is a major strategic shift, not just a budget line item. You trade a large capital expense for a predictable operational one, but you also tie your brand’s reputation to a third party and take on a new class of risks.

This decision is about more than finding the lowest hourly rate. It’s about selecting a business model that aligns with your operations, growth plans, and tolerance for ceding control.

The global call center outsourcing market is projected to grow from $381.53 billion in 2026 to nearly $656 billion by 2032, a CAGR of 9.3%. Companies are moving away from the high costs of facilities and recruitment, with some outsourcing partners offering rates starting around $15 per hour—a significant reduction compared to the fully-loaded cost of an in-house agent. You can find more data in this call center statistics report.

Comparing BPO Engagement Models

Business Process Outsourcing (BPO) vendors offer several engagement structures, each directly impacting your call center cost, service quality, and flexibility. Understanding these models is the first step.

- Dedicated Team Model: A group of agents works exclusively for your company. You get their full attention and can train them as experts on your products and brand. This is the most expensive option but provides maximum quality control, making it suitable for complex technical support or VIP customer service.

- Shared Team Model: Agents handle calls for multiple clients. This is more cost-effective because you only pay for the time they spend on your calls. The trade-off is that their expertise may be diluted, and they won’t be as deeply immersed in your brand. It’s a viable choice for straightforward, high-volume tasks.

- Transactional Model: A pure pay-as-you-go model where you are billed per call, per minute, or per resolution. It offers high flexibility and is ideal for businesses with fluctuating or seasonal call volumes. However, it can become the most expensive model during unexpected volume spikes.

The decision often comes down to cost versus control. A dedicated team acts as an extension of your company, but at a premium. Shared models offer immediate cost savings, but you must accept that the agent represents multiple brands.

Decoding BPO Pricing Structures

After selecting an engagement model, the vendor will present their pricing structure. These can be complex and may include hidden fees. It is critical to read the fine print. A rigorous due diligence process is essential.

Here are the most common pricing models:

- Per Hour Per Agent: Standard for dedicated teams. You pay a flat rate for every hour an agent is scheduled, regardless of call activity. This makes budgeting predictable, but you pay for idle time. Expect rates from $8-$15 per hour offshore to $25-$35 per hour onshore.

- Per Minute: Common in shared models, this links cost directly to usage. You are billed for every minute an agent spends handling your customers. Rates can differ significantly for inbound (e.g., $0.75-$1.25/min) versus outbound calls.

- Per Call/Resolution: A transactional approach where you pay a fixed price for each call handled or ticket closed. It is effective for simple, repeatable tasks like order entry or appointment setting.

These models must be analyzed carefully. To ensure you don’t miss any red flags, use a comprehensive vendor due diligence checklist. A low per-hour rate can be negated by hidden charges for training, reporting, or technology fees, turning an apparent good deal into a long-term financial liability.

Common Cost Traps in Call Center Modernization

The promised ROI from a call center modernization project often fails to materialize. The real financial risks are not on the vendor’s pricing sheet; they are buried in flawed assumptions and technical oversights that can quietly undermine the project.

For example, in the legacy world, we know 67% of COBOL migrations fail due to critical details like decimal precision handling. A similar level of skepticism should be applied to call center projects. The most significant risks are not the obvious license fees but the hidden complexities that can turn a strategic upgrade into a protracted and costly recovery effort.

Unpacking the Hidden Vendor Fees

Vendors often present a low initial price, but the total contract value tells the full story. The “per-seat” number is just the starting point.

Scrutinize the contract for these common additions:

- Professional Services for Integration: This is almost never included. Budget an additional 15-50% of your first year’s contract value to connect the new platform to your CRM and other backend systems.

- Mandatory Training Packages: Some vendors require you to purchase expensive, proprietary training for your team, billed as a separate, non-negotiable line item.

- Data Migration and Storage: Migrating years of call recordings and customer history from your legacy system can be costly. Subsequently, vendors often bill per gigabyte for storage.

A primary failure point is underestimating the cost and complexity of change management. Implementing new software is straightforward. Retraining hundreds of agents, redesigning workflows, and ensuring supervisors enforce new procedures is where projects often stall and budgets are exceeded.

When Not to Outsource Your Call Center

Outsourcing appears to be a simple solution for cutting labor costs, but it is not the right choice for every business. The cheapest call center is a poor investment if it compromises your core operations. Sometimes, maintaining an in-house operation is the only prudent choice, even if it appears more expensive.

An in-house model is the better strategic fit if your operation involves:

- Highly Sensitive Intellectual Property: If support agents require deep access to proprietary code, product roadmaps, or sensitive customer data, the security risk of a third-party BPO is too high. Direct control over your network and security is paramount.

- Deeply Integrated Product Support: For complex SaaS or technical products, support agents function as an extension of the engineering team. The tight, real-time feedback loop between support, product, and engineering is nearly impossible to replicate with an outsourced partner serving multiple clients.

- High-Touch, Brand-Centric Service: If your brand identity is built on a premium, white-glove customer experience, you cannot risk the inconsistency of a shared BPO agent pool. The nuance of your brand’s voice and culture must be managed directly by employees who are fully immersed in it.

Choosing to keep these operations in-house is not a failure to cut costs. It is a strategic decision to protect your most valuable assets: your IP, product quality, and brand. This risk calculation must be part of your final decision.

Frequently Asked Questions

This section provides direct, data-backed answers to common questions from CTOs and engineering leaders about call center costs.

What Is the Average Cost Per Call in a Call Center?

The industry often quotes an “average cost per call” of $2.70 to $5.60, but this is a vanity metric. It’s a trailing indicator that is not useful for strategic planning, budgeting, or modeling future costs.

A technical leader should focus on a more meaningful KPI: the fully loaded cost per agent hour. This metric bundles every direct and indirect expense into a single number. For a U.S.-based agent, this figure is typically $20+ per hour. An outsourced agent in a location like India might cost as little as $1.50 per hour. Your “cost per call” is simply a derivative of this hourly rate divided by the number of calls an agent can handle per hour.

How Do I Calculate Total Cost of Ownership for a Call Center?

A proper Total Cost of Ownership (TCO) model extends far beyond the per-seat license fee. To build a defensible budget, you must include several non-negotiable components:

- Fully Loaded Labor Costs: This includes salaries, benefits, payroll taxes, recruiting costs, and the often-overlooked cost of agent attrition and retraining. Include agents, supervisors, and any dedicated IT staff.

- Complete Technology Stack Costs: Account for CCaaS licenses, CRM seats (Salesforce, etc.), per-minute telephony charges, and any specialized tools for quality assurance (QA) or workforce management (WFM).

- One-Time Integration & Migration Costs: Budget for the professional services required to integrate the new platform with your existing systems of record. This is a common “gotcha” that vendors often omit from initial quotes.

- Ongoing Overhead & Compliance: This covers facilities and utilities (for on-premise) and the recurring costs of compliance audits for standards like PCI or HIPAA.

💡 Insider Tip: When reviewing outsourced BPO contracts, scrutinize them for hidden fees that can inflate your TCO. Common traps include mandatory training charges, fees for custom reports, or penalties for failing to meet minimum call volumes. These clauses can increase your “low” per-hour rate by 20-30%.

Is It Cheaper to Outsource a Call Center?

From a pure labor arbitrage perspective, outsourcing can reduce direct agent costs by 70-90%.

However, the lowest price is rarely the best value. A thorough analysis weighs direct savings against hidden costs, such as a potential decline in customer satisfaction from poor service, the significant management overhead required to oversee a vendor relationship, and the loss of direct control over brand representation.

In-house operations provide total control and brand alignment but at a significant cost and management premium. The decision is a trade-off between direct cost and operational risk.

Making a defensible vendor decision in a complex market is challenging. Modernization Intel provides unbiased, data-driven intelligence on 200+ implementation partners, so you can see through the sales pitches and choose the right partner based on real-world costs and failure rates. Get your vendor shortlist today.

Need help with your modernization project?

Get matched with vetted specialists who can help you modernize your APIs, migrate to Kubernetes, or transform legacy systems.

Browse Services