A Guide to Vetting Business process outsourcing providers

Picking the right business process outsourcing provider is a high-stakes decision, and it’s about far more than finding the lowest hourly rate. The legacy view of BPO as a place to offload low-skill tasks is outdated. Today, it’s a strategic decision to inject specialized skills and operational efficiency into an organization.

But that means the selection process needs to be skeptical and informed. A mismatched partnership won’t just fail to deliver; it can create new operational problems, drain management attention, and introduce security risks that didn’t exist before.

Understanding The Modern BPO Landscape

Choosing a BPO partner is no longer a simple cost-cutting exercise. It’s a complex strategic decision. The old model of BPO—a place to dump repetitive, low-skill work—is obsolete. Now, it’s about integrating specialized expertise, on-demand scalability, and new technology directly into your company’s operational fabric.

The downside? This evolution introduces a new class of risks. A poorly vetted partner can create security vulnerabilities, cause compliance failures, or become a significant time sink for internal managers. The objective is not just to find the cheapest provider. It’s to find a partner whose technical standards, security posture, and business objectives align with yours.

Market Growth and Strategic Drivers

The growth of the BPO market indicates how critical it has become. Valued at USD 302.62 billion in 2024, the global market is projected to reach USD 525.23 billion by 2030, reflecting a 9.8% compound annual growth rate, according to market analysis. You can review the full BPO market analysis to see the underlying trends.

This growth is driven by two primary factors:

- Access to Specialized Skills: Companies can engage experts in financial analysis, cybersecurity monitoring, or complex multilingual support without the cost and complexity of direct hiring.

- Instant Operational Efficiency: A mature BPO provider brings not just personnel but also documented processes, automation frameworks, and performance metrics that can immediately improve non-core functions.

The core premise of modern BPO isn’t just about reducing labor costs. It’s about leveraging a third party’s investment in technology, process optimization, and talent development—assets that are often too expensive or time-consuming to build in-house.

The Shift from Offloading to Partnership

The most effective BPO relationships today are deeply collaborative. You don’t just “throw a process over the wall” and hope it gets done. The expectation is that the provider will actively improve that process over time using their own automation tools, AI-driven analytics, and structured feedback loops.

They function as an extension of your team, not just a service provider.

This diagram highlights how functions like customer service and finance dominate the market. For a technical leader, this means you need to be surgical in matching your specific requirements to a provider’s demonstrated strengths.

A successful BPO engagement feels less like delegation and more like integration. Their performance directly impacts your performance. This reality is precisely why the vetting process is so critical. A poor choice doesn’t just waste money; it introduces tangible operational and security risks into your business.

Mapping Your Needs to the Right Kind of Provider

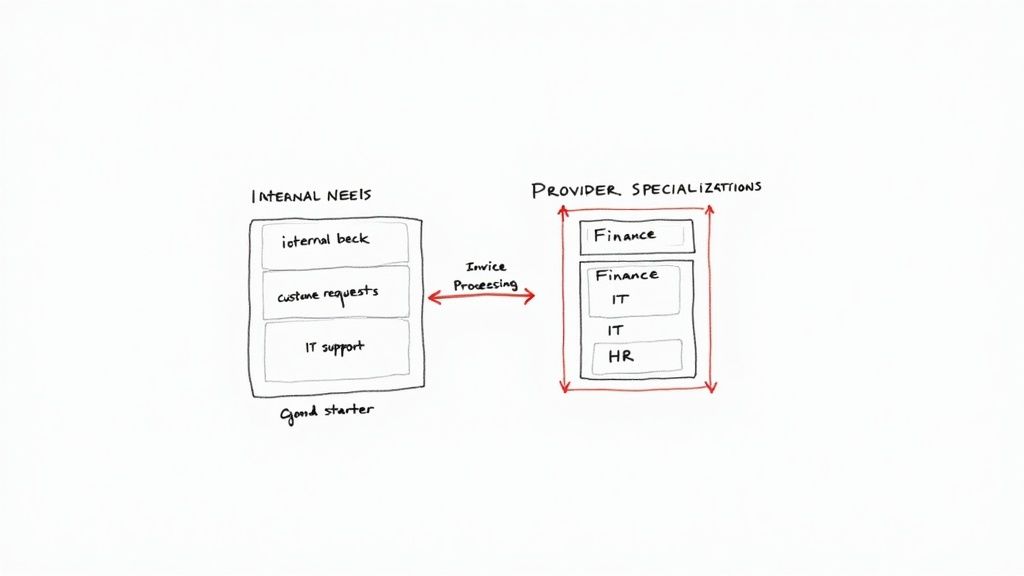

Engaging with business process outsourcing providers without a detailed map of your own requirements is a common failure pattern. Leaders often start with vague goals like “improve efficiency” and end up selecting a generalist provider for a specialist’s job. This mismatch frequently leads to scope creep, poor quality work, and a partnership that fails to deliver.

Before writing an RFP, you must translate high-level goals into a detailed requirements document. This is not a wish list; it’s the technical specification for your outsourcing partnership. It must define the exact processes, the Service Level Agreements (SLAs) you will enforce, and the tech stacks they must integrate with.

Prioritizing What to Outsource First

Not every business process is a viable candidate for outsourcing. The decision should be based on a calculation of strategic importance versus operational burden. High-volume, transactional processes are typically the safest place to start because the outcomes are easy to measure and they do not represent a core competitive advantage.

Consider these two functions:

- Invoice Processing: A high-volume, repetitive task with clear, rule-based execution. Success is tracked with metrics like cost-per-invoice (typically $1.50 - $5.00) and processing time. It represents a significant operational burden with low strategic importance. This is a strong candidate for outsourcing.

- Financial Planning & Analysis (FP&A): A low-volume, highly strategic function requiring deep institutional knowledge. Outsourcing core financial strategy is exceptionally risky and seldom successful. This should remain in-house.

Start with a process that is an operational burden but not a competitive differentiator. This approach allows you to test a provider’s capabilities, governance model, and communication protocols on a low-risk function before entrusting them with anything more critical.

This methodical approach de-risks the engagement and provides a solid baseline for performance evaluation.

Understanding Provider Specializations

The BPO market is highly fragmented. Some vendors are experts in IT helpdesk support but would be unqualified to handle regulated financial compliance. You must match your specific need to a provider’s demonstrated expertise, not their marketing claims.

For instance, customer service is the largest segment in the BPO industry, accounting for 33.4% of total revenue. Companies require high-quality, personalized experiences, and these providers have evolved beyond basic call centers into sophisticated hubs managing everything from voice processing to virtual staffing. You can find more BPO market segment data on mordorintelligence.com.

This specialization is critical. A customer service BPO invests in omnichannel communication platforms and agent training. A finance BPO, by contrast, focuses on SOC compliance, regulatory reporting tools, and staff with accounting certifications.

Core Service Categories and Their Nuances

To help you navigate the market, here is a breakdown of the main specializations you’ll encounter when evaluating business process outsourcing providers.

Provider Specialization vs. Business Function

Matching your internal function to the right provider type is the most critical step. If this is done incorrectly, the engagement is unlikely to succeed. This table can serve as a guide for vetting potential partners.

| Business Function | Required Provider Specialization | Critical Vetting Question |

|---|---|---|

| Finance & Accounting | F&A Outsourcing | ”Provide your SOC 1 Type II report and describe your team’s experience with NetSuite.” |

| IT Services | IT Outsourcing (ITO) / Managed Services | ”Walk us through your ITIL framework for incident management and your team’s AWS certifications.” |

| Human Resources | HR Outsourcing (HRO) / RPO | ”How do you ensure compliance with state-specific labor laws for remote employees?” |

| Customer Support | Customer Service BPO | ”What is your agent training methodology for handling negative customer sentiment on social media?” |

Asking targeted, evidence-based questions forces providers to substantiate their expertise.

Let’s examine each category in more detail.

Finance and Accounting (F&A)

- Their World: Accounts payable/receivable, payroll, financial reporting, and compliance.

- What Sets Them Apart: Deep expertise in regulatory frameworks like GAAP or IFRS and hands-on experience with specific ERP systems (like NetSuite or SAP). Look for SOC 1/2 Type II certifications as a baseline requirement.

IT Services

- Their World: Technical support (L1-L3), network monitoring, infrastructure management, and cybersecurity.

- What Sets Them Apart: Certifications in specific technologies like AWS, Azure, or Cisco, plus strict adherence to ITIL frameworks. For tech companies, their ability to integrate with your DevOps pipeline is a critical factor. Our guide on vetting top DevOps consulting companies provides a solid framework for this kind of technical deep dive.

Human Resources (HR)

- Their World: Recruitment process outsourcing (RPO), payroll and benefits administration, and employee data management.

- What Sets Them Apart: In-depth knowledge of local and national labor laws and experience with major HRIS platforms like Workday or SAP SuccessFactors.

Customer Support

- Their World: Inbound/outbound call centers, email, live chat, and social media support.

- What Sets Them Apart: Multilingual capabilities, significant investment in CRM and contact center technology (CCaaS), and proven training programs for managing customer interactions.

Hiring a provider without rigorously verifying their specialization is analogous to asking a front-end developer to secure your database. While both are in “tech,” their skill sets are not interchangeable. A detailed requirements document is your primary defense against making a costly error.

Decoding BPO Pricing Models And Hidden Costs

The sticker price a business process outsourcing provider quotes is rarely the final price. Sales decks are designed to anchor you to an attractive hourly rate, but the total cost of ownership (TCO) is a more complex—and higher—figure. Arriving at a realistic number requires a skeptical analysis of pricing models and a forensic search for hidden costs.

Most BPO contracts use one of three core models. A lack of understanding of the mechanics of each can lead to significant budget overruns. A provider will typically propose the model that is most advantageous to them. Your job is to push back and select the one that aligns with your business reality.

Breaking Down The Common Pricing Structures

The contract structure is an allocation of risk. In a fixed-fee model, the provider assumes the cost of their own inefficiency. In a time and materials model, that risk shifts to you.

Here’s how they function in practice:

- Fixed-Fee (Predictable but Inflexible): You pay a set price each month for a defined scope of work. This model is well-suited for stable, predictable processes, such as running payroll for a fixed number of employees. If volume is static, the price should be too.

- When NOT to buy: This model is a trap for volatile workloads. If you are outsourcing customer support where ticket volume can fluctuate significantly, you will either overpay during quiet periods or face “out of scope” charges during busy ones.

- Time and Materials (Flexible but Risky): You pay for every hour worked and every resource consumed. It provides flexibility for projects with ambiguous requirements, but it creates a misaligned incentive. The provider’s revenue increases with their own inefficiency.

- When NOT to buy: This model should not be used for standardized, repeatable tasks. It provides the provider with a blank check to bill against your budget, with little accountability for output.

- Outcome-Based (Aligned but Complex): The price is tied to achieving specific business outcomes. A vendor might be paid per qualified sales lead or a percentage of the invoices they successfully collect. This model fosters a true partnership but can be difficult to define and track the necessary metrics.

- When NOT to buy: This is a non-starter if you cannot cleanly isolate the provider’s impact. If your own marketing campaigns also influence lead quality, attributing success becomes a source of ongoing dispute.

A common mistake in BPO pricing is accepting the vendor’s preferred model without scrutiny. A fixed fee for an unpredictable process is a trap. A T&M contract for a stable one is a giveaway. The model must be matched to the nature of the work.

Uncovering The Hidden Costs Beyond The Rate Card

A BPO vendor’s proposal is a marketing document. The real costs are often buried in the contract’s fine print or emerge only after the engagement begins. Your due diligence must extend far beyond the rate card.

A realistic TCO model must include both direct vendor payments and the significant internal costs required to manage the relationship. Neglecting your own team’s time can inflate the true cost by 15-25% or more.

Here are the hidden costs to look for:

- Transition and Setup Fees: Onboarding is rarely free. Providers will charge for knowledge transfer, process documentation, and initial training. These fees are not trivial and can equal several months of service costs.

- Technology and Licensing Costs: If the provider uses proprietary software, you may be responsible for licensing fees. If they require access to your systems like Salesforce or NetSuite, you will be purchasing additional user licenses, which can cost thousands of dollars per seat annually.

- Currency Fluctuation Risk: If you engage an offshore provider, the contract is likely priced in their local currency. A negative shift in exchange rates can increase your costs. Insist on a contract priced in your currency or include a hedge clause to cap your exposure.

- Cost of Governance: This is the most frequently overlooked cost. You will have to dedicate your own personnel—project managers, team leads, IT staff—to oversee the provider, audit their work, and manage escalations. This is a significant and ongoing operational expense.

Building an accurate cost model requires moving beyond simple transactional pricing. For a call center, don’t just look at the $0.75-$1.50 cost-per-call. Factor in the hours your managers spend in weekly governance meetings, the IT time for systems integration, and the business impact of missed Service Level Agreements (SLAs). Only then are you looking at the real numbers.

Running An Effective RFP And Vendor Shortlisting Process

A vague Request for Proposal (RFP) will elicit vague, marketing-led responses. You’ll receive glossy brochures instead of verifiable data. An effective RFP is not a request; it’s a structured interrogation designed to compel transparency.

The goal is to make business process outsourcing providers demonstrate their expertise, not just claim it.

This requires a change in mindset. Stop asking “what can you do for us?” and start dictating “here is exactly what we require; prove you can deliver it.” This means replacing open-ended questions with specific, non-negotiable requirements that make it difficult for a vendor to hide behind generic case studies.

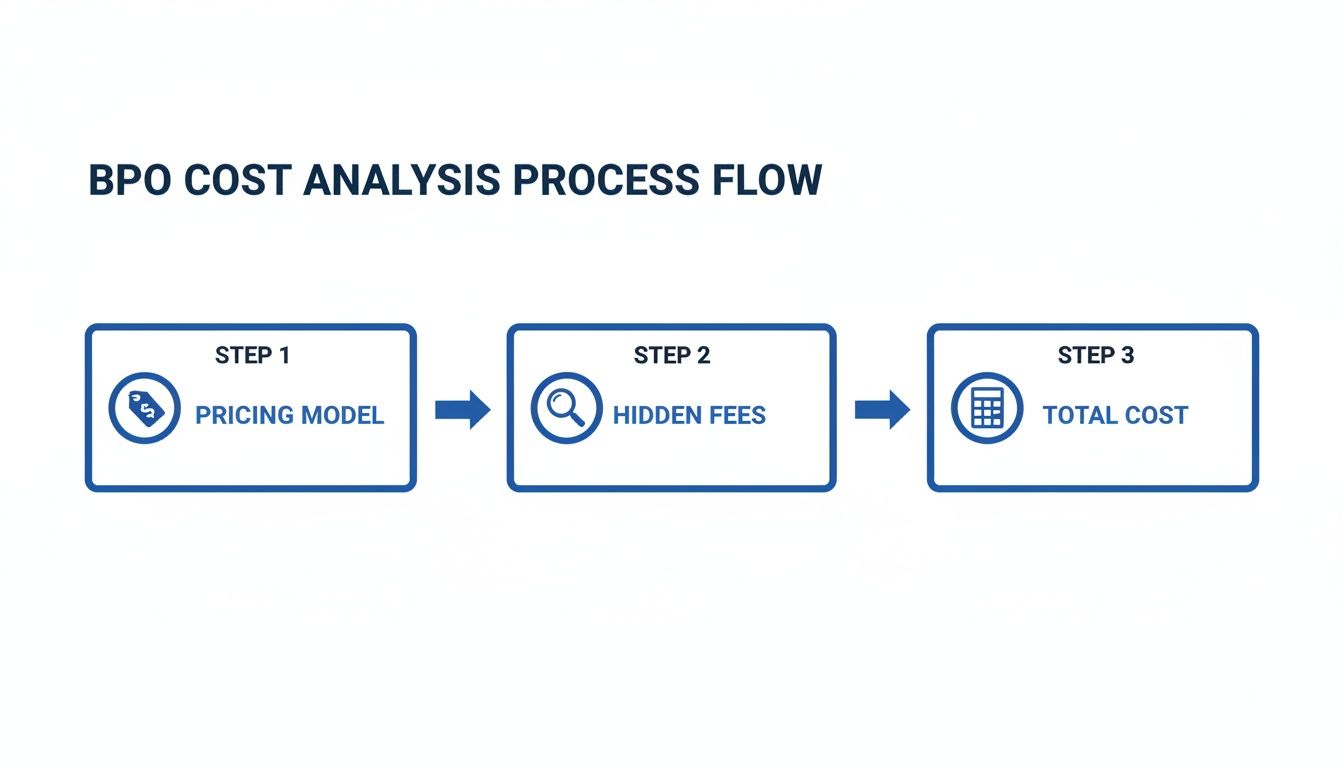

The first step is a thorough financial analysis. The process flow below shows how to integrate cost analysis into your RFP from the beginning to avoid future budget surprises.

As shown, a true cost assessment involves dissecting the pricing model and actively searching for hidden fees. Failing to demand this level of financial transparency upfront is a common and costly mistake.

Crafting An RFP That Demands Proof

A strong RFP is a series of technical and operational demands. It should be structured to facilitate direct, apples-to-apples comparisons. Ambiguity in an RFP always benefits the vendor.

Start by outlining your non-negotiables. These are the deal-breakers that any serious contender must address with specific, verifiable data.

- Service Level Agreements (SLAs): Do not ask for their standard SLAs. Define your required SLAs with precision. For example: “95% of Tier 1 support tickets must be resolved within 4 hours, measured via our Zendesk instance.”

- Reporting and Dashboards: Demand screenshots or a live demonstration of their reporting dashboards. Specify the exact metrics you require daily, weekly, and monthly, and ask how you will get real-time access.

- Team Composition and Experience: Require them to detail the proposed team structure. Mandate the specific experience and certifications of the team lead and key members assigned to your account. Do not accept generic biographies.

Your RFP should function as a filter. A provider that pushes back on detailed SLAs, is unwilling to share dashboard examples, or provides vague team descriptions is self-disqualifying. They are indicating a lack of either capability or transparency.

Mandating Security And Compliance Transparency

Security is not a feature; it is a prerequisite. In an environment where attackers target BPO providers to launch supply chain attacks, accepting verbal assurances on security is negligent. Your RFP must demand documented proof.

Threat actors like Scattered Spider have built a business model on compromising BPO call centers to access their clients. You must operate under the assumption that your vendors are a primary target.

Make your security requirements section explicit:

- SOC 2 Type II Report: Request their latest one. An inability to produce it is an immediate red flag, signaling a lack of mature, audited internal controls.

- ISO 27001 Certification: Ask for their certificate and, critically, the scope of that certification. Ensure it covers the specific services you intend to purchase.

- GDPR/CCPA Compliance: Demand they describe their exact processes for handling personally identifiable information (PII), data subject access requests (DSARs), and data breach notifications.

This is about building a defensible security posture. For a deeper dive, our comprehensive vendor due diligence checklist provides a practical framework that can be integrated directly into your RFP.

Building A Defensible Scoring Matrix

Once proposals are received, you need an objective method for scoring them. A weighted scoring matrix removes personal bias and forces a data-driven decision. It also aligns all stakeholders to evaluate providers against the same pre-agreed criteria.

This is more than a simple checklist. Each criterion is assigned a weight based on its importance to your business.

Sample BPO Vendor Scoring Matrix

| Category | Criterion | Weight | Notes |

|---|---|---|---|

| Technical Capability (40%) | 1. Demonstrated experience with our tech stack (e.g., NetSuite, AWS) | 15% | Score based on specific case study data provided. |

| 2. Clarity and feasibility of proposed SLAs | 15% | Did they meet our requirements or attempt to weaken them? | |

| 3. Security and Compliance (SOC 2, ISO 27001) | 10% | This is Pass/Fail. A ‘Fail’ disqualifies the vendor. | |

| Financials (30%) | 1. Total Cost of Ownership (TCO) Analysis | 20% | Includes all fees, licenses, and our internal management overhead. |

| 2. Pricing model alignment with our process volatility | 10% | Does their model introduce unnecessary risk if our volume fluctuates? | |

| Partnership & Fit (30%) | 1. Cultural Alignment & Communication Protocol | 10% | Based on reference checks and the clarity of their proposal. |

| 2. Scalability and Flexibility | 10% | How easily can they scale the team up or down by 25%? | |

| 3. Quality of Proposed Team and Governance Model | 10% | Assesses the actual experience of the personnel assigned to us. |

By using this structured approach, you can systematically filter out noise and shortlist the top two or three business process outsourcing providers who have not just promised results but have provided the evidence to substantiate their claims. This methodical process is your best defense against a bad partnership.

Common Failure Modes And Red Flags To Avoid

A significant number of outsourcing engagements fail. They often turn into expensive time-sinks for management before being terminated. Understanding common failure patterns is not about negativity; it is about de-risking a major business decision by learning from others’ mistakes.

Failure is rarely a single event. It is a gradual erosion of value caused by a few predictable problems. These issues almost always trace back to a weak vetting process where critical red flags were ignored in the rush to sign a contract.

The Scope Creep And Governance Collapse

The most common failure pattern begins with a poorly defined scope. An ambiguous statement of work (SOW) creates a vacuum that the provider will fill with out-of-scope charges and change orders. At this point, the partnership begins to feel more like a hostage negotiation.

A vague SOW might say “manage accounts payable.” A precise SOW says “process up to 1,500 two-way match invoices per month in NetSuite, with a 24-hour turnaround and a 99.5% accuracy rate.” Specificity eliminates ambiguity.

This problem is compounded by weak governance. Without a dedicated internal manager and a strict weekly review of performance against quantitative metrics, the engagement will drift. The provider has little incentive to improve if no one is holding them accountable to the Service Level Agreements (SLAs).

The engagement’s success is determined by the quality of your governance model. If you do not assign a dedicated internal owner to manage the relationship and audit performance weekly, you are setting the BPO engagement up for failure. This is not a “set it and forget it” solution.

Cultural Misalignment And Communication Breakdown

Cultural fit is not an HR issue; it is a core operational risk. A mismatch in work pace, communication style, or problem-solving approach can bring an engagement to a standstill.

A fast-moving tech company that relies on asynchronous Slack communication will face friction with a traditional BPO provider that insists on formal ticketing systems and a 48-hour response time for simple queries. This friction creates delays and erodes trust.

Look for these red flags during vetting calls:

- Evasive answers on team composition: Providers who are vague about who will be on your account may be hiding high turnover rates or a junior-level team.

- Generic, data-light case studies: A case study that claims “significant cost savings” without providing specific percentages or TCO models is marketing content, not evidence.

- Resistance to transparent dashboards: If a potential partner is hesitant to grant real-time access to performance dashboards (in a tool like Zendesk or ServiceNow), they want to control the narrative about their performance.

Security Negligence And Supply Chain Risk

In the current threat landscape, viewing your BPO provider as just another vendor is a major error. They are an extension of your security perimeter and a prime target for supply chain attacks. Threat actors like Scattered Spider actively compromise BPO call centers to gain a foothold into their more valuable clients.

Their security posture is your security posture. You must demand verifiable proof of their internal controls. Accepting their word on security is negligent. Initial vetting is critical, but it is not a one-time event. The complex process of what is vendor due diligence is an ongoing discipline, not a pre-contract checklist.

Look for these security red flags—they should be deal-breakers:

- No SOC 2 Type II Report: This is non-negotiable. The absence of an audited SOC 2 report indicates a fundamental gap in mature security controls.

- Vague Data Handling Policies: They must provide detailed documentation on data encryption, access controls, and breach response procedures.

- Use of Shared, Generic Accounts: If team members use shared logins instead of named accounts with role-based access control, it signals a poor security culture.

Ultimately, avoiding failure requires a skeptical, data-first mindset. You must inspect, verify, and hold business process outsourcing providers accountable for every claim they make, from their cost models to their security certifications.

Frequently Asked Questions

Evaluating business process outsourcing providers often raises a number of complex questions. Here are direct answers to the most common issues technical leaders face.

When Does It Make Sense Not To Outsource?

Outsourcing is a strategic tool, but it is not a universal solution. Some functions are too critical or too dynamic to be managed by a third party.

Never outsource your core intellectual property. For a software company, this means primary product development. The same applies to processes that rely on deep, undocumented institutional knowledge—information that is nearly impossible to capture in a Statement of Work.

Additionally, avoid outsourcing processes that are in constant flux, with requirements changing weekly. The management overhead required to keep a BPO partner synchronized will negate any potential cost savings. You will spend more time managing the vendor than it would take to do the work internally.

If you can’t write a precise, measurable SLA for it, don’t outsource it. A process is a poor candidate for outsourcing if its success metrics are subjective or if it’s cheaper to tolerate internal inefficiency than it is to manage an external vendor.

Distinguishing Onshoring, Nearshoring, And Offshoring

These terms define the trade-offs between cost, communication, and cultural alignment. Your choice directly impacts your budget and the management overhead required.

-

Onshoring: The vendor is located in your own country. This is the most expensive option. It offers minimal language barriers and no time zone complications, but comes at the highest rates. It is the appropriate choice for processes handling sensitive domestic data or requiring constant, real-time collaboration.

-

Nearshoring: The vendor is in a neighboring country, typically in a similar time zone (e.g., a U.S. company using a partner in Mexico or Costa Rica). This option often provides a good balance, offering significant cost savings without the logistical challenges of a 12-hour time difference.

-

Offshoring: The vendor is in a distant country, such as the Philippines or India for a U.S. company. This model offers the largest cost reduction—often 40-60% lower than onshore rates—but introduces the most complexity related to time zones, cultural differences, and communication styles.

Structuring An Effective Pilot Program

Never sign a multi-year BPO contract without a successful pilot program. A pilot is not a “trial”; it is a deliberate, small-scale experiment designed to test your most critical assumptions before committing significant resources. It is your escape hatch.

Begin by selecting a well-defined, non-critical portion of the workload. Do not outsource your entire customer support function. Instead, assign them 10% of your Tier 1 ticket volume or have them process invoices from a single department. This isolates variables and allows for a clear performance comparison against your internal baseline.

Define the exit criteria before the pilot begins. What constitutes success? Be specific: ticket resolution time, customer satisfaction scores, quality audit pass rates. Run the pilot for a fixed 60–90 day period, with mandatory weekly check-ins to review performance against these metrics. You are testing not only the vendor but also your own organization’s ability to manage them.

Making defensible vendor decisions for modernization projects requires more than sales pitches and marketing fluff. Modernization Intel provides the unvarnished truth on implementation partners—their real costs, common failure rates, and true specializations—so you can choose the right partner, backed by data, not vendor bias. Get your vendor shortlist at https://softwaremodernizationservices.com.

Need help with your modernization project?

Get matched with vetted specialists who can help you modernize your APIs, migrate to Kubernetes, or transform legacy systems.

Browse Services