67% of Application Modernization Projects Fail. A CTO's Guide to Not Being One of Them.

Application modernization looks great on a PowerPoint slide, but project data tells a much grimmer story. A significant number of these initiatives fail to deliver anything close to their promised ROI. They often get derailed by underestimated complexity, a disconnect between technical goals and business outcomes, and selecting the wrong implementation partner, turning a planned upgrade into a high-cost distraction.

Why Most Modernization Projects Underperform

The pressure to modernize is significant. The market is estimated at $19.16 billion for 2025 and is projected to grow to $32.71 billion by 2029. This growth is driven by the urgent need to address years of accumulated technical debt.

But here’s the critical data point: an estimated 67% of these projects underperform or fail outright. This isn’t about minor hiccups. We’re talking about subtle but catastrophic technical mistakes, like losing decimal precision when migrating COBOL business logic to a cloud-native service.

This high failure rate isn’t random. It stems from a few predictable, recurring issues that leadership often overlooks during the planning phase.

Miscalculating Complexity and Technical Debt

Legacy systems are rarely well-documented. They’re often a complex web of undocumented dependencies, brittle code, and forgotten business rules. A primary reason projects derail is unaddressed technical debt, which makes reducing technical debt a mandatory first step. When teams proceed without a comprehensive architectural analysis, they encounter unforeseen roadblocks, leading to significant timeline and budget overruns.

For example, a “lift and shift” of a mainframe application to the cloud appears straightforward. However, this approach often ignores latent performance bottlenecks, hardcoded IP addresses, or the “data gravity” that makes large-scale data migration a significant challenge. The substantive work isn’t just migrating code; it’s disentangling decades of tactical fixes and patches. Our complete guide on legacy system modernization provides a deeper analysis of these challenges.

The Pitfall of Choosing the Wrong Strategy

Not all modernization strategies are equal, and a mismatch between strategy and application context is a common failure pattern. A company pursuing immediate cloud cost savings might choose Rehosting, only to find they’ve moved their inefficient application to a more expensive hosting model. Conversely, a complete Rewrite promises maximum future value but carries the highest risk and cost.

A common error is applying a single modernization strategy to all applications. A stable, low-risk system might only require a light Replatforming. However, a core business system that actively constrains innovation likely needs a full Rearchitecture. Matching the modernization approach to the application’s specific context is critical.

To help you assess the landscape, here’s a summary of common modernization approaches and their typical failure modes.

Modernization Strategies Quick Risk Profile

This table outlines the core patterns, their primary use cases, and common failure modes. Use it to validate initial strategic thinking.

| Strategy | Primary Use Case | Common Failure Mode | Relative Cost |

|---|---|---|---|

| Rehost | Rapid cloud migration for OpEx reduction | Migrates technical debt without addressing it | Low |

| Replatform | Upgrade infrastructure with minimal code change | Underestimating platform compatibility issues | Low-Medium |

| Refactor | Improve code quality and maintainability | Introducing new regressions into stable code | Medium |

| Rearchitect | Shift to a new architecture (e.g., monolith to microservices) | High complexity and extended project timelines | High |

| Rebuild | Rewrite components from scratch | Scope creep and budget overruns | High |

| Replace | Adopt a COTS/SaaS solution | Mismatched features and vendor lock-in | Varies |

Choosing the right path isn’t just a technical decision; it’s a business one. Each strategy has a different risk profile, timeline, and budget implication. An incorrect choice at this stage is difficult to recover from.

Decoding The Six Core Modernization Strategies

“Application modernization” is a broad term, not a single action. It represents a spectrum of strategic choices, each with a distinct cost, risk profile, and potential business outcome. A successful strategy requires understanding these trade-offs, not simply adopting the latest cloud trend.

Consider your legacy application as a physical asset. You could relocate it, perform cosmetic upgrades, undertake a major renovation, or demolish it and build anew. Each option has vastly different consequences for your budget and timeline. The key is to match the strategy to the application’s real business value, not to force a uniform solution across the portfolio.

These strategies are often referred to as the “6 Rs.” Let’s analyze them.

1. Rehost (Lift and Shift)

This is the most direct approach. Rehosting involves moving an application from its current environment to a new infrastructure—typically a public cloud like AWS or Azure—with no changes to the application’s code or architecture.

- Technical Change: Minimal. The work is focused on provisioning new infrastructure and data migration. The application itself remains untouched.

- Business Impact: The primary benefit is speed. It is the fastest method to exit a physical data center, which can yield immediate operational cost reductions. However, this strategy does not address any underlying technical debt within the application.

- Ideal Scenario: A hard deadline to close a data center requires immediate action. This is a tactical move, not a strategic overhaul.

2. Replatform (Lift and Tinker)

Replatforming is a step beyond a simple move. It involves migrating the application to the cloud while making small, targeted modifications to leverage cloud capabilities.

This could involve swapping a self-managed database for a managed cloud service like Amazon RDS or upgrading the application server. The application’s core logic is unchanged, but surrounding platform components are modernized. It provides a balance between the speed of rehosting and the benefits of modernization.

3. Refactor

Refactoring focuses on improving the internal structure of the code without altering its external behavior. You aren’t adding new features; you are reorganizing the existing code for better efficiency and maintainability.

The goal is to pay down technical debt and make the application easier and safer to modify in the future. This may involve optimizing a slow algorithm, clarifying complex code, or breaking down large functions into smaller, more manageable units.

This is a critical strategy for legacy systems where code fragility impedes development. It requires a skilled team capable of performing significant code changes without introducing new regressions, but it is a sound investment in the application’s long-term viability.

4. Rearchitect

This involves a fundamental change to the application’s architecture to enable new capabilities. The classic example is decomposing a large monolithic application into a set of smaller, independent microservices.

This path is chosen when the existing architecture is a direct impediment to business goals—for instance, when a minor change requires extensive regression testing and a high-risk deployment. Rearchitecting is complex and carries significant risk, but the potential payoff includes increased development velocity and scalability. For a deeper dive, review the differences between brownfield vs greenfield modernization.

Complex projects like this are also where significant issues can arise.

As the diagram shows, minor underperformance early in a project can cascade into budget overruns and scope creep.

5. Rebuild (Rewrite)

Rebuilding involves rewriting an application from scratch while preserving its original scope and specifications.

This option is typically selected when the existing codebase is unmaintainable or built on obsolete technology with no available support. It offers the benefit of a clean slate but is one of the riskiest and most expensive strategies. These projects are known for extended timelines and high failure rates. When considering a rebuild, it is crucial to evaluate modern tools, including the best web frameworks for migrating from no-code if the business has outgrown its initial platform.

6. Replace

This strategy involves decommissioning a custom-built application in favor of a commercial-off-the-shelf (COTS) or Software-as-a-Service (SaaS) product.

This approach is logical for applications that handle generic business functions not central to competitive advantage—such as CRM, HR, or accounting. The primary risk is not technical but functional. The new solution must meet at least 80% of critical business requirements out of the box. Heavy customization often leads to vendor lock-in and increased long-term costs.

To clarify these options, a side-by-side comparison is useful. Each strategy represents a different point on the spectrum of cost, risk, and business impact.

Comparing Application Modernization Solutions

| Strategy | Technical Change | Business Impact | Cost Range / Model | Ideal Scenario |

|---|---|---|---|---|

| Rehost | Minimal (Infrastructure only) | Low (Cost reduction) | $ (OpEx) | Urgent data center exit |

| Replatform | Low (Minor code/config tweaks) | Moderate (Cloud optimization) | $$ (OpEx + Small CapEx) | Need quick cloud wins without a full rewrite |

| Refactor | Moderate (Internal code only) | Moderate (Improved maintainability) | $$ (CapEx) | High technical debt is slowing down feature work |

| Rearchitect | High (Major architectural changes) | High (Increased agility & scalability) | $$$$ (Large CapEx) | Monolithic architecture is a business bottleneck |

| Rebuild | Very High (Complete rewrite) | High (Clean slate, modern stack) | $$$$$ (Very Large CapEx) | The current application is beyond saving |

| Replace | N/A (Switch to SaaS/COTS) | Varies (Standardizes a non-core function) | $$$ (Subscription OpEx) | The function is a commodity, not a differentiator |

The optimal choice depends on context. A “lift and shift” may be a sound tactical move for one application, while a full “rebuild” is the only strategic option for another. The key is to analyze the business value, technical condition, and strategic importance of each application before committing to a path.

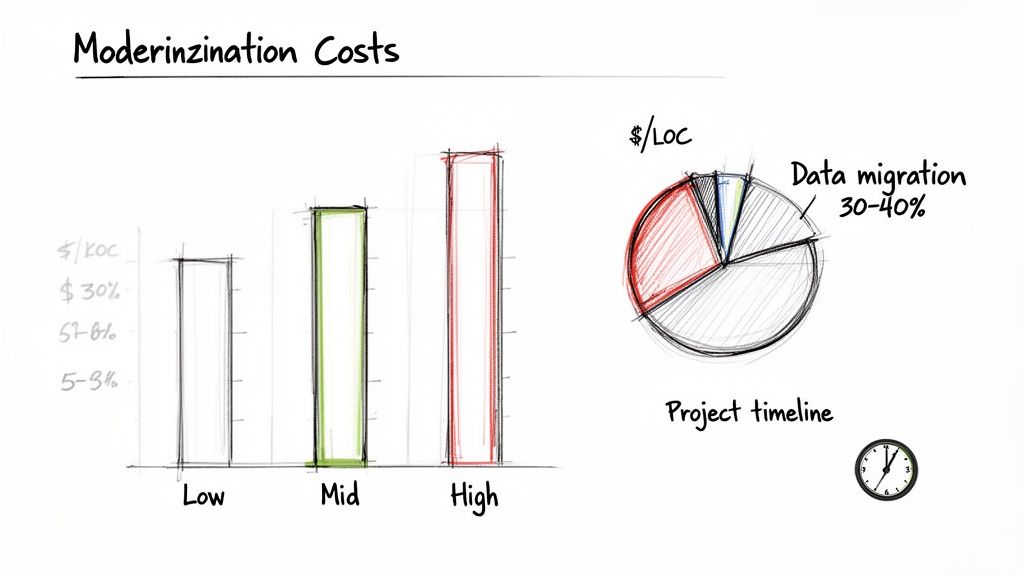

The Financial Realities of Modernization Costs

The viability of any modernization project is determined by its budget. Without defensible numbers, a business case is merely a set of assumptions. To avoid the significant budget overruns common in these initiatives, it’s essential to understand the financial models behind different application modernization solutions.

Costing a modernization project is notoriously difficult. The most accurate initial answer is “it depends.” However, we can establish realistic cost ranges by analyzing how vendors price this work.

Deconstructing Vendor Pricing Models

Vendors typically use one of a few core models to price modernization services. Understanding these models allows for an apples-to-apples comparison of proposals and helps identify potential cost risks.

- Per-Line-of-Code (LOC): This is the standard model for legacy-to-modern language migrations, particularly involving COBOL. The vendor charges a fixed rate per line of code converted and tested.

- Time and Materials (T&M): This model is common for complex projects like a full re-architecture where the scope is not well-defined. You pay for the hours worked. It offers flexibility but presents a significant budget risk if not managed closely.

- Fixed-Bid Project: This provides cost certainty but comes at a premium. The vendor incorporates a substantial contingency buffer into the price to cover potential unknowns.

For mainframe migrations, the per-LOC model is the most concrete starting point for initial estimates.

Expect costs between $1.50 to $4.00 per line of code for most COBOL-to-Java or C# migration projects. This means a one-million-LOC system could range from $1.5M to $4.0M for code conversion alone.

This price range is driven by key variables that determine project risk and effort.

Why Modernization Costs Fluctuate

The wide cost range reflects the complexity of legacy systems. Not all code is equal, and several factors can significantly increase the price of a modernization effort.

1. Code Complexity: Is the codebase a tangled mix of “GOTO” statements and undocumented logic, or is it well-structured? Code analysis tools can quantify complexity, and a higher complexity score directly correlates to a higher migration cost. A realistic budget requires a clear understanding of the system’s state; our guide on the technical debt calculation formula provides a framework for this assessment.

2. Data Gravity and Migration: Data migration is often more difficult than code migration. The volume, combined with the challenge of transforming legacy data types (like packed decimals), can make data migration a massive project in itself. In many large-scale modernizations, data migration consumes 30-40% of the total project timeline and budget.

3. Compliance and Security Requirements: Modernizing an application in a highly regulated industry like finance or healthcare adds significant overhead. The need for stringent data masking, auditable access controls, and compliance with standards like PCI-DSS or HIPAA introduces layers of work not present in other sectors.

This demand is fueling market expansion. The global application modernization services market, valued at approximately $21.78 billion in 2025, is projected to reach $62.61 billion by 2032, growing at a CAGR of 16.3%. For CTOs, this means the market is crowded, and identifying true specialized expertise is more critical than ever.

To build a credible business case, you must move beyond vague estimates and anchor financial projections in these real-world cost drivers. Scrutinize every vendor proposal through this lens—it’s the key to funding your project for success.

How to Analyze Vendor Strengths and Weaknesses

Selecting a modernization partner requires careful due diligence. The market includes specialists, generalists, and sales-driven firms, each with distinct motivations and capabilities. Choosing a partner whose expertise does not align with your project’s specific needs is a common and avoidable cause of failure.

Marketing materials and self-reported success rates are insufficient for evaluation. A vendor’s true value is found in their business model, technical niche, and primary revenue drivers. Understanding their incentives allows you to see beyond the sales pitch and make a defensible decision.

Mapping Vendor Types to Modernization Paths

Not all application modernization solutions are the same, and neither are the vendors selling them. A firm that excels at rapid “lift and shift” cloud migrations is unlikely to be the right choice for a complex COBOL-to-Java rewrite. It’s about matching the right expertise to the specific task.

Here’s a breakdown of the vendor landscape:

- Large Global System Integrators (SIs): Think Accenture, Deloitte, or TCS. Their strength is managing large-scale, multi-year programs across diverse business units. They are adept at navigating enterprise bureaucracy. The drawbacks are typically higher costs, longer timelines, and a potential lack of deep, niche technical skills.

- Boutique Specialization Firms: These are specialists. One firm may focus exclusively on COBOL migrations for financial institutions, while another specializes in decomposing .NET monoliths into microservices. They offer a level of technical depth that large SIs often cannot replicate. The trade-off is their narrow focus and higher cost structure. Minimum engagements often start around $400K.

- Cloud Providers’ Professional Services: The in-house teams at AWS, Google Cloud, and Azure are experts at migrating workloads to their platforms. They are well-suited for Rehosting and Replatforming projects. However, their core incentive is to increase your cloud consumption, which can lead to recommendations for oversized resources or long-term commitments (like Reserved Instances) that may not align with your best interests.

Recognizing Conflicting Incentives

A vendor’s recommendation is rarely unbiased; it is filtered through their business model. Recognizing this is prudent due diligence.

A significant risk arises when a vendor’s financial success is misaligned with your project’s success. A Value-Added Reseller (VAR) will promote the software they resell. A cloud provider wants you to consume their services, sometimes to excess.

Here are the incentives to be aware of.

| Vendor Type | Primary Incentive | Potential Downside |

|---|---|---|

| Cloud Provider | Maximize consumption of their cloud services | Pushes for over-provisioning and long-term lock-in (Reserved Instances) |

| Software Vendor | Drive adoption of their proprietary tools | Creates vendor lock-in and limits future architectural flexibility |

| Value-Added Reseller (VAR) | Resell specific software licenses for commissions | Recommendations are biased toward their partner products, not the best solution |

| System Integrator (SI) | Maximize billable hours and project scope | Can lead to “land and expand” tactics and drawn-out timelines |

This does not imply malicious intent. It simply means you must evaluate their advice with a healthy dose of skepticism.

When a VAR proposes a specific middleware product, the first question should be, “Why is this a better choice than the open-source alternatives?” When a cloud provider offers a three-year savings plan, you must weigh the discount against the cost of reduced architectural flexibility.

The most successful application modernization solutions come from partners whose success is directly tied to yours.

A Defensible Vendor Selection Framework

Selecting the right modernization partner isn’t about finding one who promises a perfect project. It’s about finding one who is transparent about how they manage challenges. Standard RFP processes, focused on features and hourly rates, are often inadequate for this purpose. You need a method to stress-test a vendor’s real-world technical capabilities and honesty.

This requires moving beyond polished case studies. The most valuable signals come from questions that force a vendor to demonstrate their work, not just describe it. A competent partner will welcome rigorous questions. A less capable one will provide evasive answers.

Beyond the Standard RFP Questions

A robust selection process is evidence-based. Standard RFPs often attract generic marketing responses. You need to reframe your vetting process around specific, technically-grounded questions that reveal a vendor’s actual experience.

Consider adding these questions to your evaluation checklist:

-

Demand a Failure Analysis: “Provide a sanitized, verifiable case study of a modernization project that encountered significant challenges or failed to meet its primary objectives. What were the root causes, and what specific process changes did your firm implement as a result?” This question assesses transparency and a culture of continuous improvement. A vendor who claims to have never had a project fail is a vendor with limited experience in complex initiatives.

-

Go Deep on Technical Methodology: “For a COBOL-to-Java migration, explain your precise method for converting

COMP-3packed decimals tojava.math.BigDecimal. Provide code-level examples of how you ensure decimal precision during data transformation and validation.” This probes for genuine expertise. The difference between usingfloatandBigDecimalis the source of multi-million dollar rounding errors in financial systems. -

Scrutinize the Actual Team: “Provide anonymized resumes for the specific architects and senior engineers who would be assigned to our project. What is their direct, hands-on experience with our exact legacy stack and target architecture?” This helps mitigate the “bait and switch,” where senior experts sell the project, but a junior team is assigned to implement it.

Assessing Financial and Business Alignment

Technical competence is only half the equation. You must also confirm that the vendor’s business model aligns with your success, not just their revenue. Misaligned incentives are a primary driver of the scope creep and budget overruns that affect these projects.

A vendor’s proposal is not just a technical plan; it’s a reflection of their business model. If their primary incentive is to maximize billable hours on a Time & Materials contract, their project plan will invariably expand to fill the available budget.

Use these questions to identify potential conflicts of interest:

- Incentive Structure: “How is your project team compensated? Are there performance bonuses tied directly to our project’s key outcomes, such as meeting budget, timeline, and post-deployment stability targets?”

- Subcontractor Reliance: “What percentage of the proposed work will be performed by third-party subcontractors versus your full-time employees? How do you vet them and manage the quality of their deliverables?”

This skeptical, evidence-based approach shifts the burden of proof to the vendor, forcing them to substantiate claims with data and concrete examples. The result is a partner selection you can confidently defend and a significantly lower risk of choosing the wrong team.

When to Avoid Application Modernization

Modernizing for its own sake is a costly error. While the market for cloud-hosted applications is projected to reach $51.45 billion by 2031, not every legacy system warrants a portion of that investment. The most strategic modernization decision is sometimes to do nothing.

Making this call requires a frank assessment of business risk versus technical debt. To see how your situation compares, Modernization Intel offers benchmarks from over 200 firms, which can help identify when migration risks outweigh the potential rewards.

The most obvious candidate to leave untouched is a stable application with low business criticality. If it performs its function reliably, requires minimal maintenance, and does not impede revenue or new feature development, the business case for a costly overhaul is weak. You risk introducing new regressions into a stable system for marginal benefit.

The Problem of Lost Knowledge

A major red flag is the loss of institutional knowledge. Many legacy systems, particularly those with decades of embedded business logic, were built by engineers who have since retired or left the company.

When the domain experts capable of safely rewriting or refactoring the application are no longer available, any major modernization project becomes extremely high-risk. There is a high probability of breaking subtle, undocumented business rules that are critical to the system’s function. The cost of rediscovering this logic through trial and error can be prohibitive.

Containment as a Viable Strategy

When a full modernization is not viable, the objective shifts from replacement to containment. Instead of performing high-risk open-heart surgery, you treat the legacy system as a black box and build around it.

An effective containment strategy is API-wrapping. You build a modern API layer around a mainframe or legacy application to expose its core data and functions. This allows new services to interact with it without modifying the fragile underlying code.

This approach offers a pragmatic middle ground.

- Risk Mitigation: You avoid the high-stakes gamble of a full rewrite, preserving the stability of the core system.

- Incremental Progress: New applications can leverage legacy data, enabling innovation without a “big bang” migration.

- Cost Control: Building an API is significantly less expensive and faster than a multi-year modernization program.

This strategy acknowledges that for certain systems, living with manageable technical debt is a more responsible business decision than pursuing a high-risk, low-value project.

Frequently Asked Questions

When evaluating an application modernization project, vendor proposals can start to sound identical. The critical questions—those that determine success or failure—are rarely addressed in marketing materials. Here are candid answers to the questions technical leaders should be asking.

How Do You Estimate Costs with Poor Documentation?

If a vendor offers a fixed-bid contract for a system with minimal documentation, proceed with extreme caution. They are either underestimating the complexity or planning to issue numerous change orders once the project begins.

A credible partner will propose a paid discovery phase to de-risk the project. This typically involves:

- Code Scanning Tools: Automated scanners analyze the codebase to map dependencies and data flows, creating a baseline architectural blueprint where one does not exist.

- Proof-of-Concept (PoC): A small, representative slice of the application is modernized as a pilot. This establishes a defensible cost metric (e.g., cost-per-function-point or cost-per-line-of-code) that can be used to extrapolate the full budget.

- Contingency: A budget for a poorly documented system should include a 30-40% contingency fund. This is not padding; it is a realistic acknowledgment of the unknown complexities that will inevitably be discovered.

What Is the Biggest Technical Mistake in Mainframe Migrations?

The single most catastrophic error in mainframe-to-cloud projects is mishandling data conversion, specifically with COBOL’s COMP-3 (packed decimal) format. This subtle mistake can lead to silent, widespread data corruption that may not be detected until significant financial damage has occurred.

COBOL uses fixed-point arithmetic, which guarantees absolute precision for financial calculations. Modern languages like Java default to floating-point numbers (

float,double). A migration that maps aCOMP-3field to adoublewill introduce small rounding errors that compound over millions of transactions, corrupting financial data.

This is a non-negotiable technical issue. The correct implementation is to map legacy fixed-point types to a library designed for high-precision mathematics, such as java.math.BigDecimal. A vendor who cannot explain their exact methodology for this conversion is not qualified to handle your core financial systems.

Should We Use a Large SI or a Boutique Firm?

There is no single correct answer; the choice between a large Global System Integrator (SI) and a specialized boutique firm depends on the project’s specific needs.

A large SI is structured for massive scale and enterprise governance. Their strength lies in managing sprawling, multi-year programs that span multiple business units and geographies. If the primary challenge is orchestrating hundreds of stakeholders in a company-wide digital transformation, their program management capabilities are essential.

A boutique firm, in contrast, offers deep, focused expertise. They are the specialists for high-stakes, technically complex modernizations of a single, mission-critical system. If project success depends on the flawless execution of a COBOL-to-Java rewrite for a core banking platform, the boutique’s experienced engineers are almost always the lower-risk choice.

Making the right choice isn’t about getting more information; it’s about getting the right intelligence. Modernization Intel delivers unbiased data on over 200 partners, with real project costs, failure analysis, and niche specializations. We help you build a shortlist you can actually defend. Get the unvarnished truth at https://softwaremodernizationservices.com.

Need help with your modernization project?

Get matched with vetted specialists who can help you modernize your APIs, migrate to Kubernetes, or transform legacy systems.

Browse Services